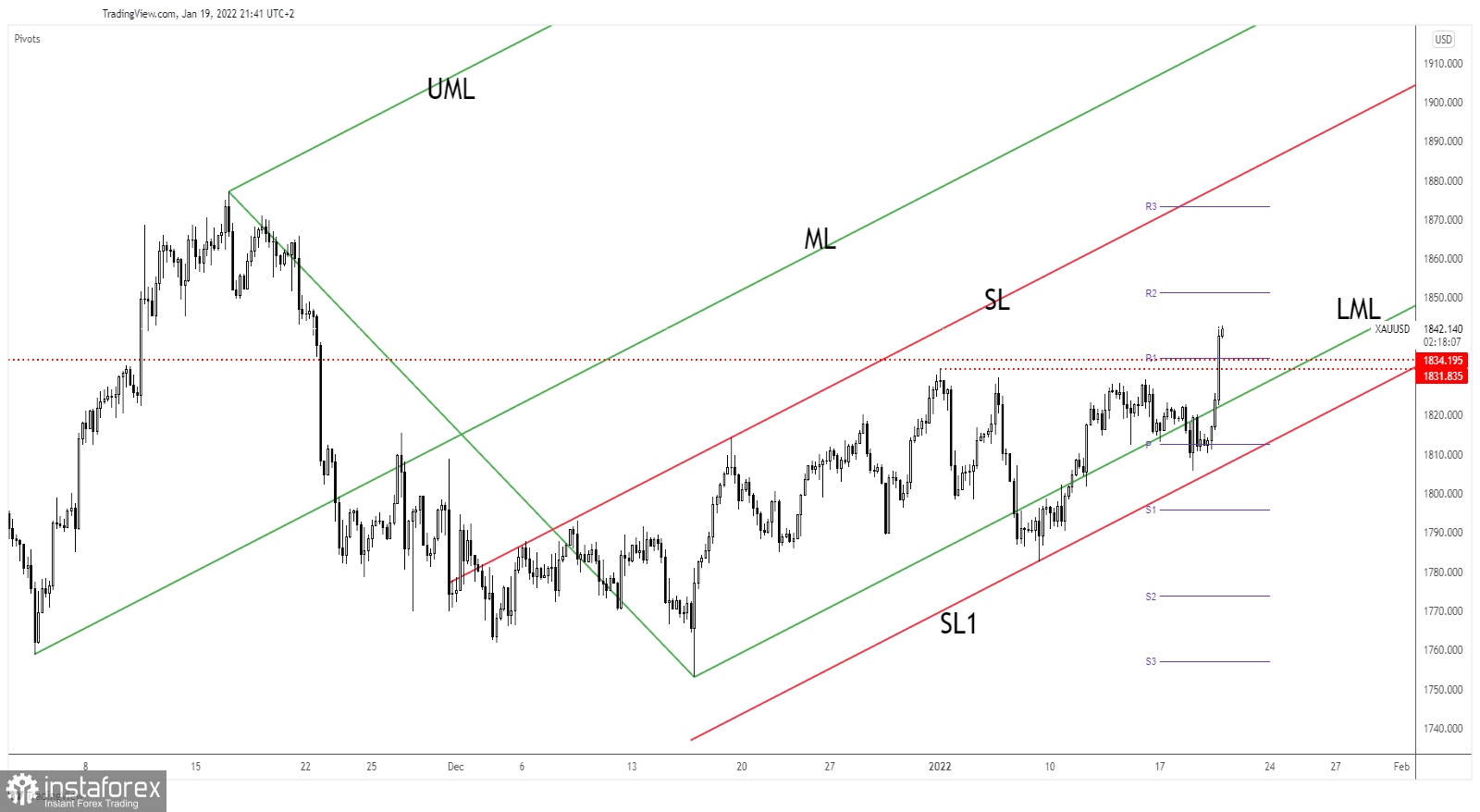

The price of Gold rallied today. It was traded at the 1,842.89 level at the time of writing versus 1,810.34 today's low. Technically, the price passed above strong upside obstacles signaling strong buyers and potential upside continuation.

The UK CPI rose by 5.4% exceeding 5.2% expected and compared to 5.1% growth in the previous reporting period. Also, the Core CPI reported a 4.2% growth versus 3.9% expected. XAU/USD's growth was supported by inflationary pressure, Omicron, and geopolitical tensions between Russia and Ukraine.

XAU/USD ignored major resistance

Gold found support on the weekly pivot point (1,812.66) failing to reach and retest the outside sliding line (SL1). Now, it has jumped above the 1,831.83 - 1,834.19 resistance area signaling strong buyers and potential further growth.

Failing to stabilize below the lower median line (LML) indicates strong buyers. Still, after its amazing rally, XAU/USD could come back down to test and retest the 1,834.19 before resuming its upwards movement.

Gold outlook

A minor consolidation above the 1,843.19 - 1,831.83 could bring new long opportunities. Gold could extend its growth as long as it stays above the broken resistance area. The next major upside target is represented by the inside sliding line (SL).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română