Intermediate operational scale (Weekly)

What will autumn have in store for us? Options for the development of the movement of #USDX vs EUR/USD & GBP/USD & USD/JPY (Daily) on August 31, 2020.

____________________

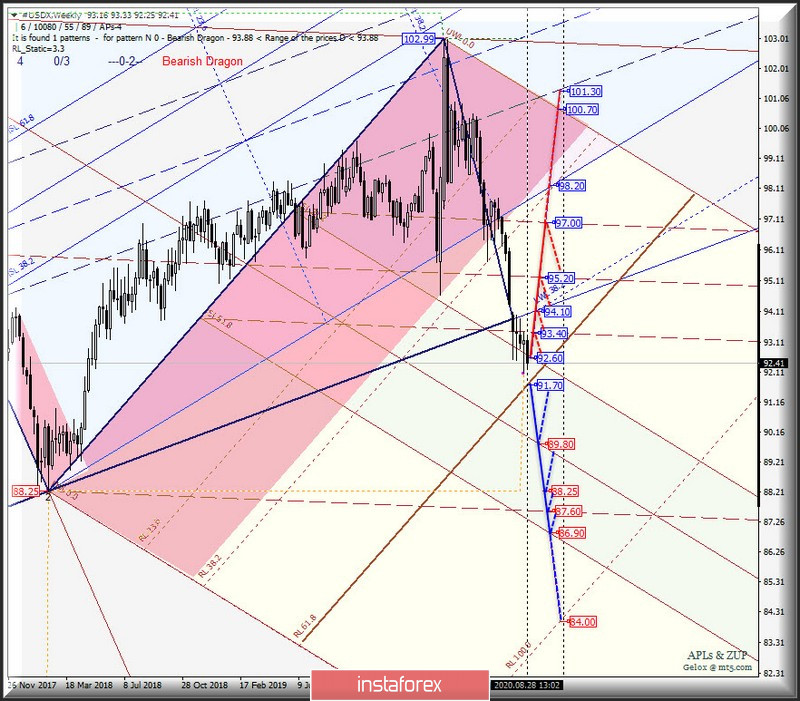

US dollar index

From August 31, 2020, the movement of the dollar index #USDX will continue, depending on the development and direction of the breakdown of the range:

- resistance level of 92.60 - the upper limit of ISL38.2 of the equilibrium zone of the Minor operational scale fork;

- support level of 91.70 - reaction line RL61.8 of the Minor operational scale fork.

In case of breakdown of the resistance level of 92.60 at the upper border of ISL38.2 of the equilibrium zone of the Minor operational scale fork, the #USDX movement will be directed to the boundaries of the 1/2 Median Line Minor channel (93.40 - 95.20 - 97.00).

If the support level of 92.70 is broken down on the RL61.8 Minor reaction line, the development of the dollar index movement will continue in the equilibrium zone (92.60 - 89.80 - 86.90) of the Minor operational scale fork, taking into account the processing of the local minimum 88.25 and the final Shiff Line Minor (87.60).

The layout of the #USDX movement options from August 31, 2020 is shown on the animated chart.

____________________

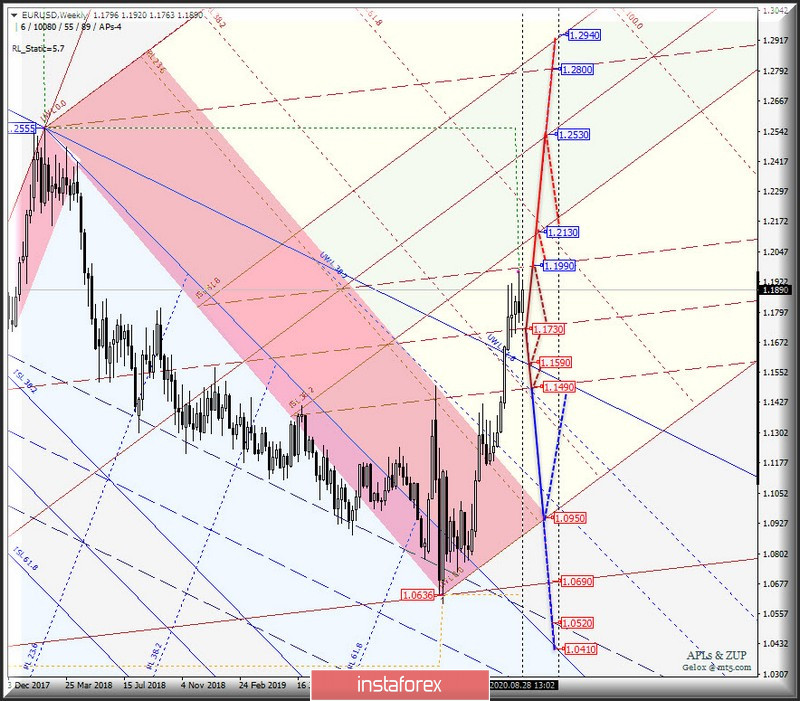

Euro vs US dollar

From August 31, 2020, the development of the movement of the single European currency EUR/USD will continue in the 1/2 Median Line channel (1.1490 - 1.1790 - 1.1990) of the Minor operational scale fork with reference to the UTL control line (1.1590) of the Intermediate operational scale fork - we look at the animated chart for the markup for working out these levels.

The downward movement of EUR/USD will continue in the event of a breakdown of the support level of 1.1490 at the lower border of the channel 1/2 Median Line Minor and will be directed to the initial SSL line (1.0950) of the Minor operational scale fork.

The upward movement of the single European currency will continue in the event of a breakdown of the upper border of the channel 1/2 Median Line Minor - resistance level of 1.1990 - and will be directed to the equilibrium zone (1.2130 - 1.2530 - 1.2940) of the Minor operational scale fork.

The EUR/USD movement options from August 31, 2020 are shown on the animated chart.

____________________

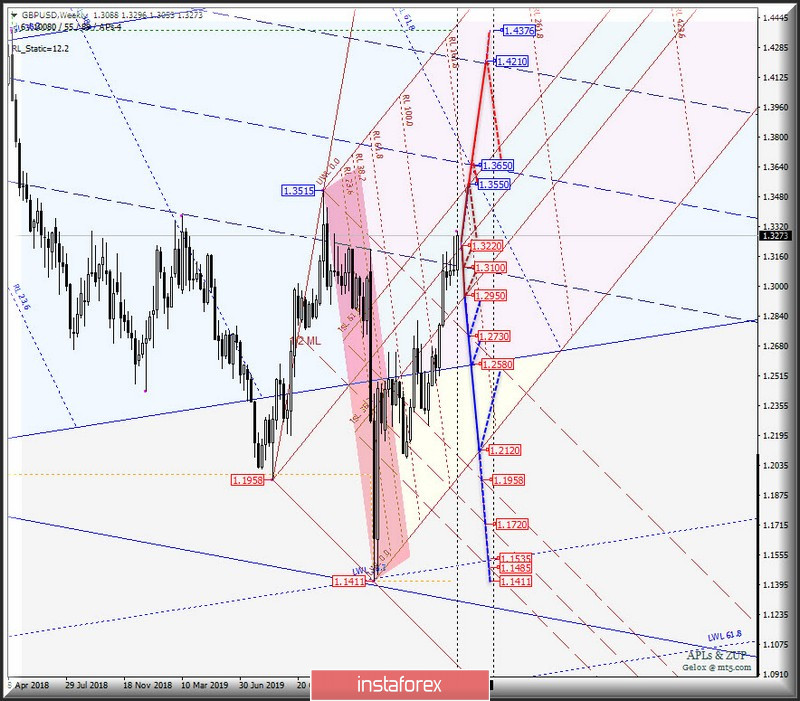

Great Britain pound vs US dollar

The development of the movement of Her Majesty's currency GBP/USD from August 31, 2020 will continue in the equilibrium zone (1.2950 - 1.3220 - 1.3550) of the Minor operational scale fork, taking into account the working out of the lower border of the channel 1/2 Median Line (1.3100) of the intermediate operational scale fork - the markup of movement within this zone is presented on an animated chart.

The relevance of the development of the downward movement of GBP/USD will be confirmed by the breakdown of the support level of 1.2950 at the lower border of ISL38.2 of the equilibrium zone of the Minor operational scale fork and this movement will be directed towards the targets:

- final Shiff Line Minor (1.2730);

- initial line of SSL (1.2580) of the Intermediate operational scale forks;

- initial line SSL (1.2120) of the Minor operational scale fork.

The upward movement of the currency of Her Majesty will continue after a breakout of the resistance level of 1.3550 on the top border ISL61.8 of the equilibrium zone of the Minor operational scale fork, and will be sent to 1/2 Median Intermediate (1.3650) and the upper border of the channel 1/2 Median Line (1.4210) of the Intermediate operational scale forks.

Options for the movement of GBP/USD from August 31, 2020 are shown on the animated chart.

____________________

US dollar vs Japanese yen

The movement of the currency "Land of the Rising Sun" USD/JPY from August 31, 2020 will be due to the training and direction of a breakout of the range:

- resistance level of 106.00 - the starting line SSL of the Intermediate operational scale forks;

- support level of 105.00 - the upper border of the channel 1/2 Median Line of the Minor operational scale fork.

If the resistance level 106.00 on the starting line SSL of the Intermediate operational scale forks will determine the development of the upside movement of USD/JPY to the borders of the equilibrium zone (107.70 - 109.20 -110.70) of the Minor operational scale fork with the prospect of updating local maximum 112.23.

Breakdown of the support level of 105.00 - the development of the movement of the "Land of the Rising Sun" currency will continue in the 1/2 Median Line channel (105.00 - 103.50 - 101.95) of the Minor operational scale fork with the prospect of updating the local minimum 101.19.

The markup of USD/JPY movement options from August 31, 2020 is shown on an animated chart.

____________________

The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders).

Formula for calculating the dollar index:

USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036.

Where the power coefficients correspond to the weights of currencies in the basket:

Euro - 57.6 %;

Yen - 13.6 %;

Pound - 11.9 %;

Canadian dollar - 9.1 %;

Swedish Krona - 4.2 %;

Swiss franc - 3.6 %.

The first coefficient in the formula brings the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română