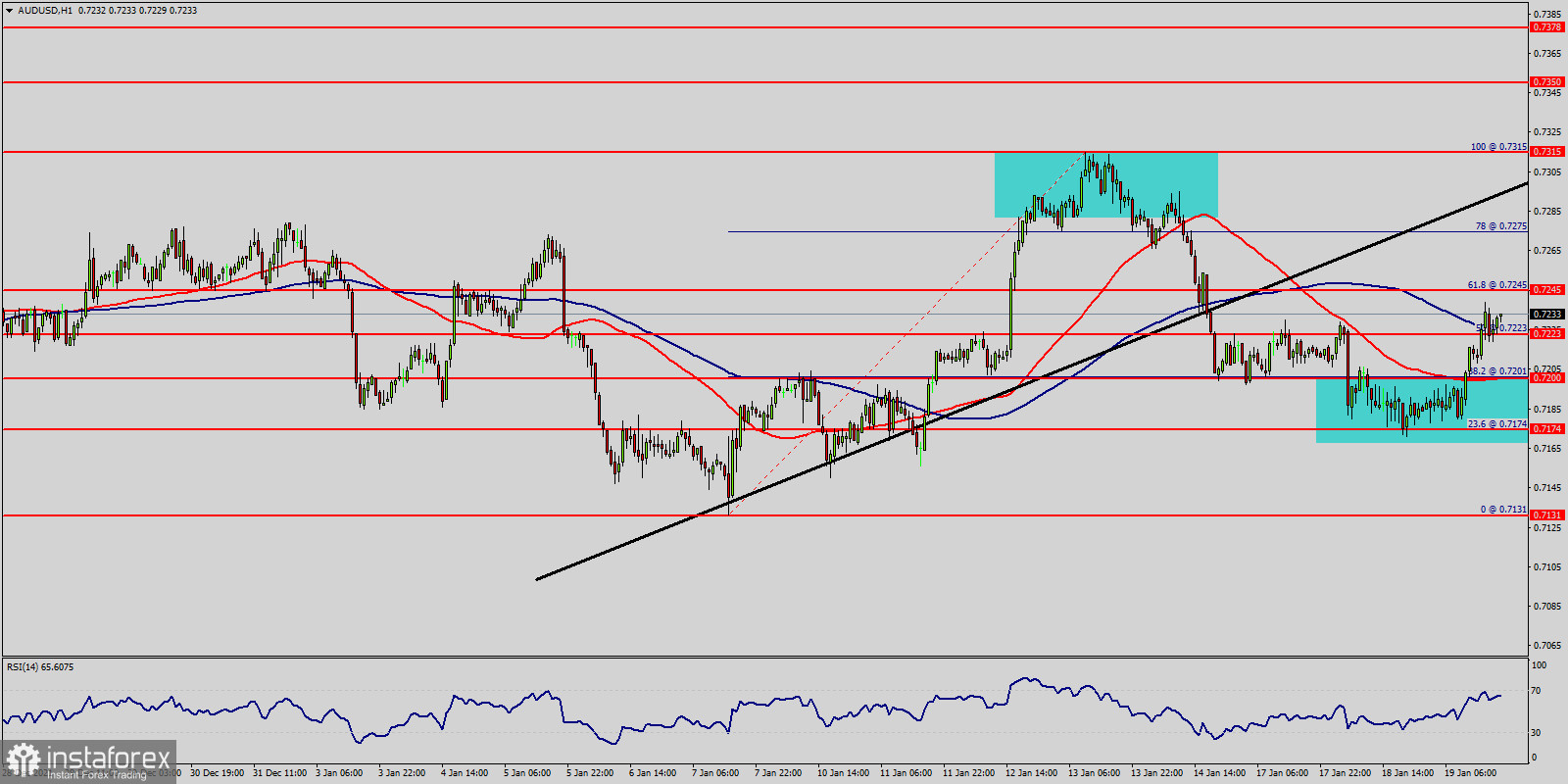

The AUD/USD pair didn't make any significant movements yesterday. There are no changes in our technical outlook. The bias remains bullish in the nearest term testing 0.7231 or higher.

Immediate support is seen around 0.7200. A clear break above the level of 0.7231 that area could lead price to the neutral zone in the nearest term.

The AUD/USD pair set above strong support at the level of 0.7200, which coincides with the 38.2% Fibonacci retracement level. This support has been rejected for four times confirming uptrend veracity.

Hence, major support is seen at the level of 0.7200 because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend from the area of 0.7200 and 0.7233.

The AUD/USD pair is trading in a bullish trend from the last support line of 0.7200 towards the first resistance level at 0.7315 in order to test it.

This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.7315 and further to the level of 0.7350.

Amid the previous events, the price is still moving between the levels of 0.7200 and 0.7350. The weekly resistance and support are seen at the levels of 0.7350 and 0.7200 respectively.

In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the sideways channel has completed. The level of 0.7350 will act as second resistance and the double top is already set at the point of 0.7315.

At the same time, if a breakout happens at the support levels of 0.7200 and 0.7174 , then this scenario may be invalidated. But in overall, we still prefer the bullish scenario.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română