Crypto Industry News:

According to a report citing Assen Vassilev, Bulgaria's deputy prime minister for EU funds and finance minister, the government is in talks with industry stakeholders and the Bulgarian national bank about the cryptocurrency payments initiative.

As the European Central Bank plans to develop a CBDC for countries using the Euro, Bulgaria will not benefit from this application in the near term. However, the country has committed to joining the Euro area in 2024. However, the government is taking more proactive steps to strengthen its financial ecosystem with a crypto payment program.

Bulgaria is not really one of the most popular and reputable cryptocurrency focused countries. Still, it is one of the ones with the greatest Bitcoin assets. In 2017, the country seized 213,519 bitcoins from an underground criminal network. Since little is known about the seized funds, no one is sure whether the country has sold these coins or is still holding them.

Bulgaria's move to implement cryptocurrency trading in the short to medium term is likely to drive the Balkan people to favor the use of bitcoin and alterations around the world. Regardless of the scope of its crypto program, the country will likely need to step up its plans before entering the Eurozone in 2024.

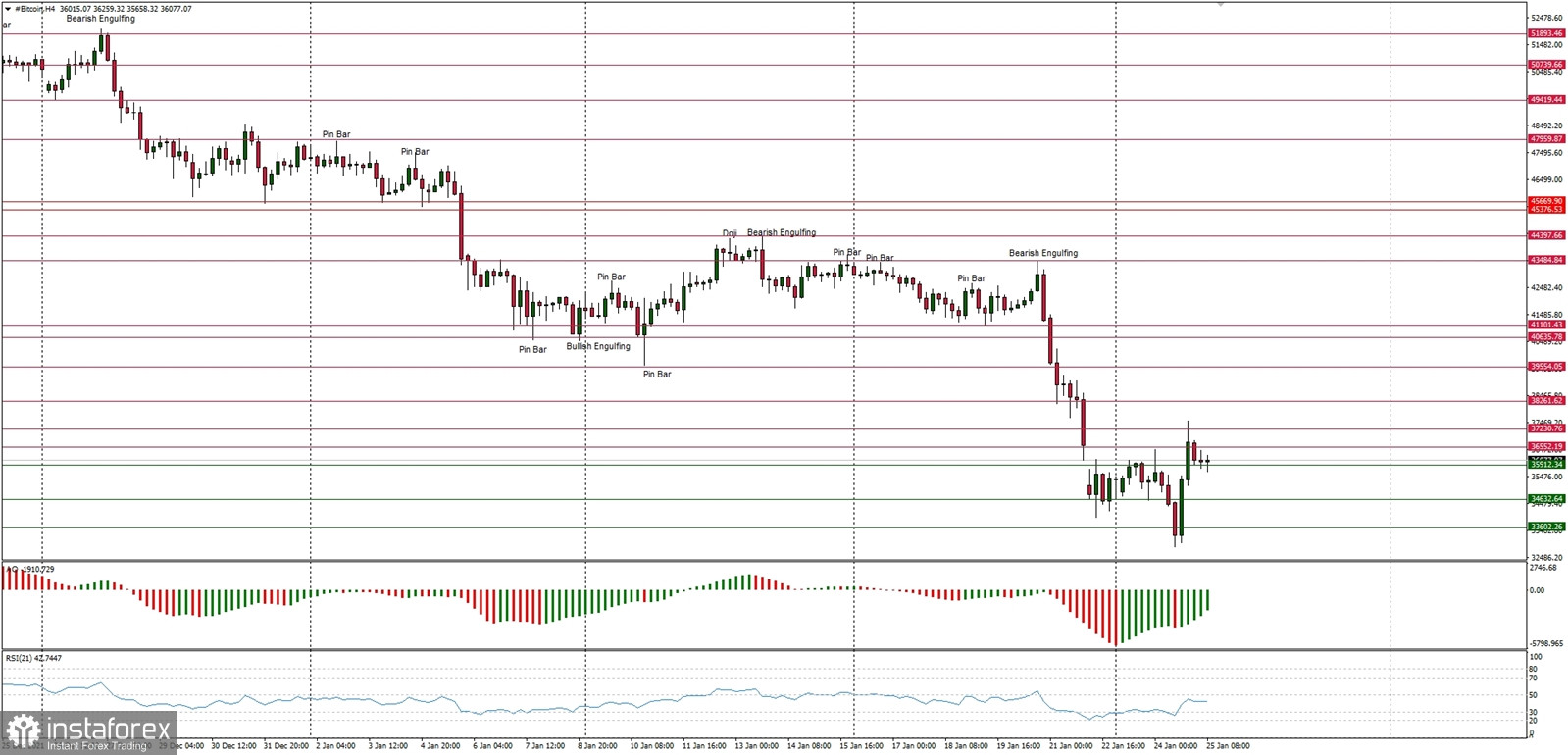

Technical Market Outlook

The BTC/USD pair has made a new lower low at the level of $32,875, but there are some indication of a potential bullish reversal in progress. The next target for bears is seen at the level of $29,254 and this is the line in sand before a collapse under the $10,000 level, however the demand side is trying to break through the nearest technical resistance seen at $36,522, $37,230, $38,261 and $39,555. The market conditions are extremely oversold on H4 and Daily time frames, but the momentum is pointing up towards the neutral level of fifty.

Weekly Pivot Points:

WR3 - $49,548

WR2 - $46,360

WR1 - $39,808

Weekly Pivot - $37,007

WS1 - $32,011

WS2 - $27,102

WS3 - $20,525

Trading Outlook:

The market is controlled by bears that pushed the price way below the level of $40k, so a breakout above this level is a must for bulls for a trend reversal. The market retrace more than 50% since the ATH at the level of $69,654 and the next long-term technical support is located at $29,254. The corrective cycle is still in progress and is much more complex and time-consuming than anticipated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română