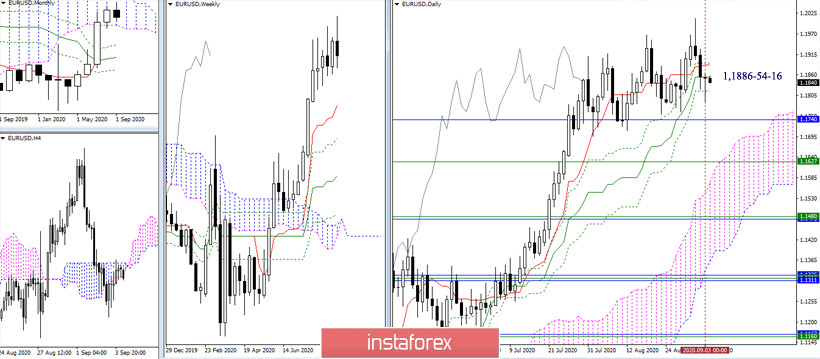

EUR / USD

We are closing the working week today. The advantages and initiative during the week mainly belonged to the players to decline. Now, the pair is in the attraction and influence zone of the daily golden cross (1.1886-54-16). On the other hand, the elimination of the Ichimoku cross is the main condition for further strengthening of bearish mood. Next, we can note the support of 1.1740 (the lower border of the monthly cloud) and 1.1627 (the weekly short-term trend).

The players to decline currently retain their main advantage in the lower halves, but still, the bulls managed to win back the central pivot level of the day (1.1835) today. Now, the next upside pivot is the resistance of the weekly long-term trend (1.1893). A consolidation above which will change the current balance of power and may serve as the beginning for the formation and implementation of the rebound from the met supports of the upper halves (1.1816-54-86). Meanwhile, working below the weekly long-term trend will maintain the advantage on the bearish side. It is noteworthy that the attraction of support levels from the upper halves (1.1818-54-86) can restrain the development of the situation in this area.

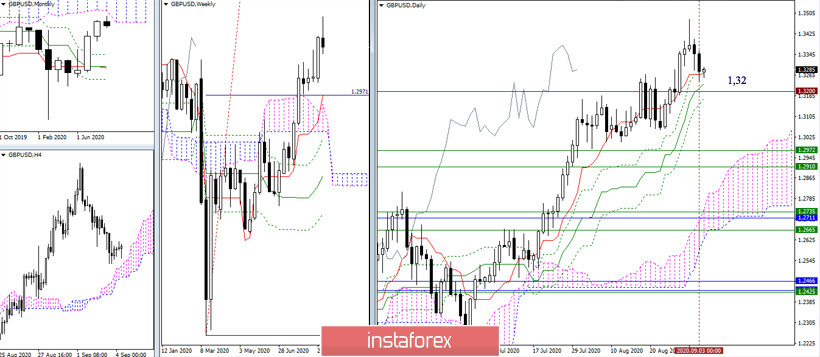

GBP / USD

After closing August's trading, the bulls relaxed and passed the initiative to the opponent. As a result, the daily correction to the Ichimoku gold cross (1.3270 - 1.3231 - 1.3171), strengthened by the historical level of 1.32, was executed. A consolidation below will affect the current balance of power and pave the way for the implementation of a weekly downward correction. The first reference point of which is now at 1.2972 (Tenkan). Moreover, working above the historical border of 1.32 preserves the prospects for the recovery of the upward trend. In this situation, the nearest upward pivot remains in the lower border of the monthly cloud (1.3584).

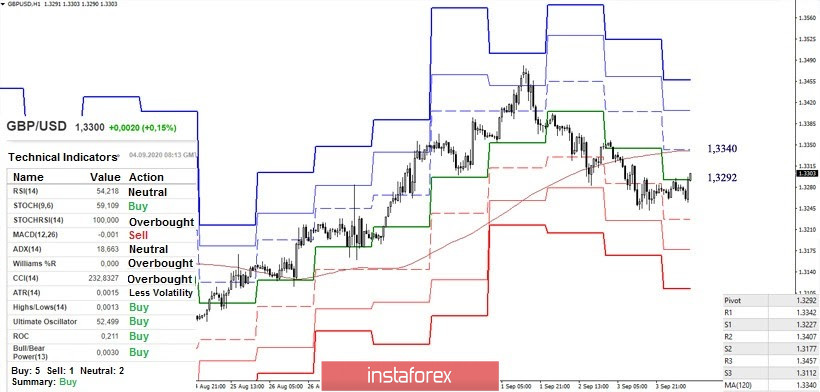

Also in the lower halves, the pair declined below the key levels that determine the current balance of power. The key levels are now joining forces around 1.3292 (central pivot level) - 1.3340 (weekly long-term trend). Working below these resistances and restoring the downward trend (1.3242) will return the relevance to the supports of the classic pivot levels 1.3227 - 1.3177 - 1.3112. A consolidation above 1.3292 - 1.3340 will affect the existing distribution of forces, while 1.3407 (R2) - 1.3457 (R3) - 1.3481 (maximum extremum) will stand in the way of further recovery of bullish positions.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română