Outlook on September 3:

Analytical overview of currency pairs on the H1 scale:

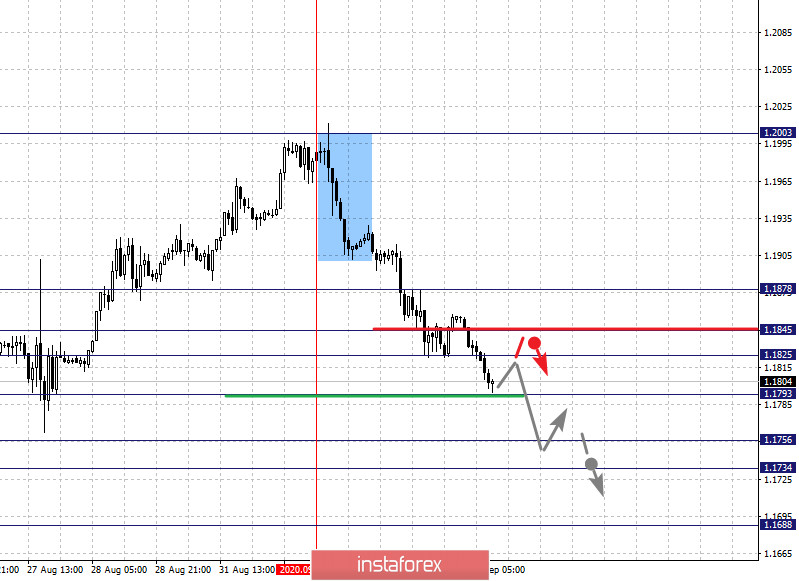

The key levels for the euro/dollar pair on the H1 chart are 1.1878, 1.1845, 1.1825, 1.1793, 1.1756, 1.1734 and 1.1688. We are following the development of the downtrend cycle on September 1. Here, the decline is expected to continue after the breakdown of 1.1793. In this case, the target is 1.1756. Meanwhile, there is a short-term downward movement and consolidation in the range of 1.1756 - 1.1734. We consider the level of 1.1688 as a potential value for the bottom. Upon reaching which, an upward pullback can be expected.

A short-term upward movement is possible in the range of 1.1825 - 1.1845. If the last value breaks down, it will lead to a deep correction, The target is 1.1878, which is the key support level for the downward structure from September 1.

The main trend is the downward cycle from September 1

Trading recommendations:

Buy: 1.1825 Take profit: 1.1845

Buy: 1.1847 Take profit: 1.1876

Sell: 1.1790 Take profit: 1.1757

Sell: 1.1754 Take profit: 1.1735

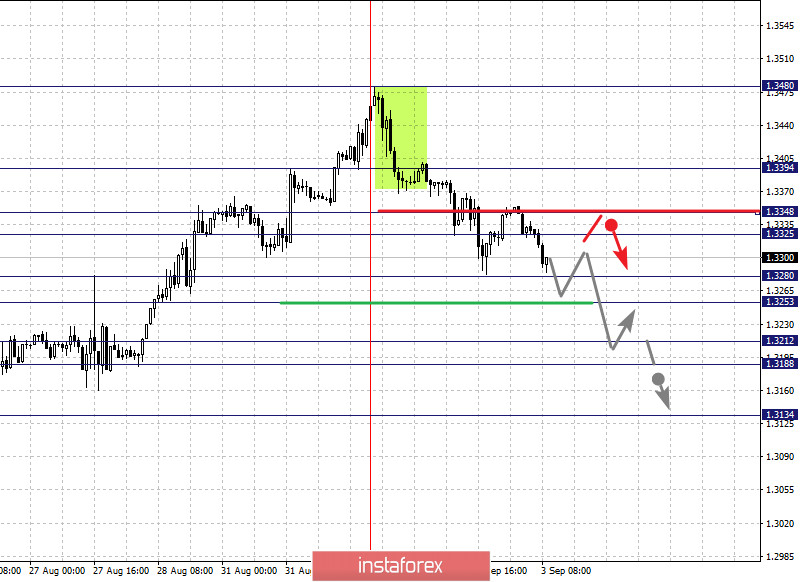

The key levels for the pound/dollar pair are 1.3394, 1.3348, 1.3325, 1.3280, 1.3253, 1.3212, 1.3188 and 1.3134. We are following the descending structure from September 1st. On the other hand, a short-term downward movement is expected in the range of 1.3280 - 1.3253, breaking through the last value will lead to a strong decline. The target is 1.3212. It is followed by another short-term downward movement and consolidation in the range of 1.3212 - 1.3188. We consider the level of 1.3134 as a potential value for the bottom. Upon reaching which, we expect an upward pullback.

A short-term upward movement is expected in the range of 1.3325 - 1.3348, breaking through the last value will lead to a strong movement. Here, the target is 1.3394, which is the key support for the downward movement.

The main trend is the descending structure from September 1.

Trading recommendations:

Buy: 1.3325 Take profit: 1.3346

Buy: 1.3350 Take profit: 1.3394

Sell: 1.3280 Take profit: 1.3254

Sell: 1.3251 Take profit: 1.3212

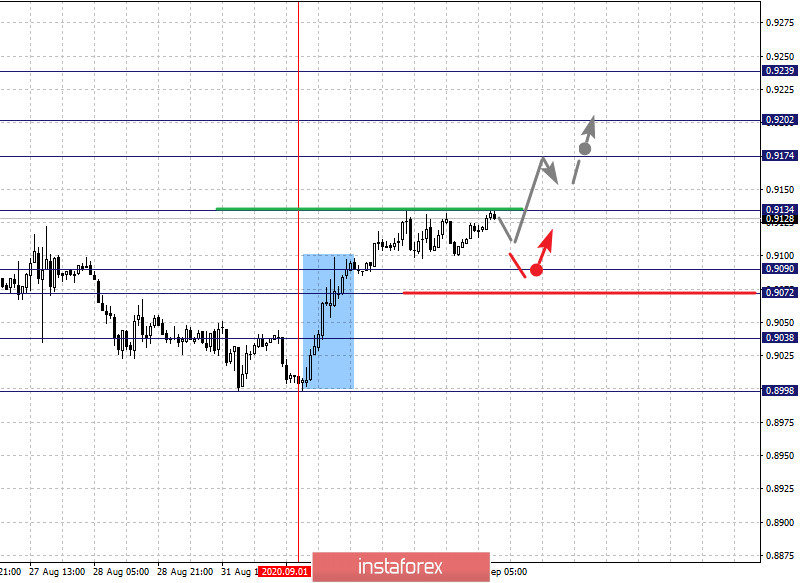

The key levels for the dollar/franc pair are 0.9239, 0.9202, 0.9174, 0.9134, 0.9090, 0.9072, 0.9038 and 0.8998. The price is forming potential initial conditions from the September 1 cycle. The upward movement, in turn, is expected to continue after the breakdown of 0.9134. In this case, the target is 0.9174. There is a short-term upward movement and consolidation in the range of 0.9174 - 0.9202. Now, we consider the level 0.9239 as a potential value for the top. Upon reaching which, we expect a downward pullback.

A short-term decline is possible in the range of 0.9090 - 0.9072. If the last value breaks down, a deep correction will emerge. Here, the potential target is 0.9038, which is the key support level for the top.

The main trend is the formation of initial conditions for the top from September 1

Trading recommendations:

Buy : 0.9134 Take profit: 0.9174

Buy : 0.9176 Take profit: 0.9202

Sell: 0.9090 Take profit: 0.9072

Sell: 0.9070 Take profit: 0.9040

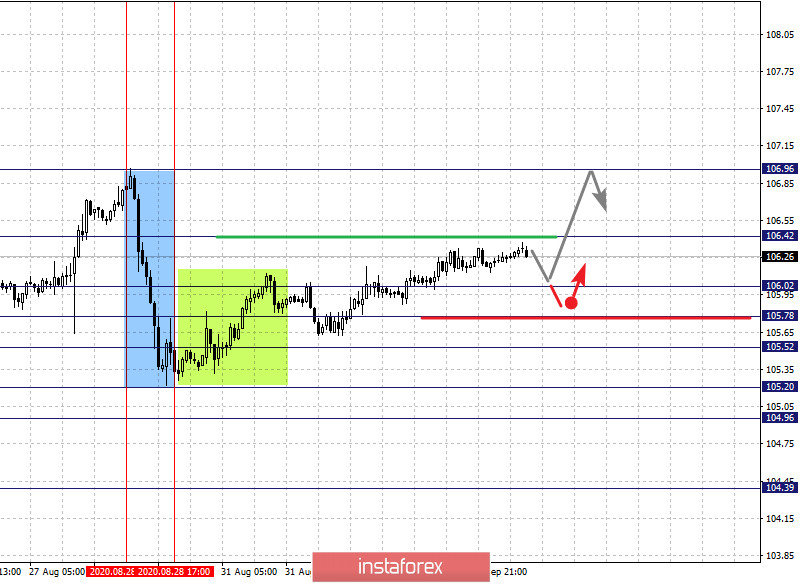

The key levels for the dollar/yen pair are 106.96, 106.42, 106.02, 105.78, 105.52, 105.20, 104.96 and 104.39. The price is in equilibrium. Here, the level 106.42 is the key support for the downtrend structure, and its breakdown will lead to the development of the upward movement from August 28. In this case, the first potential target is 106.96.

A short-term downward movement is possible in the range of 106.02 - 105.78; hence, an upward reversal is very likely. The breakdown of the level of 105.78 will lead to a deeper movement. In this case, the target is 105.52. Now, the main downward movement is expected to continue after the breakdown of the level of 105.52. In this case, the target is 105.20. Price consolidation is in the range of 105.20 - 104.96. For the potential value for the bottom, we consider the level of 104.39. A strong movement to which is expected after the breakdown of 104.94.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 106.44 Take profit: 106.95

Buy : Take profit:

Sell: 106.00 Take profit: 105.80

Sell: 105.76 Take profit: 105.52

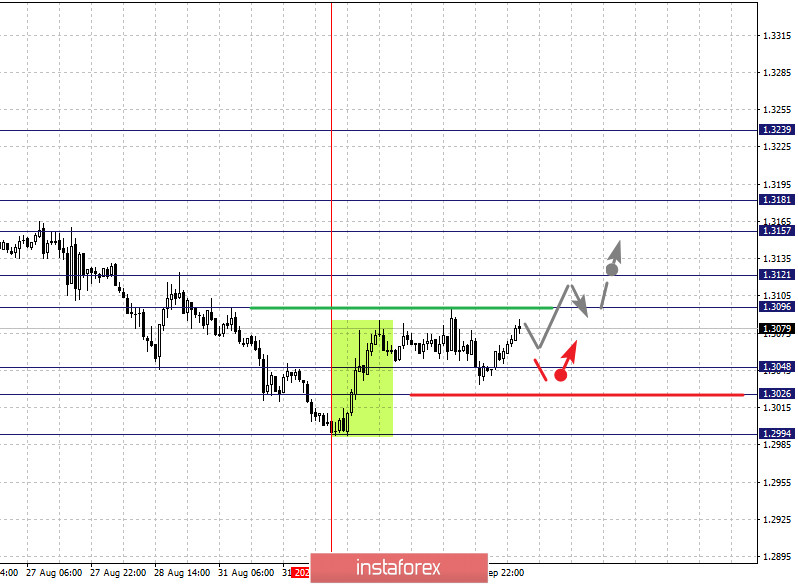

The key levels for the USD/CAD pair are 1.3239, 1.3181, 1.3157, 1.3121, 1.3096, 1.3048, 1.3026 and 1.2994. The price is forming potential initial conditions for the September 1 high. Meanwhile, a short-term upward movement is expected in the range of 1.3096 - 1.3121, breaking through the last value will lead to a pronounced upward movement. Here, the target is 1.3157. There is a short-term upward movement and consolidation in the range of 1.3157 - 1.3181.

A short-term downward movement is possible in the range of 1.3048 - 1.3026. If the last value breaks down, the downward movement will continue. In this case, the potential target is 1.2994.

The main trend is a local descending structure from August 24, potential building for the top from September 1

Trading recommendations:

Buy: 1.3096 Take profit: 1.3120

Buy : 1.3123 Take profit: 1.3157

Sell: 1.3048 Take profit: 1.3027

Sell: 1.3024 Take profit: 1.2996

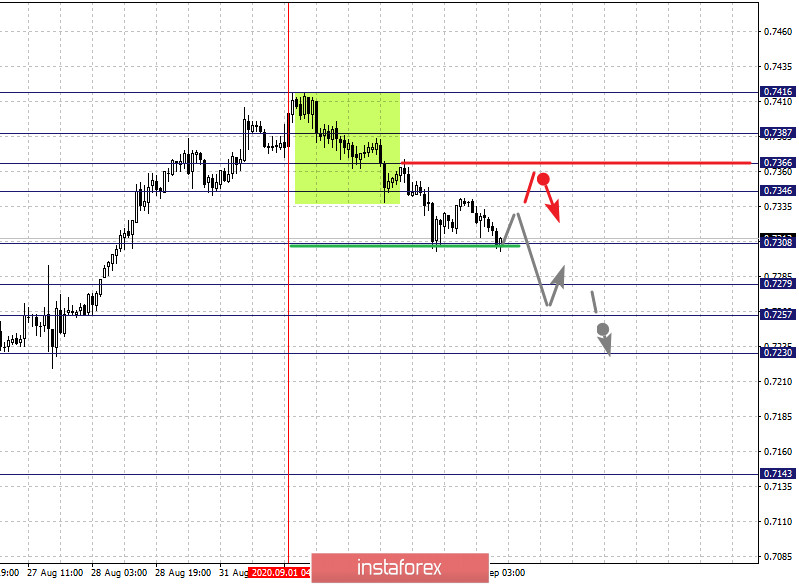

The key levels for the AUD/USD pair are 0.7416, 0.7386, 0.7366, 0.7346, 0.7308, 0.7279, 0.7257 and 0.7230. The price here is in the correction from the upward structure on August 21. The decline is expected to continue after the breakdown of the level of 0.7308. In this case, the target is 0.7279. Now, there is a short-term downward movement and consolidation in the range of 0.7279 - 0.7257. For the potential value for the bottom, we consider the level of 0.7230. Upon reaching which, we expect an upward pullback.

A short-term upward movement is expected in the range of 0.7346 - 0.7366. If the last value breaks down, it will lead to a deep correction. The target is 0.7387, which is the key support for the bottom. In turn, its breakdown will favor the development of an upward trend. Here, the potential target is 0.7416.

The main trend is the descending structure from September 1

Trading recommendations:

Buy: 0.7346 Take profit: 0.7364

Buy: 0.7367 Take profit: 0.7385

Sell : 0.7306 Take profit : 0.7280

Sell: 0.7277 Take profit: 0.7258

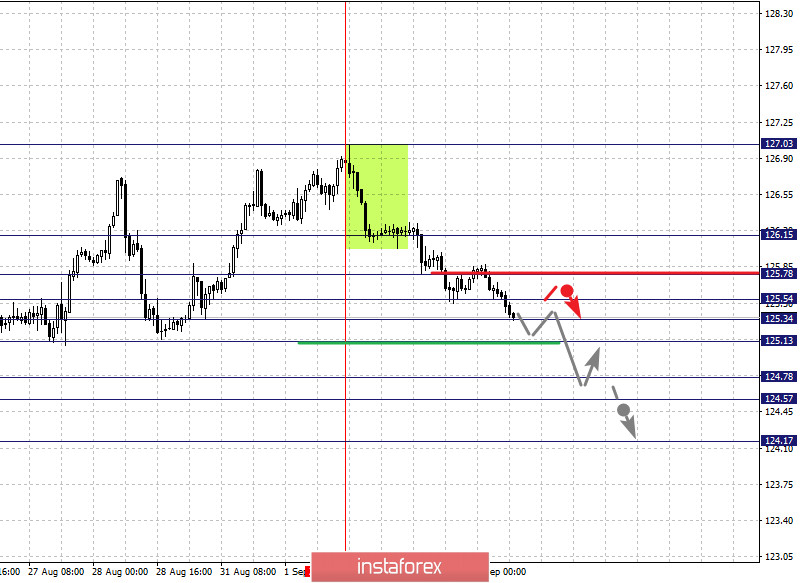

The key levels for the euro/yen pair are 126.15, 125.78, 125.54, 125.34, 125.13, 124.78, 124.57 and 124.17. We are following the descending structure from September 1st here. Now, a short-term downward movement is expected in the range of 125.34 - 125.13, breaking through the last value should be accompanied by a strong decline. Here, the target is 124.78. On the other hand, there is a short-term downward movement and consolidation in the range of 124.78 - 124.57. We consider the level 124.17 as a potential value for the bottom, from which we expect an upward pullback.

A short-term upward movement is expected in the range of 125.54 - 125.78, breaking through the last value will lead to a deeper movement. Here, the target is 126.15, which is the key support for the downward structure.

The main trend is the downward cycle from September 1

Trading recommendations:

Buy: 125.55 Take profit: 125.76

Buy: 125.80 Take profit: 126.15

Sell: 125.13 Take profit: 124.78

Sell: 124.55 Take profit: 124.18

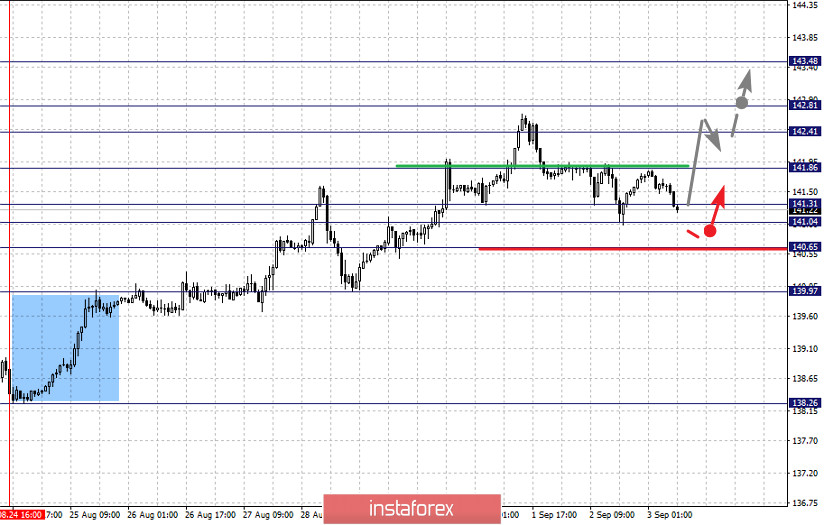

The key levels for the pound/yen pair are 143.48, 142.81, 142.41, 141.86, 141.31, 141.04 and 140.65. We are following the development of the rising structure from August 24. The upward movement is expected to continue after the breakdown of 141.86. In this case, the target is 142.41. On the other hand, there is a short-term upward movement and consolidation in the range of 142.41 - 142.81. For the potential value for the top, we consider the level 143.48. Upon reaching which, we expect a downward pullback.

A consolidated movement is possible in the range of 141.31 - 141.04, breaking through the last value will lead to a deep correction. Here, the target is 140.65, which is the key support level for the top.

The main trend is the upward structure from August 24

Trading recommendations:

Buy: 141.88 Take profit: 142.40

Buy: 142.42 Take profit: 142.80

Sell: 141.30 Take profit: 141.05

Sell: 141.02 Take profit: 140.65

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română