Frankly speaking, Federal Reserve Chairman Jerome Powell greatly disappointed market participants, although a full reaction to his words followed some time after his speech. In fact, the Fed chief did not say anything. What we have heard is promises that the US central bank will pursue a more flexible policy that is better suited to the current situation. The only thing that was really specific was that if inflation rises above the target level of 2.0%, the Fed will act immediately and raise the refinancing rate. From all this, market participants concluded that as long as inflation is below 2.0%, the refinancing rate will remain at the current level. Although Powell didn't say so. Moreover, its streamlined wording suggested that the Fed might as well raise the refinancing rate. But there is no certainty. And against the background of the fact that the day before the European Central Bank actually announced the gradual beginning of monetary policy tightening, something similar was expected from Powell. So investors were really disappointed with his speech.

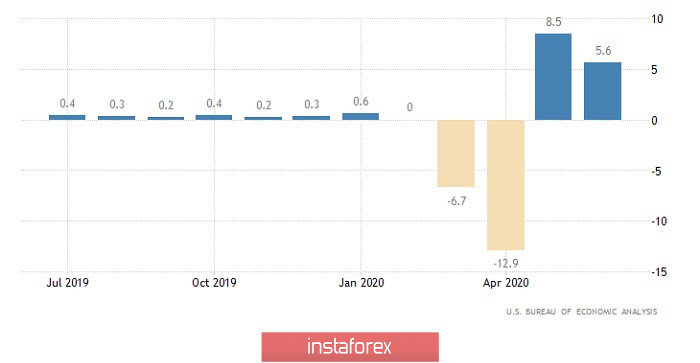

At the same time, the dollar had every reason for confident growth. But nobody looked at macroeconomic data yesterday. The second estimate of GDP for the second quarter was much better than forecasts, as it turns out that the rate of economic recession accelerated from -5.0% not to -32.9%, but only to -31.7%. In addition, the labor market continues to recover, despite the fact that everyone was already waiting for this process to stop. The number of initial applications for unemployment benefits fell from 1,104,000 to 1,006,000, which, however, turned out to be slightly worse than the forecast of 1,004,000. But much more importantly, the number of repeated applications for unemployment benefits decreased from 14,758,000 to 14,535,000. But it was expected to grow to 14,900,000. So the macroeconomic statistics in the United States, frankly speaking, were pretty good.

GDP Growth Rate (United States):

If no one was interested in macroeconomic data yesterday, then it is practically nonexistent today. The only thing published is the personal income and expenses of Americans. At the same time, if revenues are to decrease by 0.4%, then expenses may rise by 1.2%. Take note that incomes have been declining for two consecutive months, while expenses are only growing. And this is an extremely unpleasant situation. The drop in income is, of course, a consequence of record high unemployment. But the increase in spending in this situation is worrying, because sooner or later, if the labor market does not recover, aggregate consumption will sharply decline and thereby only further aggravate the already difficult economic situation.

Personal expenses (United States):

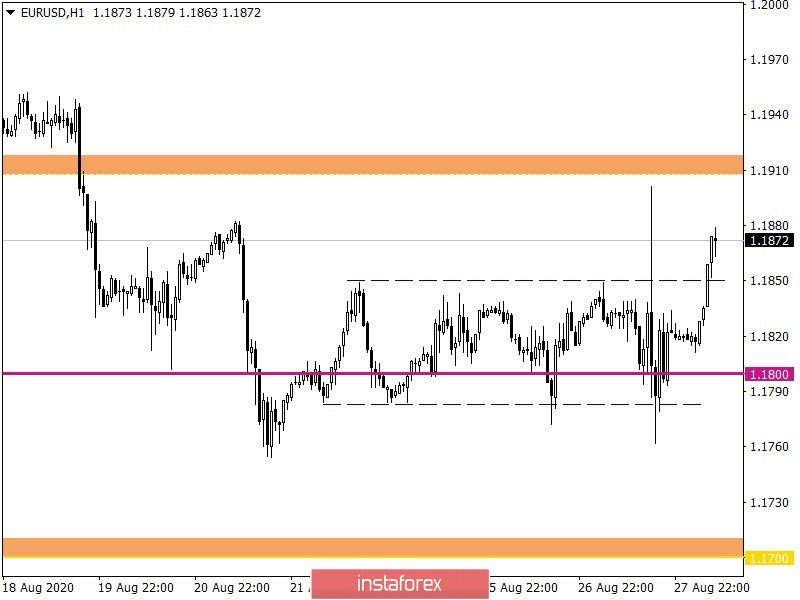

The EUR/USD pair showed ultra-high activity yesterday, as a result of which the 1.1785/1.1850 price range locally broke through the upward direction.

The increase in volatility is due to two factors: prolonged stagnation in the 1.1785/1.1850 range; information and news background described above.

Looking at the trading chart in general terms (daily period), you can see that the high activity is not broken by the cyclical nature of the main side channel 1.700/1.1800/1.1900.

We can assume that the upward trend set during the Asian session will remain for some time, but stagnation may occur in the 1.1900/1.1910 area.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments on the minute, hourly and daily intervals signal a buy since the price is approaching the upper border of the main flat.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română