Yesterday's forecast that the pair found a strong support near 1.1862 and may show strengthening was confirmed during yesterday's trading. The fundamental background yesterday was also on the side of the single European currency. The European Central Bank (ECB) has leaked information about more optimistic forecasts for the region's economic recovery after the COVID-19 pandemic.

The European Central Bank will announce its decision on interest rates today at 12:45 (London time). Also, the press conference of ECB President Christine Lagarde will begin at 13:30 (London time). The forecasts for inflation are assumed to not undergo significant changes compared to the estimates made in June, and the GDP data will be revised upwards at all. In addition to economic forecasts, market participants will be interested in the rhetoric of Christine Lagarde's speech. This is the most important day for the single European currency and the market as a whole. Before proceeding to the technical picture of the main currency pair of the Forex market, I note that a fairly impressive block of macroeconomic statistics will also be published from the US today. All details in the economic calendar.

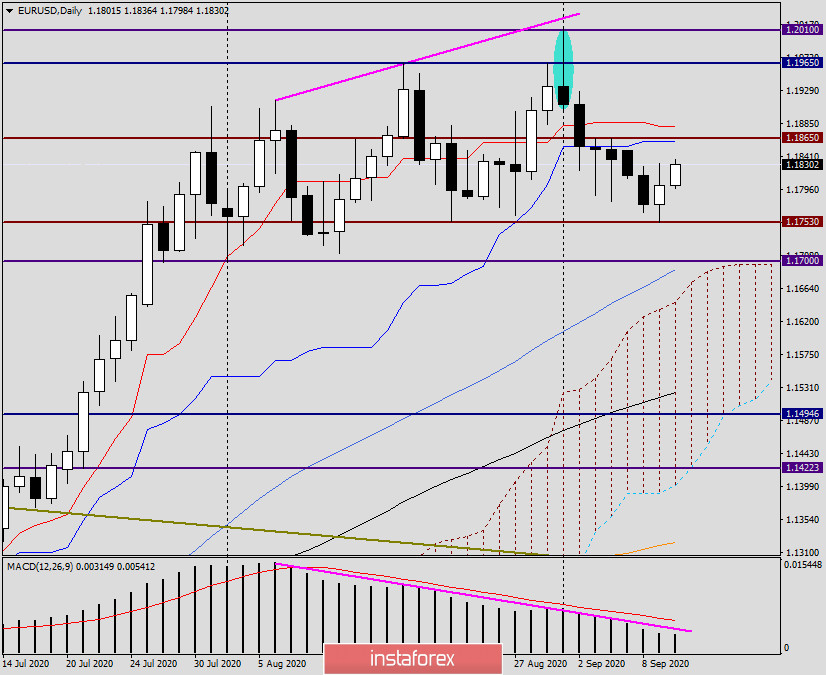

Daily

As a result of yesterday's growth, the euro bulls managed to finish trading above the significant level of 1.1800, which is a very positive moment for the subsequent strengthening of the pair. Today, at the time of writing, the strengthening of the EUR/USD continues, and the pair has already rewritten yesterday's highs of 1.1831, having visited 1.1836. However, the quote has slightly rolled back from this mark and is now trading near 1.1830. If the rise continues, the nearest target at the top will be the area of 1.1860-1.1880, where the Kijun and Tenkan lines of the Ichimoku indicator are located, as well as the horizontal resistance level of 1.1865, where the trading highs of September 3-4 were shown. The bearish scenario will continue to be implemented in the event of a breakdown of the support level of 1.1753, where yesterday's minimum values were shown, as well as the lows of trading on August 21. In the current situation, the pair is trading in the range of 1.1865-1.1753, and the further price direction of EUR/USD will largely depend on the direction of the exit from this range. I note that exits from various ranges, as well as breakouts of significant levels and lines, most often occur at such important events like today's ECB decision on rates and the press conference of the head of this department. This is the so-called driver for price movement.

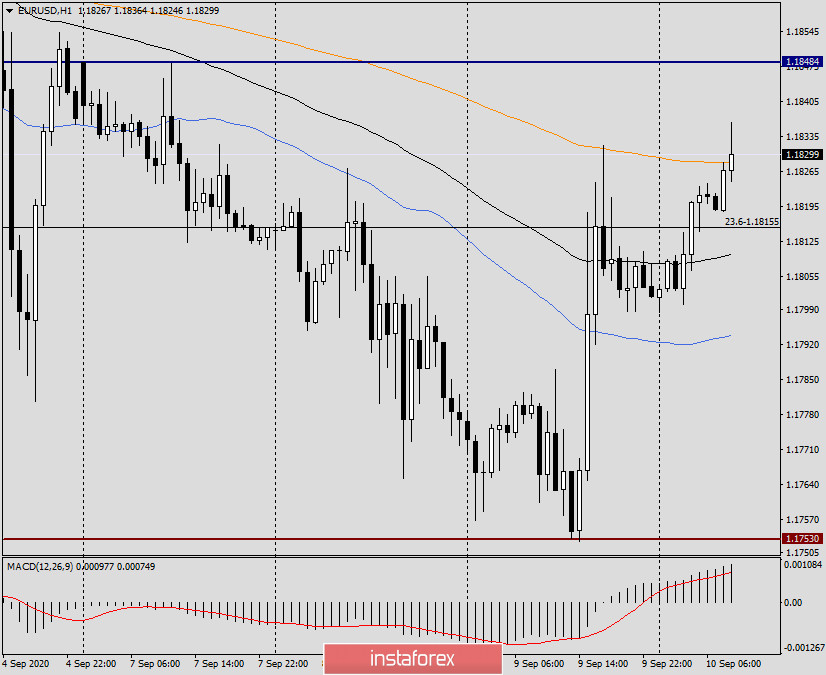

H1

On the hourly chart, the pair is testing the orange 200 exponential moving average for an upward breakout, which was already pushing the quote down yesterday. If the current attempts to break through the 200 EMA are successful and three consecutive hourly candles close over the 200 exponentials, you can plan to buy a pair on the rollback to the broken 200 EMA. If the euro bulls are unable to raise the price above 200 EMA and bearish candles appear under this moving average, it will be possible to think about selling EUR/USD.

If you express your personal subjective opinion, then the technical picture is more likely for the pair to grow. At the same time, I would like to remind you once again that today is a rather difficult day for trading. Most likely, during Lagarde's speech, we will see increased volatility and sharp multidirectional price movements. For those who will trade at these events, I do not recommend setting large goals. It is much more reasonable to quickly pick up your own and exit the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română