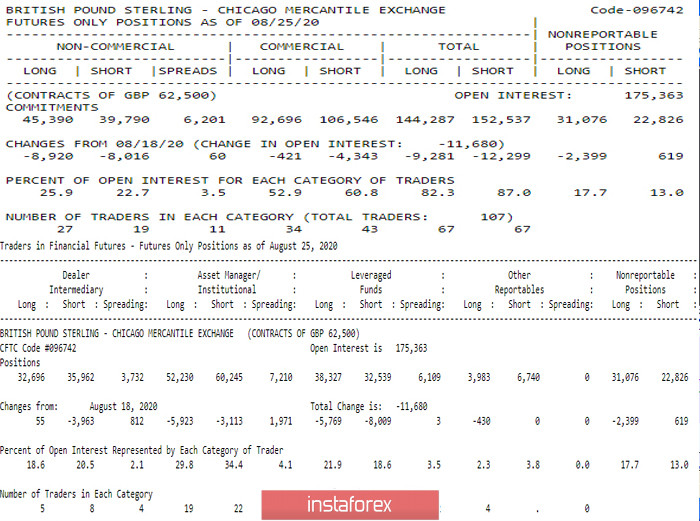

The upward movement was replaced by contraction. At the same time, we can talk about the last reporting period (COT on 08.25.20), from which a reduction was carried out in all areas. The open interest to the pound declined (175363 against 187043; -11680). Moreover, the net positions of all groups also declined: Non-Commercial (5600; - 904), Commercial (13850; -3922), Dealer Intermediary (3266; -4018) and total position (8250; -4018). Despite the overall reduction in positions, major players managed to maintain the priority of the directions, which was indicated the day before. The Non-Commercial Group, which is responsible for the current trend and preferences, managed to maintain the prevalence of long positions. On the other hand, the Commercial group, which determines the long-term outlook, retained the advantage in favor of short positions. Thus, the final result remained with the dominance of short positions.

The main conclusion

The expectation of working the correction was not met. The bears failed to hold the situation in the long term. Moreover, during the general reduction of positions, the players managed to get ahead to increase, perhaps due to the fact that their positions were affected to a lesser extent.

Technical picture

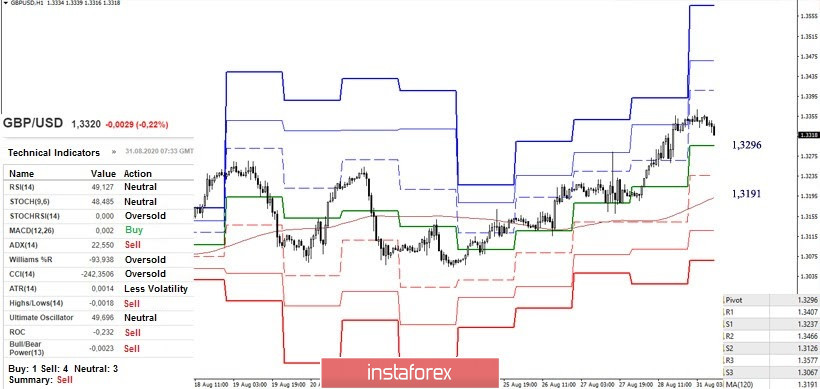

The bulls closed last week's trading as positive as possible. Today, we are closing the month and most likely, the potential of July will get confirmation. Last week, bulls regained the key level of 1.32 and retraced the upward trend. Now, their pivot point is located to the upper border of the monthly cloud (1.3601). In case of the development of another correction and new activity of players to decline, the key support is now at 1.32 (historical level + daily short-term trend). Moreover, a break below could significantly calm down the strength of the players on the rise.

A downward correction began in the lower halves. The most important supports today are located at 1.3296 (central pivot level) and 1.3191 (weekly long-term trend). The weekly long-term trend has been strengthened by the support of the upper halves, therefore, a consolidation below will require a new assessment of the situation, since the balance of power will be affected not only on H1, but also in the upper halves. On another note, exiting from the correction zone (1.3368) will return the relevance of the upward guidance in the form of classic pivot levels (1.3407 - 1.3466 - 1.3577).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română