EUR / USD continues to rise in the market, which contradicts the current situation of the eurozone economy.

Perhaps this better-than-expected rate of EUR / USD is a product of rising demand for gold and decreasing value of US securities caused by ultra-low yield. Nonetheless, it shouldn't have been rising amid this deep recession and deflationary pressure, especially since tough times are yet to come in the EU economy. In addition, although some macroeconomic data does not affect trading in the market, it does not reduce the problems of the European Central Bank. An expensive euro would mean expensive goods and services, which will harm exports, and accordingly, the economy.

Thus, many assume that at the next ECB meeting, the regulator will tighten its rhetoric on the euro, taking additional monetary stimulus to sustain economic recovery. Unfortunately, such a decision would lead to a drop in EUR / USD.

At the moment though, the pair is trading at quite high price levels, and it will remain to do so until the ECB announces changes in the monetary policy. In such a case, major support will be at 1.1760, and a breakout from which will lead to a strong decline to 1.1710 and 1.1590. However, price will continue to increase if the quotes return above the level of the 19th figure, along which EUR / USD may even move past 1.2000.

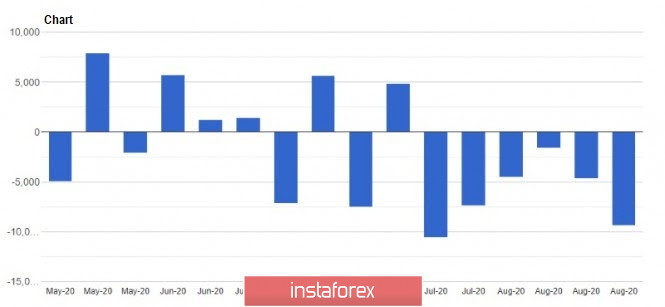

With regards to macroeconomic reports, quite good data on the US labor market was published yesterday, but it did not raise dollar demand in the market, since the report was a little bit below than what economists had forecasted. Nonetheless, jobs in the US private sector still increased by 428,000 in August, and it is much better than the rate last July.

Meanwhile, budget deficit more than tripled this year due to the measures taken by the US government to counter the coronavirus pandemic, so experts expect a rise up to $ 3.3 trillion this fiscal year, or 16% of GDP. In addition, active negotiations are currently underway to approve another program that amounts to $ 1.5 trillion, in order to sustain the current pace of economic recovery. Thus, experts predict that in 2021, the US budget deficit will be 8.6%, but in 2027, it will gradually subside.

The fast pace of economic recovery is further indicated by the rising factory orders in the United States. Latest data shows that orders were up 6.4% from the previous month, while economists had expected it to be just 6.2%.

Unfortunately, the same can not be said to business activity in the area of New York, as ISM reported that the current business conditions in the area dropped to 42.9 points in August.

Oil

Price declined slightly from the highs, mainly due to a decrease in commercial oil reserves in the United States. Latest data revealed a dropped of about 9.4 million barrels in the week of August 22 to 28, while analysts expected a decrease of 1.2 million barrels.

Increasing dollar demand has also led to a slight correction in oil prices, however, there is no reason to worry as most likely, WTI will remain in a narrow price range at 39.30-43.80 for a long period of time, until the pandemic subsides and the global economy recovers.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română