Outlook on August 31:

Analytical overview of currency pairs on the H1 scale:

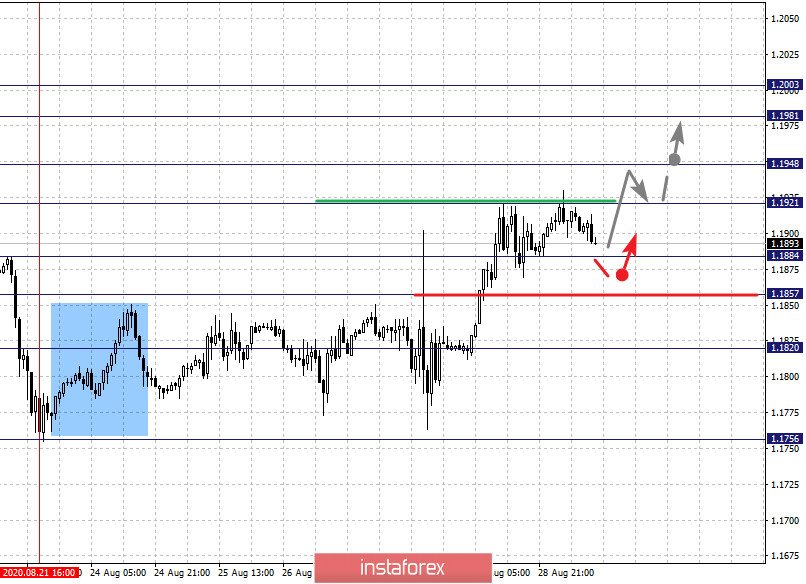

The key levels for the euro/dollar pair on the H1 chart are 1.2003, 1.1981, 1.1948, 1.1921, 1.1884, 1.1857 and 1.1820. We are following the development of the August 21 cycle here. Now, a short-term upward movement is expected in the range of 1.1921 - 1.1948 and breaking through the last value will lead to a movement to the level of 1.1981. As a potential value for the top, we consider the level 1.2003. Upon reaching which, we expect consolidation and a downward pullback.

A short-term downward movement is possible in the range of 1.1884 - 1.1857. If the last value breaks down, it will lead to a deep correction. Here, the target is 1.1820, which is the key support for the upward structure of August 21.

The main trend is the upward cycle of August 21

Trading recommendations:

Buy: 1.1921 Take profit: 1.1946

Buy: 1.1950 Take profit: 1.1980

Sell: 1.1884 Take profit: 1.1858

Sell: 1.1855 Take profit: 1.1823

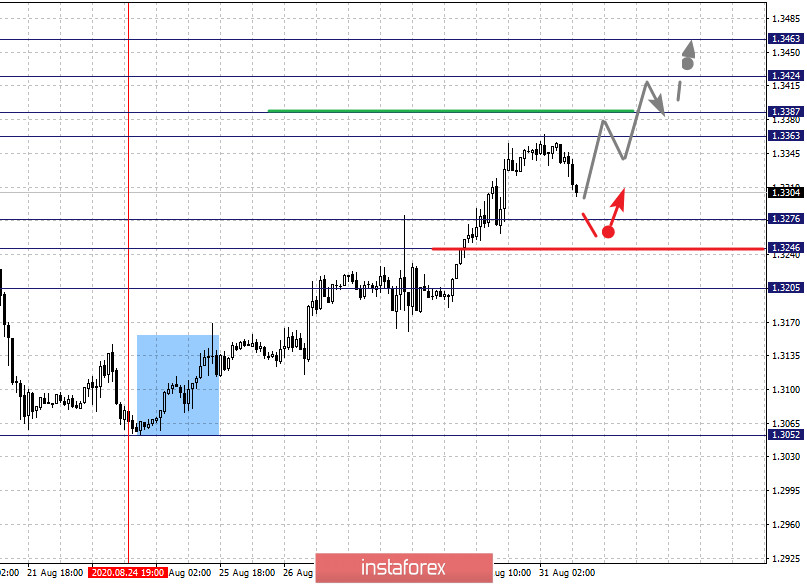

The key levels for the pound/dollar pair are 1.3463, 1.3424, 1.3387, 1.3363, 1.3276, 1.3246 and 1.3205. Here, we are following the upward cycle on August 24. A short-term upward movement is expected in the range of 1.3363 - 1.3387, breaking through the last value will lead to a movement to the level of 1.3424. We expect consolidation near this level. On the other hand, we consider the level of 1.3463 as a potential value for the top; upon reaching this value, we expect a downward pullback.

A short-term downward movement is possible in the range of 1.3276 - 1.3246, a breakdown of the last value will lead to a deep correction. Here, the target is 1.3205, which is the key support for the top.

The main trend is the upward cycle of August 24

Trading recommendations:

Buy: 1.3363 Take profit: 1.3385

Buy: 1.3388 Take profit: 1.3424

Sell: 1.3276 Take profit: 1.3247

Sell: 1.3244 Take profit: 1.3207

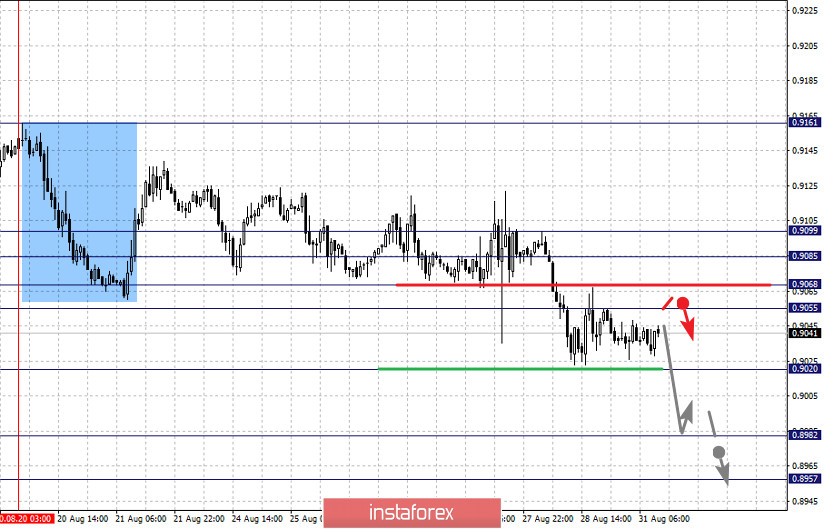

The key levels for the dollar/franc pair are 0.9099, 0.9085, 0.9068, 0.9055, 0.9020, 0.8982 and 0.8957. We are following the downtrend cycle from August 20. Here, the downward movement is expected to continue after breaking through the level of 0.9020. In this case, the target is 0.8982. There is consolidation near this level. For the potential value for the bottom, we consider the level of 0.895. We expect consolidation and an upward pullback near this level.

A short-term upward movement is possible in the range of 0.9055 - 0.9068, breaking through the last value will lead to a deep correction. Here, the potential target is 0.9085. We consider the level 0.9099 as a potential value for the top and upon reaching which, we expect the initial conditions for the upward cycle to form.

The main trend is the downward cycle from August 20.

Trading recommendations:

Buy : 0.9055 Take profit: 0.9066

Buy : 0.9070 Take profit: 0.9085

Sell: 0.9020 Take profit: 0.8985

Sell: 0.8980 Take profit: 0.8958

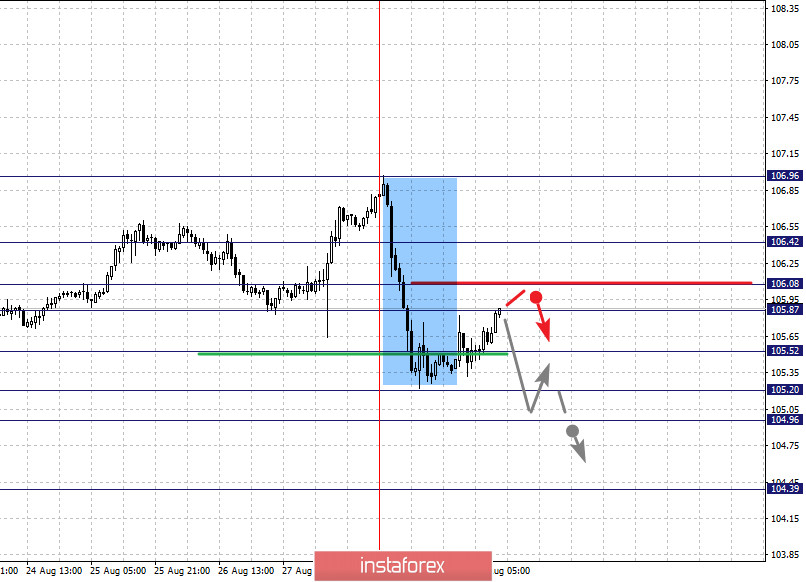

The key levels for the dollar/yen pair are 106.42, 106.08, 105.87, 105.52, 105.20, 104.96 and 104.39. Here, we are following the formation of the downward potential from August 28. We expect the downward movement to continue after the breakdown of 105.52. In this case, the target is 105.20. Meanwhile, price consolidation is in the range of 105.20 - 104.96. For the potential value for the bottom, we consider the level 104.39. A strong upward movement is expected after the breakdown of the level of 104.94.

A short-term upward movement is possible in the range of 105.87 - 106.08 and breaking through the last value will lead to a deep correction. Here, the target is 106.42, which is the key support for the downward structure from August 28.

The main trend is the formation of the downward potential from August 28

Trading recommendations:

Buy: 105.87 Take profit: 106.08

Buy : 106.10 Take profit: 106.40

Sell: 105.52 Take profit: 105.20

Sell: 104.95 Take profit: 104.40

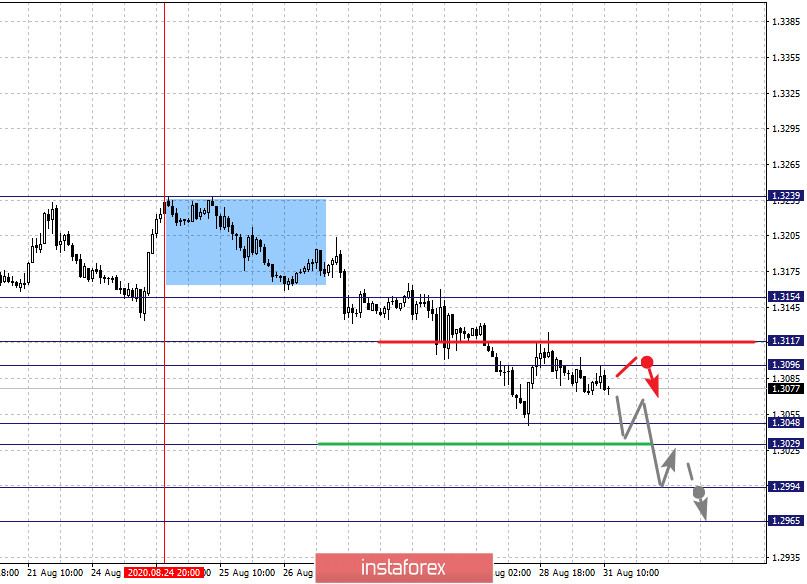

The key levels for the USD/CAD pair are 1.3154, 1.3117, 1.3096, 1.3048, 1.3029, 1.2994 and 1.2965. Here, we are following the downtrend cycle from August 24. The downward movement is expected to continue after the price passes the noise range 1.3048 - 1.3029. In this case, the target is 1.2965. A consolidation and an upward pullback is near this level.

A short-term upward movement is possible in the range of 1.3096 - 1.3117. If the last value breaks down, a deep correction will emerge. The target is 1.3154, which is the key support for the downward cycle.

The main trend is the local descending structure of August 24

Trading recommendations:

Buy: 1.3096 Take profit: 1.3117

Buy : 1.3120 Take profit: 1.3154

Sell: 1.3029 Take profit: 1.2995

Sell: 1.2992 Take profit: 1.2965

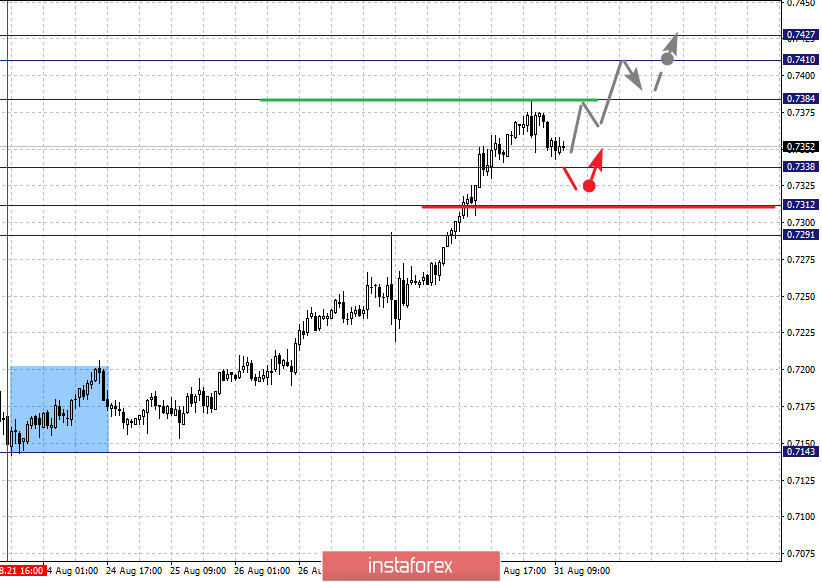

The key levels for the AUD/USD pair are 0.7427, 0.7410, 0.7384, 0.7338, 0.7312 and 0.7291. We are following the upward cycle of August 21 here. The continuation of the upward movement is expected after the breakdown of the level of 0.7384. In this case, the target is 0.7410. Now, for the potential value for the top, we consider the level of 0.7427. Upon reaching which, we expect consolidation and downward pullback.

The movement into correction is expected after the breakdown of the level of 0.7338. The target is 0.7312. For the potential value for the bottom, we consider the level of 0.7291, from which the initial conditions for the downward cycle is expected to form.

The main trend is the upward cycle of August 21

Trading recommendations:

Buy: 0.7384 Take profit: 0.7410

Buy: 0.7412 Take profit: 0.7426

Sell : 0.7336 Take profit : 0.7314

Sell: 0.7310 Take profit: 0.7291

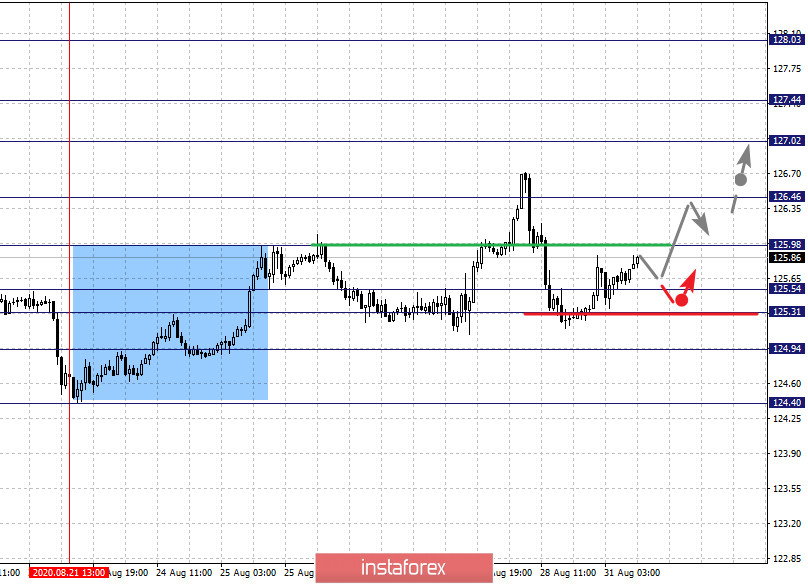

The key levels for the euro/yen pair are 128.03, 127.44, 127.02, 126.46, 125.98, 125.54, 125.31, 124.94 and 124.40. The upward structure for August 21 is being followed here. The resumption of the upward movement is possible after the breakdown of the level of 125.98. In this case, the first target is 126.46 and the breakdown of which should be accompanied by a strong upward movement. The target is 127.02. On the other hand, we consider the level of 127.44 as a potential value for the top. Upon reaching which, we expect consolidation. We consider the level of 128.03 as a potential value for the upward structure, from which we expect a downward pullback.

A short-term downward movement is expected in the range of 125.54 - 125.31. The breakdown of the last value will lead to a deeper movement. Here, the target is 124.94, which is the key support for the top. Its breakdown will favor the development of a downward trend. In this case, the potential target is 124.40.

The main trend is the upward structure of August 21

Trading recommendations:

Buy: 125.98 Take profit: 125.44

Buy: 125.47 Take profit: 127.00

Sell: 125.30 Take profit: 124.95

Sell: 124.93 Take profit: 124.43

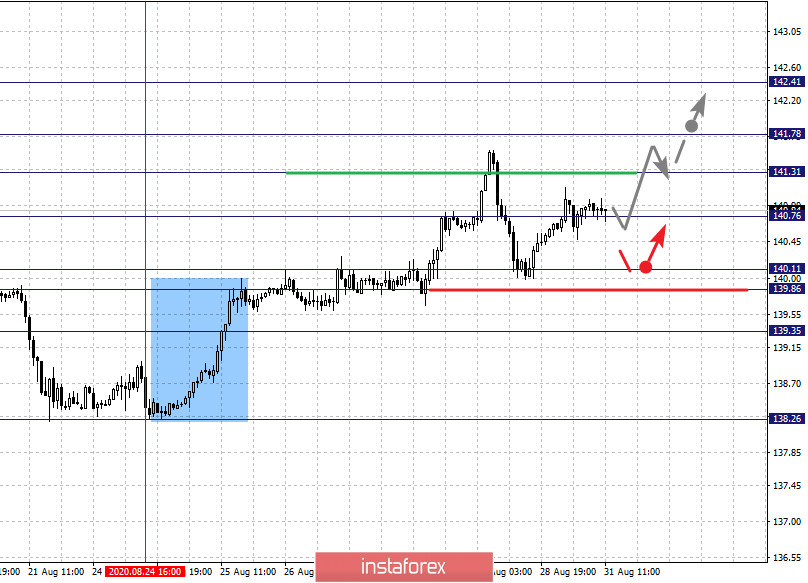

The key levels for the pound/yen pair are 142.41, 141.78, 141.31, 140.76, 140.11, 139.86 and 139.35. We are following the development of the rising structure from August 24. Here, the upward movement is expected to continue after the breakdown of 140.76. In this case, the target is 141.31. There is a short-term upward movement and consolidation in the range of 141.31 - 141.78. Now, for a potential value for the top, we consider the level of 142.41 Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 140.11 - 139.86, breaking through the last value will lead to a deep correction. Here, the target is 139.35, which is the key support for the top.

The main trend is the upward structure from August 24

Trading recommendations:

Buy: 140.76 Take profit: 141.30

Buy: 141.33 Take profit: 141.76

Sell: 140.11 Take profit: 139.87

Sell: 139.84 Take profit: 139.37

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română