Trading recommendations for EUR / USD on August 31

Analysis of transactions

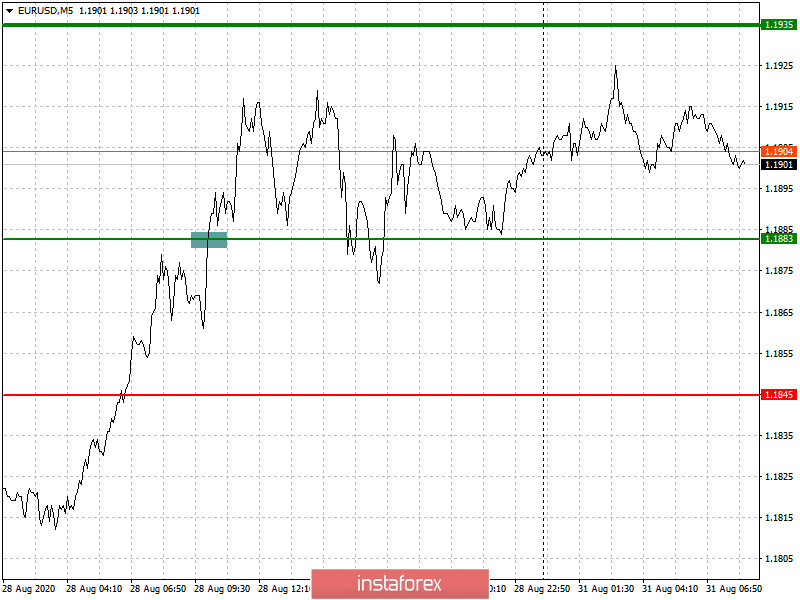

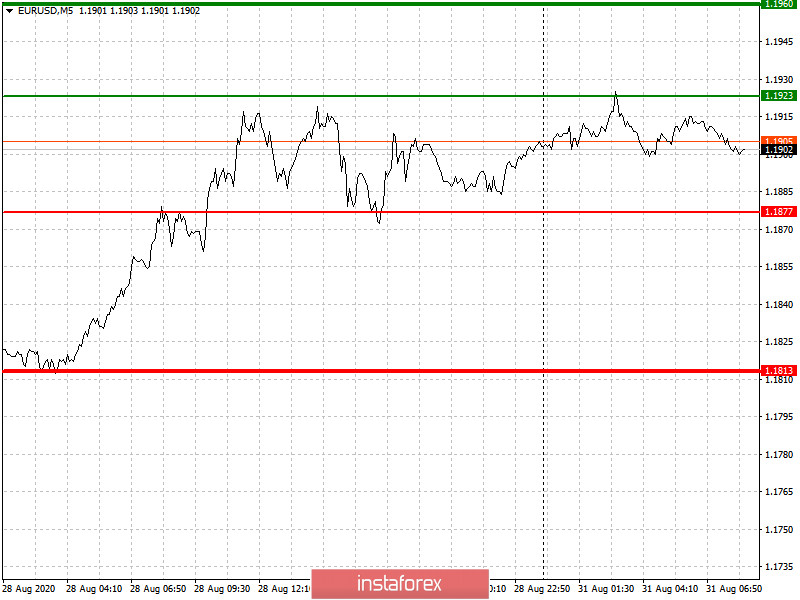

Price increased by about 30 points on Friday, but then stopped moving right after. Nonetheless, the bullish mood in the euro remains, having good and improving data on the eurozone economy.

Today, inflation reports in Italy and Germany will be published, and if data turns out good or maybe even better than forecasts, the EUR / USD pair shall remain trading upwards in the market.

- Set long positions from 1.1923 (green line on the chart) to 1.1960, and take profit at the level of 1.1960.

- Set short positions from 1.1877 (red line on the chart) to 1.1813, but then these may turn out unprofitable since the market has formed a bullish impulse that may continue at the beginning of September. In any case, take profit at the level of 1.1813.

Trading recommendations for GBP / USD on August 31

Analysis of transactions

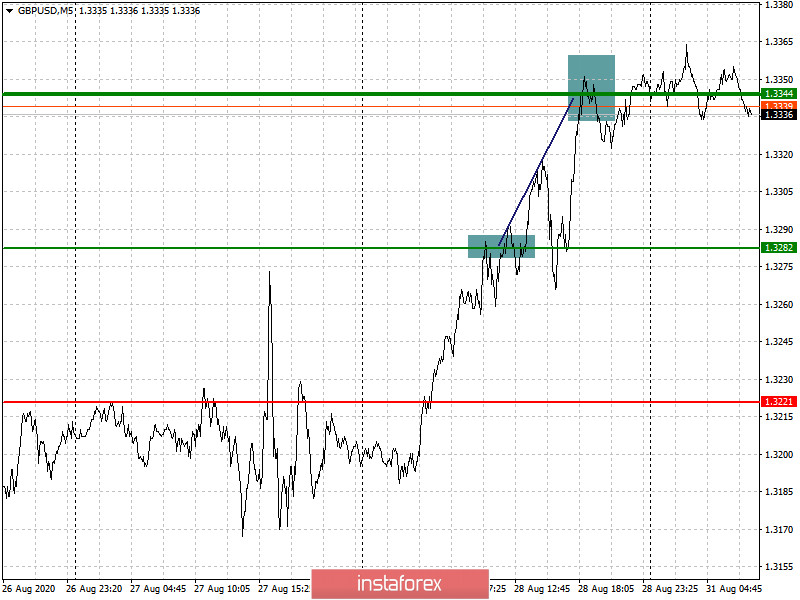

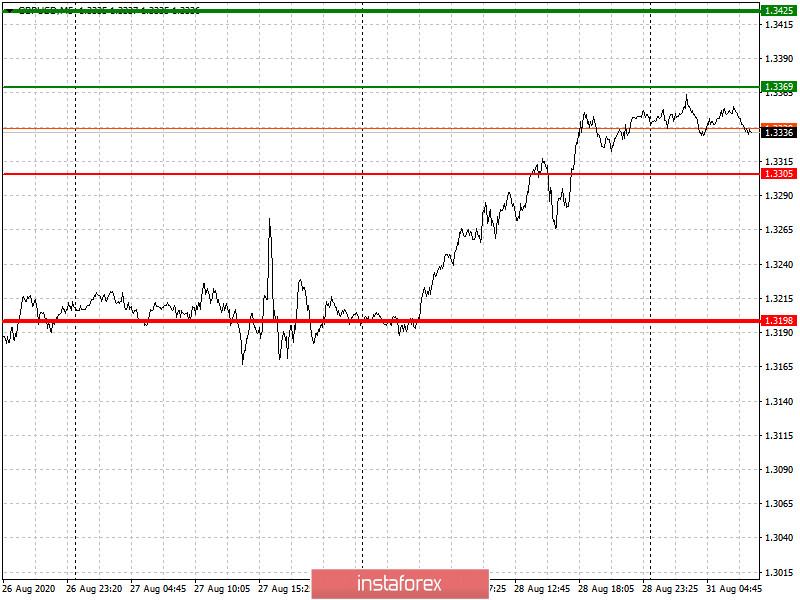

Demand for the pound increased last Friday, as a result of which the GBP / USD pair moved upwards from 1.3282. It brought about 60 points of profit to long positions from the market.

Remarks of Bank of England head Andrew Bailey also rose demand for the GBP / USD pair. Now, the bulls need to wait for positive statements from the Fed, in order to maintain the upward mood in the market.

- Set up long positions from 1.3369 (green line on the chart) to 1.3425 (thicker green line on the chart), and take profit at a price level of 1.3425.

- Sell shorts after the price reaches 1.3305 (red line on the chart), as a breakout of which will lead to a larger decline in the GBP/USD pair. Take profit at the level of 1.3198.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română