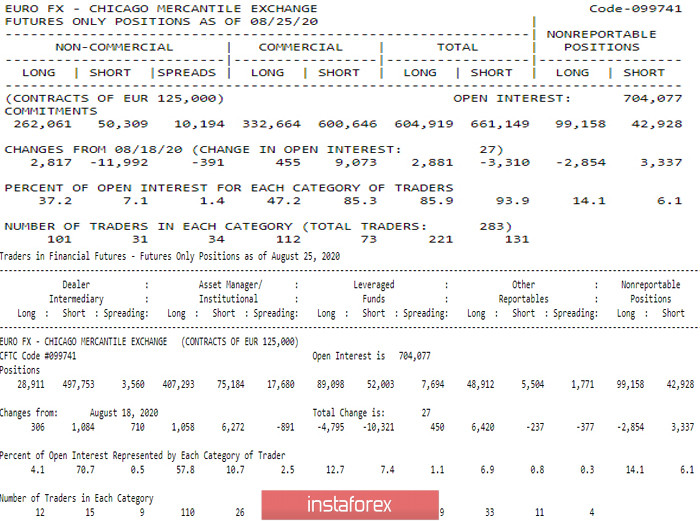

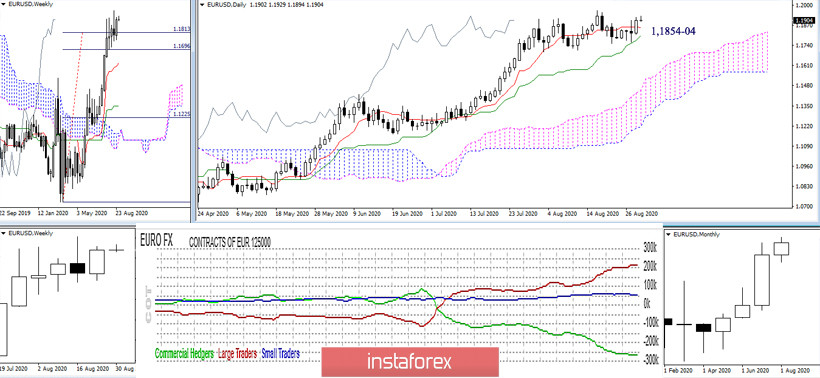

According to the latest COT report on 08.25.20, open interest in the euro remained around the same level, which only shows a slight increase (704077 against 704050). At the same time, the net positions of the main market participants were increased. In the Non-Commercial group, the frequency of long positions over short ones was 5 and a half times, the net position here is equal to 211752 (+14809). This result was achieved by actively reducing short positions (long +2817 and short -11992). On the other hand, short positions in the Commercial group are still taking the lead, having more advantage. The net position also showed a general growth (+8618), which is equal to 267982. Since there is a certain parity between the groups of large players, the total position now retains a slight advantage (only 8%) of short positions.

The main conclusion

The trend continues. The leadership of long positions in the group responsible for the current trend (Non-Commercial) is mainly achieved by reducing the opponent's positions, so the pair has not yet managed to achieve a clear bullish impulse.

Technical picture

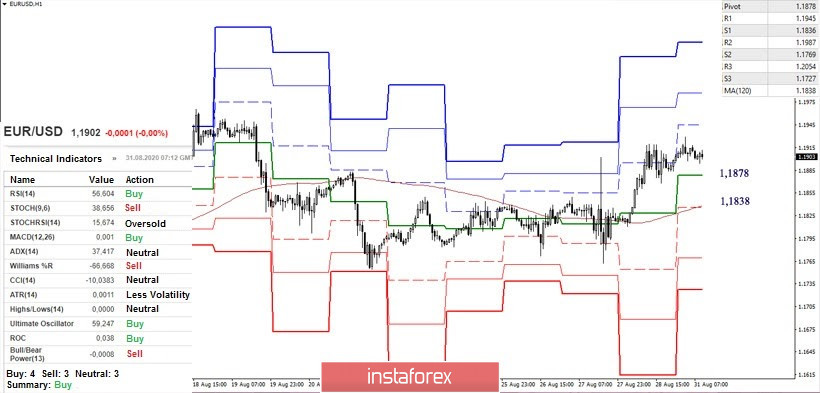

In technical terms, there is work in the correction zone. The strength and influence of the supports (1.1813 - 1.1740 - 1.1695) continue to limit the development of the downward correction. The lines of the day cross are closing the gap, which can provoke a change in the direction of the cross in the near future, and therefore, the overall daily priorities. The daily Ichimoku Cross supports are located at 1.1854-04 today. As long as the euro is above the cross, the majority of forces is on the side of the upside, while the weakening factor is the pair's presence in the zone of the downward correction. The nearest upward reference is now the maximum extremum (1.1966), then the interests of the bulls will be directed towards the rise to the upper border of the monthly cloud (1.2167).

In the lower halves, the advantage belongs to the players to increase. The classic pivot levels are located at 1.1945 - 1.1987 - 1.2054, which serve as pivots within the day. On the other hand, the key supports are found at 1.1878 (central pivot level) and 1.1838 (weekly long-term trend). A consolidation below will change the balance of forces and will lead the pair to the support zone of the daily cross (1.1854-04). If the daily supports breaks down and firmly consolidates below, the balance of forces already on the daily time frame will change. Now, after passing the key supports of this section (1.1813 - 1.1740 - 1.1695), a weekly downward correction can be expected.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română