Trading recommendations for EUR/USD on September 4

Analysis of transactions

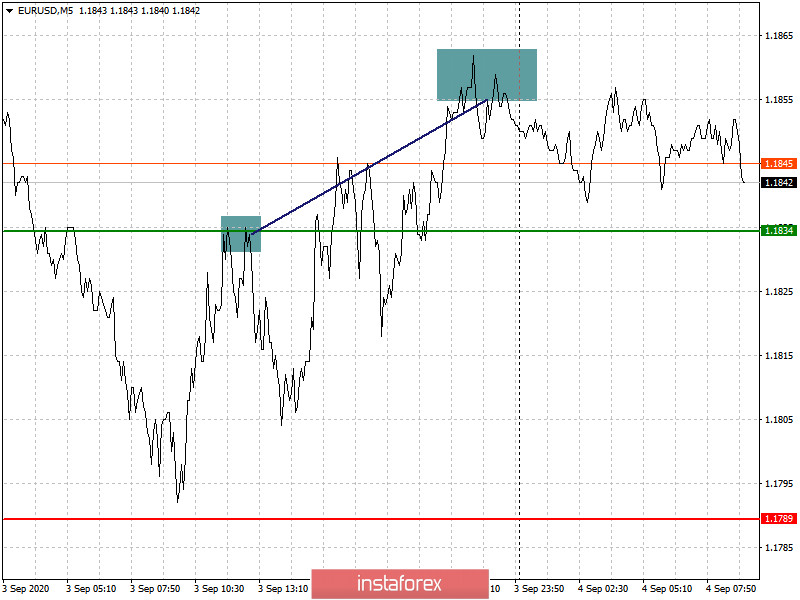

Long positions from 1.1834 brought about 25 points of profit in EUR/USD. The main reason for this price increase is the steady pressure in USD, created by weak ISM report for the US non-manufacturing sector.

Today, an important report for the US labor market is scheduled to be published, and it may affect the rate of EUR/USD in the market. A weak reading will lead to a sharp rise in the euro, while a recovery in the indicators will bring demand back to the US dollar.

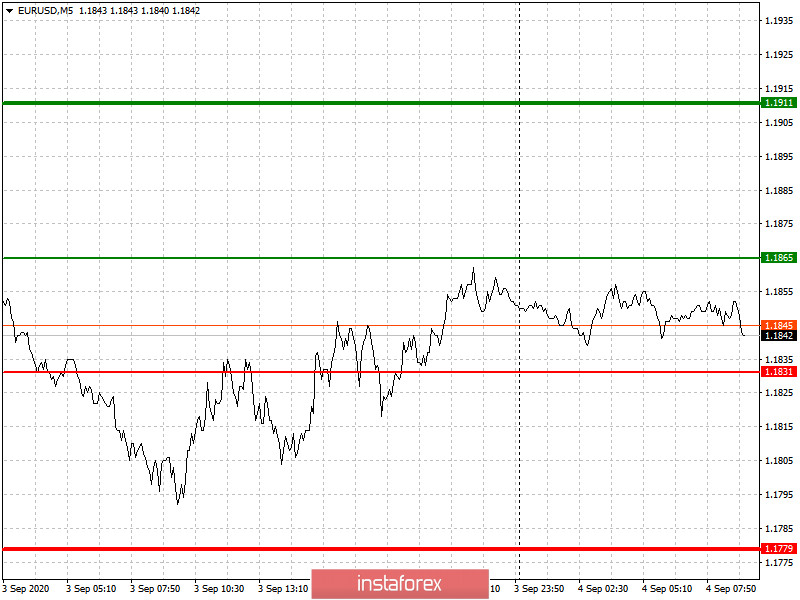

- Set long positions from 1.1865 (green line on the chart) to 1.1911, and take profit at the price level 1.1865. A weak indicator for the US labor market will decrease dollar demand even more, which will lead to a rise in EUR/USD in the market.

- As for shorts, only good data on the US labor market will lead to a decline in the pair, and in such a case, sell shorts at price level 1.1831 (red line on the chart) to price level 1.1779. Take profit at 1.1779.

Trading recommendations for GBP/USD on September 4

Analysis of transactions

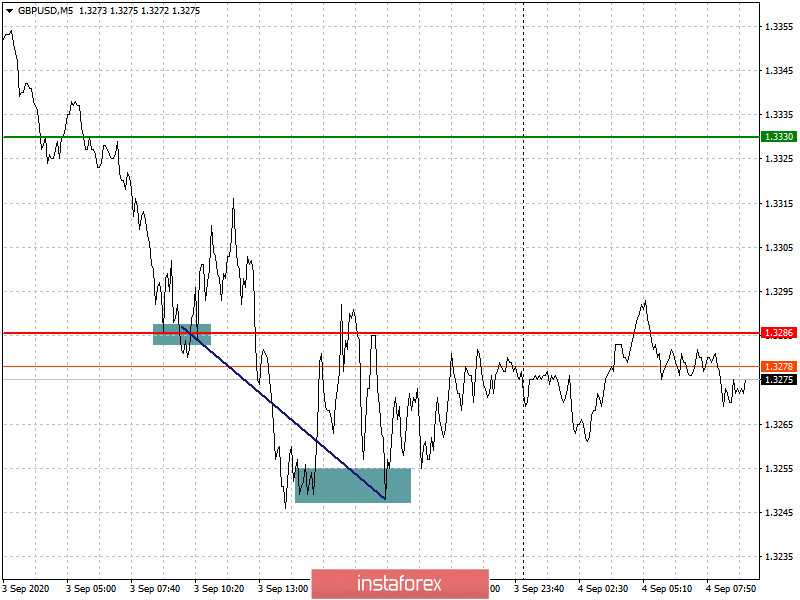

Good PMI for the US service sector slightly spoiled market sentiment of GBP/USD bears, nonetheless, short positions from 1.3286 still were able to bring profit of about 40 points.

A very important report for the US labor market will be published today, and its data will very much affect trading in the market. Thus, if indicators come out strong or better than the forecasts, that is, a decrease in unemployment in the United States, demand for the dollar will rise, which will inevitably decline GBP/USD.

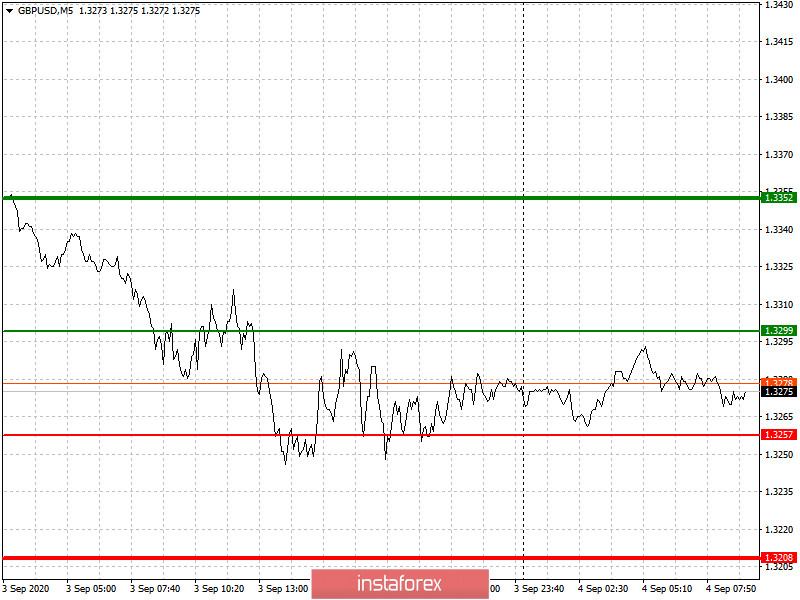

- Since long positions are quite risky today, set them from 1.3299 (green line on the chart) to 1.3352 (thicker green line on the chart), and take profit at price level 1.3299. Only weak data on the US labor market will lead to an increase in GBP/USD.

- Meanwhile, shorts may be opened from 1.3257 (red line on the chart) to 1.308, with target profit around 1.3208.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română