Things are currently hard for the US currency: on the one hand, it needs to fight off the attacks of the European one, and on the other, it must constantly prove itself to the global economy. Analysts say that the constant support of the dominant status is making the dollar exhausted.

Many experts are confident that the dollar's further subsidence will not benefit the world economy. Earlier, its weak position contributed to the growth of trade volumes, being the driver of the global economy. However, the current decline in USD, which started during the COVID-19, turned out to be different. According to analysts, it will bring nothing but negativity to the world economic system and global trade.

The investors set the downward vector to the dollar's dynamics, who have sharply lost interest in it. The dollar has lost its former popularity in the international market since June 2020 began. Previously, investors considered the USD as a "safe haven", but now, they are letting it sink further below.

According to experts, there is almost no reason for investing in the US currency. Investing in it becomes unprofitable, since the Fed lowered the interest rates, which narrowed the gap between the American and other developed economies. The recent innovation of the regulator related to targeting the inflation rate of 2% and the decision not to contain it in order to increase economic growth in the country also worsened the situation. This measure caused a mixed reaction from the market and analysts. Many believe that the Fed has deliberately turned the economic driver, contributing to the long-term weakening of the USD. It is possible that this approach will help stimulate consumption and economic growth, but it will put the strongest pressure on the dollar.

Along with the fall in investor confidence in the dollar, their interest in the prospects for the eurozone and the single currency is growing. It is due to the emergence of the European Fund for Economic Recovery of € 750 billion, formed to help the countries most affected by the pandemic. For most market participants, the prospects for the Euro seem more optimistic than the future dynamics of the US currency.

Currency strategists of leading banks believe that the euro will rise in price by another 5% in the near future. There are plenty of reasons for optimism, some of them are the steady growth of the eurozone economy and the euro's active rise at the beginning of this week. Experts say that the recent decline in the euro may be a respite before the start of a long "bullish" trend. Now, the euro is on the way to break through the next significant level $ 1.2500. Analysts are confident that it will overcome this barrier sooner or later. However, this is now unlikely. Today, the EUR/USD pair was trading below the psychologically important level of 1.1800, hovering around the range of 1.1797-1.1798.

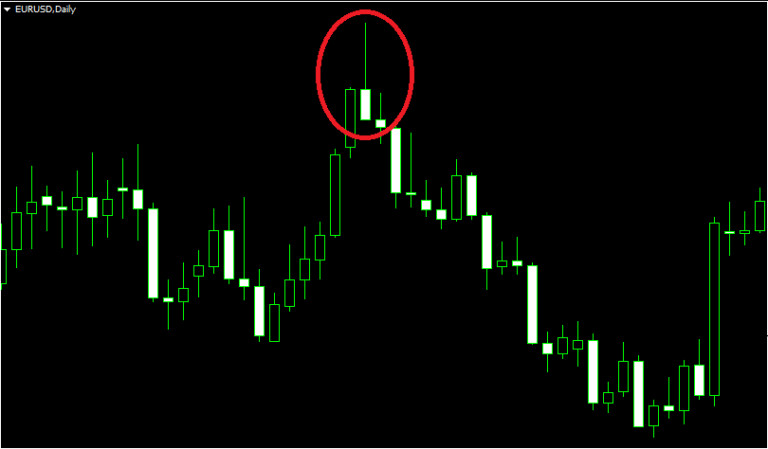

According to experts, the dynamics of the euro partly repeated the model of behavior three years ago, when it instantly exceeded the $ 1.2000 level, but then retreated. Later, it was able to rise to $ 1.2500. On Wednesday, the single currency surprised the market by forming a bearish candlestick – so-called "shooting star". Experts consider it a sign of an impending correction that could affect the dynamics of the euro in the long term.

For the global economy and further dynamics of the US and European currencies, the growth rate in the EUR/USD pair is very important. At present, the euro, unlike the US dollar, is moving upward at an orderly pace. This is due to the significant difference in the rates of economic growth of the EU and the US and the difference in interest rates. According to experts, even the recent sharp decline in inflation in the euro zone's core CPI (to 0.4%) will not be able to pull the EUR to the bottom, unlike the USD, which is more sensitive to macro statistics.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română