Global markets ended last week with the expected dynamics, which followed after J. Powell announced Fed's new monetary policy at the Jackson Hole symposium. In general, the meaning of which is to reach the inflation rate of 2% or above this mark even for a short time.

What awaits the world markets in general and currency exchange in particular in the long and short term?

The Fed's announced rate is expected to be for long-term – first, it will support the US stock market, which received strong assurances from the head of the Central Bank that the very low monetary rate will be prolonged. In this situation, the yields of US Treasury government bonds will begin to decline again, since Fed's extremely low interest rates will put pressure on them. This will be an important negative factor for the dollar, which will continue to decline as long as the saturation of dollars in the global financial system is at a critically high level.

We believe that this idea will dominate the currency market in the coming months. With regard to the long-term period, both a risk of the presence of a further weakening of the dollar, and its termination are noted. We have no doubt that maintaining the monetary rates of central banks, whose currencies are among the main ones and are traded against the dollar, will demonstrate sustained weakness. But if, for example, the ECB or, say, the RBA suddenly becomes concerned about the strong exchange rates of their national currencies against the dollar, which will hinder the successful competition of their producers in the global market, then the measures taken on their part aimed at weakening exchange rates will stop dollar's "anti-rally".

How will the situation in the currency market develop this week?

There is a lot of important economic data coming out this week, which can certainly affect the dynamics of both the dollar and the major currencies. These are the figures of production indicators both in Europe, USA and Canada and the values of consumer and industrial inflation in the euro area. Of course, the market's focus will be on the values of new jobs in the States that the US economy in August. On the other hand, there will be a meeting on monetary policy in Australia, however, it should be noted that the currency pairs where the US dollar is present will fully depend on the incoming data from US, since their dynamics will either confirm the need for Fed's long-term inflation targeting measures or will weaken hopes for an extremely long-term soft monetary policy, which is clearly negative for the dollar.

Forecast of the day:

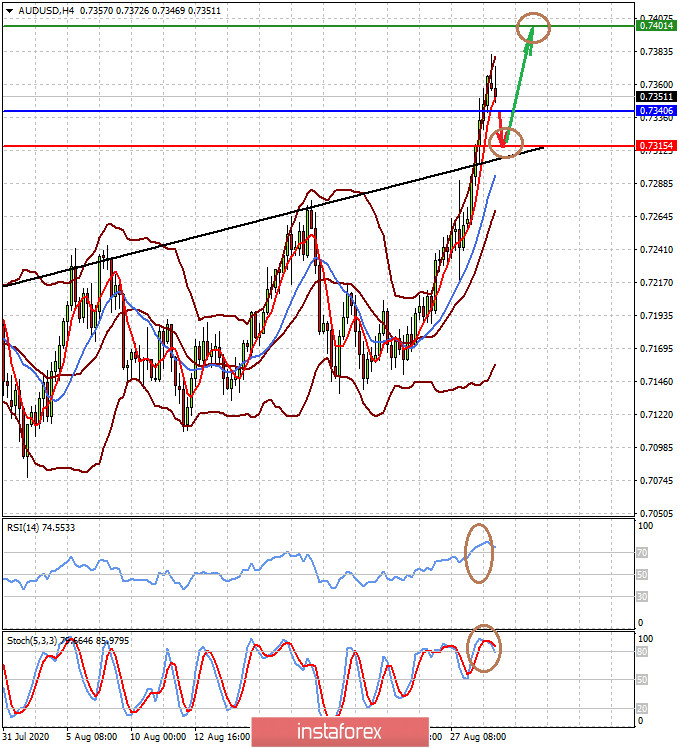

The AUD/USD pair is correcting downward on the wave of local overbought and the publication of weaker statistics from China. A price drop below the 0.7340 level would lead to a fall towards 0.7315, before the pair resumes to 0.7400.

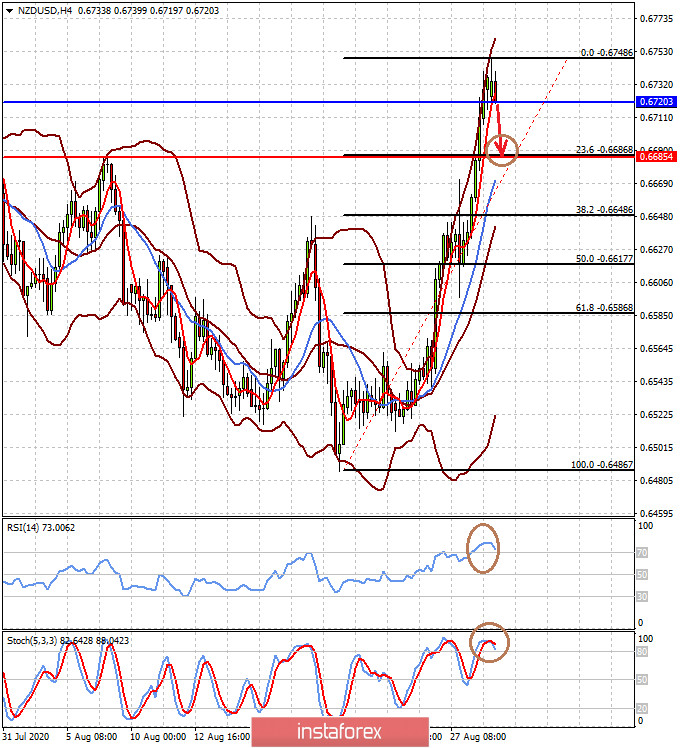

The NZD/USD pair is also correcting downward. Its decline below 0.6720 will lead to a price drop to the level of 0.6685.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română