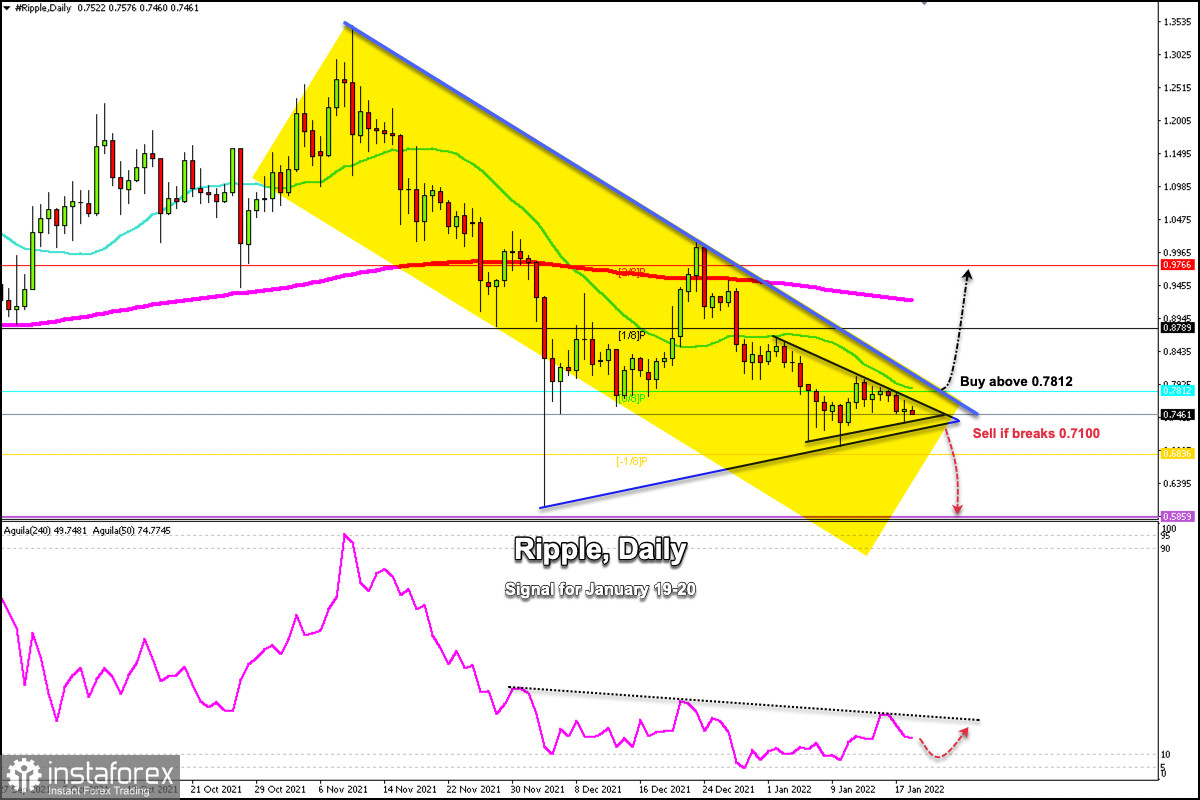

Ripple (XRP/USD) remains under bearish pressure, currently trading below the 21 SMA and below the 0/8 Murray both located at the same level at 0.7812.

Since the collapse on December 4, 2021 to the low of 0.6036, the crypto has managed to recover to 0.9610, printed on December 23. This was its last high that was above the 200 EMA. Now XRP is going through a very bearish stage, falling for a long time more than 50% of the recovery it had.

On the other hand, due to its correlation with BTC, the price of XRP is likely to rise 16% to retest 1/8 Murray at 0.8789. If BTC continues defending the zone of 40,000, there is hope that XRP will break the downtrend channel and consolidate above 78.12 for a short-term bullish outlook.

If in the next few days, the price of Ripple surpasses and breaks the bearish pressure zone, located at 0.7812, it could go towards the 200 EMA at 0.9210 and reach 2/8 of Murray at 0.9766.

As long as Ripple keeps hovering below 0.78, it will still be very bearish so the bears are probably still in control. A sharp break below the symmetrical triangle could see a drop to -2/8 Murray at 0.5859.

Support and Resistance Levels for January 19 - 20, 2022

Resistance (3) 0.7851

Resistance (2) 0.7694

Resistance (1) 0.7583

----------------------------

Support (1) 0.7354

Support (2) 0.7114

Support (3) 0.6836

***********************************************************

Scenario

Timeframe H4

Recommendation: buy above

Entry Point 0.7812

Take Profit 0.8789 (1/8) 0.9796 (2/8)

Stop Loss 0.7460

Murray Levels 0.6836 (-1/8) 0.7812 (0/8) 0.8789 (1/8)

***********************************************************

Alternative scenario

Timeframe H4

Recommendation: sell if breaks

Entry Point 0.7100

Take Profit 0.6836 and 0.5859 (-2/8)

Stop Loss 0.7450

***********************************************************

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română