The main event of last week was the data on the US labor market, which gives investors an idea of the pace of recovery of the world's largest economy from COVID-19. As reported by the US Department of Labor on Friday, the number of new jobs in the non-agricultural sector of the American economy was 1 million 371 thousand in August. This is lower than forecasts, which were reduced to 1 million 400 thousand. However, the unemployment rate has unexpectedly dropped to 8.4%, while it was expected to be 9.8%. However, as already noted, this decrease in unemployment in the United States can be explained by the lifting of restrictions caused by the coronavirus pandemic and the active hiring of new employees or by the return of previously employed employees from vacation. As for the average hourly wage, it increased by 0.4%. This is a fairly good indicator (forecast 0.0%), and it can also be attributed to a more active recovery of the US labor market. In my opinion, the data on labor reports came out quite well. However, it is too early to conclude right here and now. The daily increase in COVID-19 infections in the United States has waned, however, the centers of the epidemic remain, as well as endless talk about the second, third, or some other wave of the COVID-19 pandemic.

Before considering the technical picture of the main currency pair of the Forex market, I will highlight two events that can be considered the most important this week. On Thursday, September 10, the European Central Bank (ECB) will announce its decision on interest rates, followed by a press conference of ECB President Christine Lagarde. Many experts believe that Lagarde may hint at new stimulus measures for the recovery of the Eurozone economy from COVID-19. The next day, the US will publish data on the consumer price index. This is the most important inflation indicator, which will be particularly important in light of the new monetary policy of the Fed. There are still a lot of different macroeconomic statistics to be published this week, however, we will remember them directly on the day of publication. As for today, judging by the extremely small number of macroeconomic reports, we can safely consider it a typical Monday when the market is swaying.

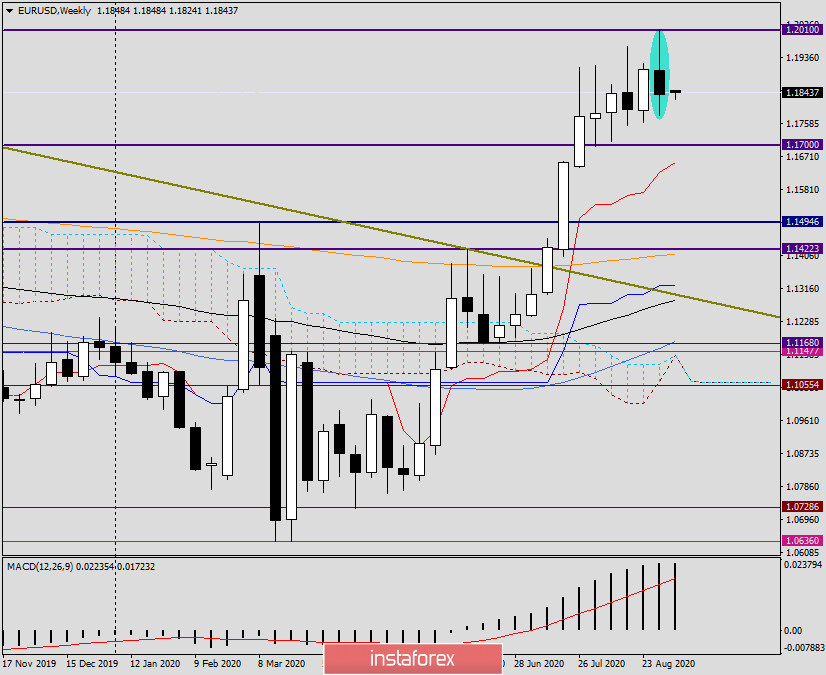

Weekly

At the end of last week's trading, the euro/dollar currency pair declined by 0.5%. As previously expected, the pair failed to overcome a very important and strong psychological level of 1.2000 on the first attempt, as a result of which there was a rebound from 1.010 and the last five-day trading closed at 1.1837. It should be noted that the mark of 1.1900 is quite strong and important. Over many years of observations, we have often seen that it was 1.1900, not 1.2000, that turned the price around or had a significant impact on it. This led to the fact that the euro bulls failed to complete weekly trading not only above 1.2000, but also to gain a foothold over 1.1900. I believe that this may become a serious problem for the prospects for further growth. At the moment, judging by the last weekly candle and the price from which its long upper shadow began to grow, it is possible that the exchange rate will reverse and the trend will change. However, at the moment, it is still too early to draw such conclusions. Ahead of the ECB, with Lagarde's performance and the key support level of 1.1700. I believe that only after the pair is fixed below this mark, it will be possible to note a change in the trend and expect a subsequent decline to 1.1600 and 1.1500. To continue the upward trend, euro bulls need to pass 1.1900, 1.2000, and close trades above the previous highs of 1.010. We can admit that some of the others have very difficult tasks.

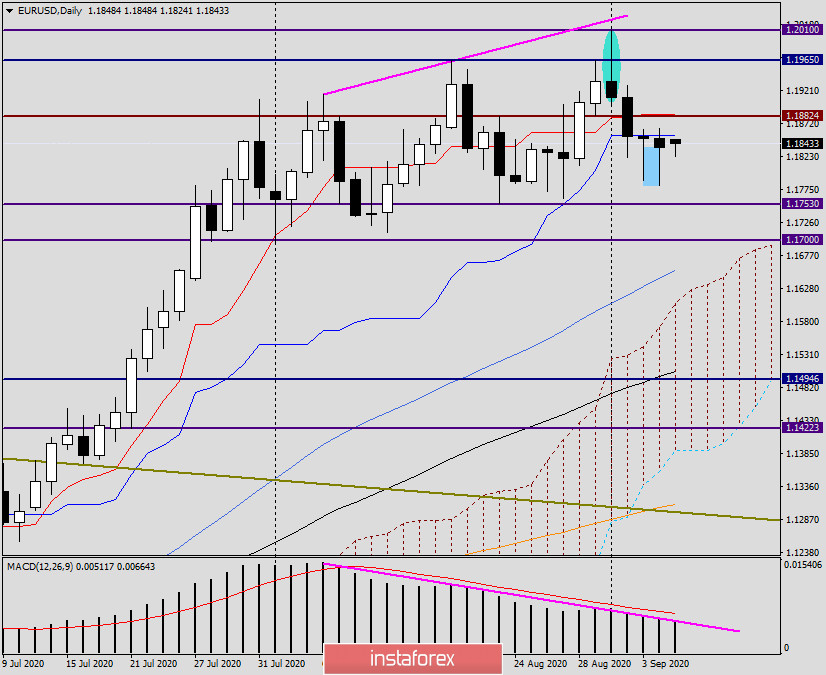

Daily

On the daily chart, the pair is stuck under the Kijun line of the Ichimoku indicator, and it can't pass it yet. If this is still possible, the euro/dollar will move to the area of 1.1885, where the falsely broken resistance level of 1.1882 and the red Tenkan line are located. After overcoming these obstacles, then we can seriously count on another attempt to break above 1.1900 and 1.2000.

Another important point to consider is to look at the very long shadows of the last two daily candles. This usually indicates that the market does not want or can not move down, which means that it will grow or be in a sideways range. At the same time, the last weekly candle, which can be considered a reversal, as well as the closing of the week at 1.1900 and the bearish divergence of the MACD indicator on the daily chart, are in favor of a decline. I am convinced that in such contradictory situations, it is better to take your time and wait for the appropriate signals before entering the market. In my personal opinion, growth will have good prospects after overcoming the price zone of 1.1868-1.1882. A downward scenario (at least up to 1.1700) will become possible after passing the strong support zone of 1.1781-1.1753. At the moment, if the pair rises to 1.1868-1.1882 and bearish candles appear, we sell EUR/USD. If there is a decline in the designated support area and there will be candlestick signals for growth, we buy. Tomorrow, we will look at smaller timeframes and try to determine the exact prices for entering the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română