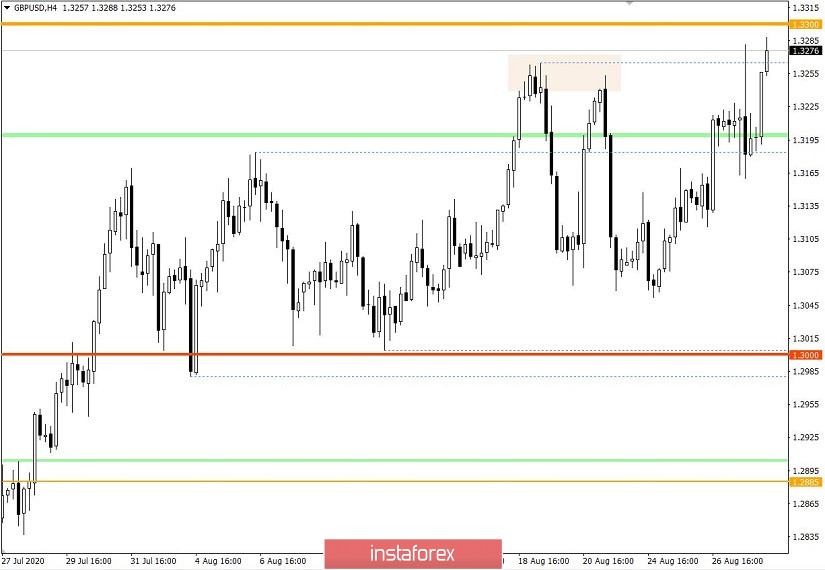

The pound traded upwards this week, as a result of which the quote managed to move past the flat located at 1.2985 // 1.3085 // 1.3185, and updated the local high 1.3265.

Such is mainly due to the weak US dollar in the market, which helped so much in raising the rate of GBP / USD.

However, the extremely high degree of overbought in the pound will sooner or later lead to an uncontrolled collapse of the currency in the market, so local operations are deemed to be the best trades as of the moment.

Thus, if we look at the M30 chart for yesterday, we will see that long positions surged at 13: 45-14: 15, after which short positions arose at 14: 20-15: 05.

It resulted in the highest volatility since the beginning of the week, amounting to 121 points, which is 5% higher than the average value.

In addition, the second estimate for the US Q2 GDP was released yesterday, where instead of a slowdown in economic growth to -32.9%, a decline to -31.7% was recorded.

At the same time, weekly data on unemployment claims was also published, the records for which have decreased according to the report.

Repeated applications reduced by 223 thousand, from 14,758,000 to 14,535,000, while initial applications declined by 98 thousand, from 1,104,000 to 1,006,000.

These data, although good, saw a negative reaction from market participants. The reason for which is the speculation connected with the recent speech of Fed chairman Jerome Powell on monetary policy.

During the annual economic symposium in Jackson Hole, Powell announced revisions in the Fed policy.

"Our long-term inflation target is still 2%. However, if it falls below such after economic downturns, and never rises above in a strong economy, inflation will average less than 2% over time. Households and businesses will expect this result, which means that expectations will tend to fall below our target, thereby reducing the realized inflation.

To prevent such an outcome and possible unfavorable dynamics, our new statement indicates that we will strive for inflation to average 2% over time. Consequently, during periods that inflation fall below 2%, appropriate monetary policy will be issued. "

Next week is set to be eventful in terms of statistics. First, data on the UK lending market will be published, after which ADP and the US Department of Labor will release their reports on the US labor market.

Monday, August 31

UK - Bank holiday (Weekend)

Tuesday, September 1

UK 09:30 - Manufacturing PMI (August)

UK 09:30 - Data on lending market

- Volume of consumer lending by the Bank of England (July)

- Number of approved mortgages (July)

- Volume of mortgage lending (July)

US 15:00 - ISM Manufacturing PMI (August)

Wednesday, September 2

US 13:15 - ADP report on employment in the private sector (August)

Thursday, September 3

US 13:30 - Report on claims for unemployment benefits

US 15:00 - ISM Non-Manufacturing PMI (August)

Friday, September 4

US 13:30 - report by the US Department of Labor

- Change in the number of people employed in the non-agricultural sector

- Unemployment rate

- Average hourly wages

Further development

Studying the trading chart, we can see that a bullish mood arose during the Asian session, and it resulted in the quote moving past the local highs, in the direction of price level 1.3300.

However, resistance will be strong around this area, so movement will slow down in the chart. In addition, if expected statistics coincide with the real figures next week, price will roll back, in the direction of 1.3230.

Alternative scenario

In order to maintain a bullish mood, consolidate the quote above the level of 1.3350.

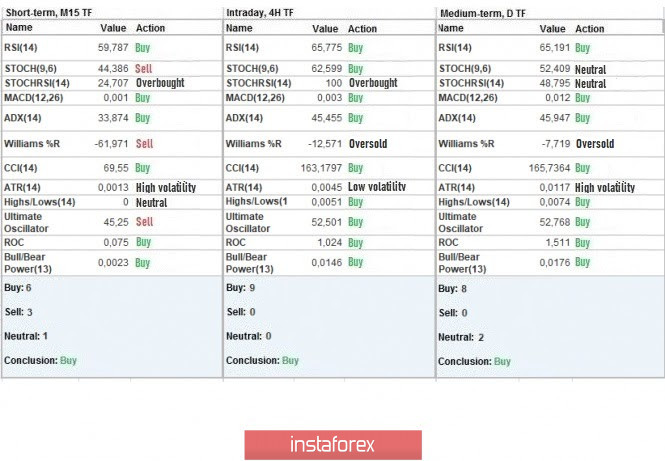

Indicator analysis

Looking at the different time frames (TF), we can see that the indicators on the minute, hourly and daily periods all signal buy due to the quote moving past the local highs.

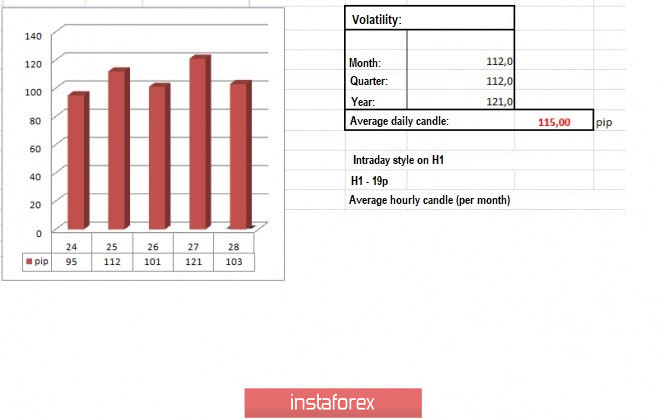

Weekly volatility / Volatility measurement: Month; Quarter; Year

Volatility was measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year.

(Its dynamics on August 28 was calculated, taking into account the time this article is published)

Volatility is 103 points today, which is practically the average level. If the dynamics is continuously provoked by speculation, activity may increase in the market.

Key levels

Resistance zones: 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support zones: 1.3200; 1.3000 ***; 1.2885 *; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000.

* Periodic level

** Range level

*** Psychological level

Also check the brief trading recommendations for the EUR/USD and GBP/USD pairs here.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română