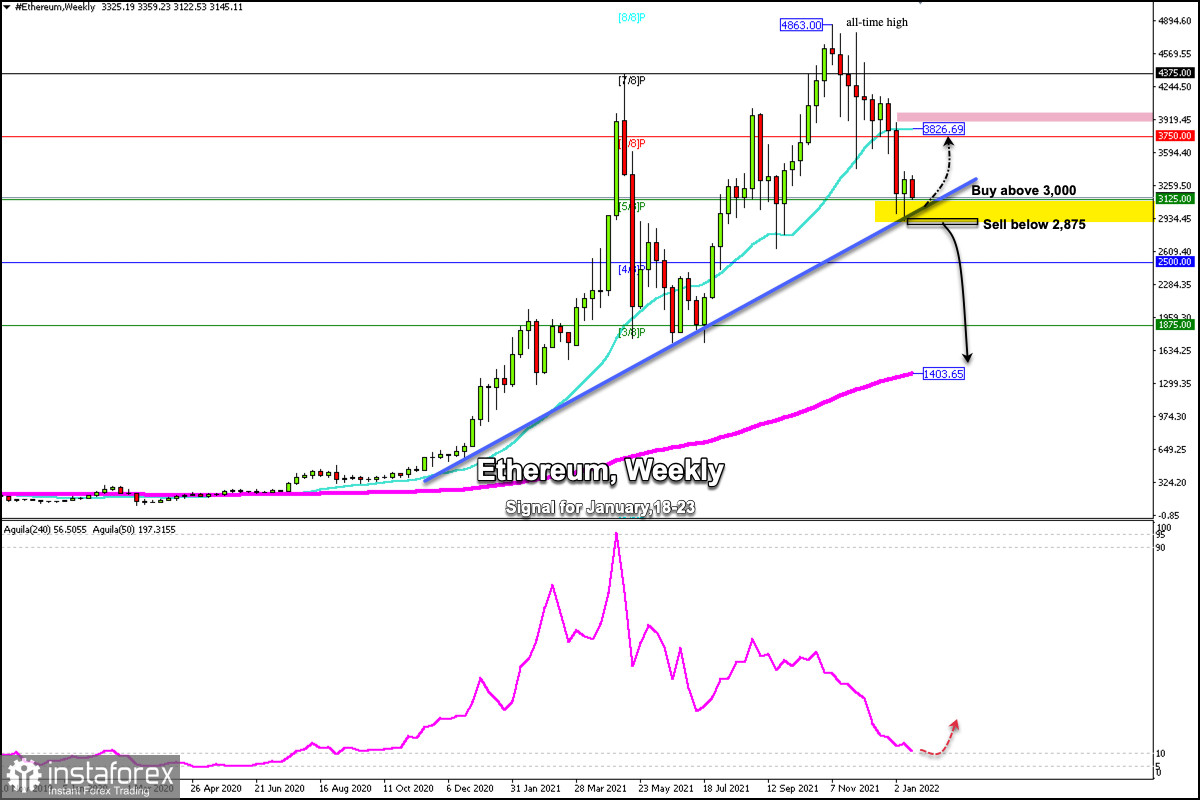

Ethereum (ETH) price is trading at a critical support level of 5/8 Murray and above the weekly trend channel projected from Oct 11, 2020.

The bulls are defending the psychological level of $3,000 and a technical bounce is expected in the next few days above this zone with targets towards 6/8 Murray at 3,750 and up to the 21 SMA at 3,826.

On the other hand, the price of Bitcoin is also consolidating above the psychological level of $40,000, yet it is still struggling to maintain its uptrend.

A sharp break below $37,500 could drag Ether and the other minor Cryptocurrencies that are correlated to BTC.

If Bitcoin loses its key level of $40,000, Ether could start a drop below 2,900 and approach 4/8 Murray at 2,500 and in the medium term to 3/8 located at 1,875.

The all-time high on Ether was $4,863. From this level, ETH/USD accumulates 11 weeks of correction. It is likely that the support level of the trend channel can give it the boost it needs so that it can recover some of the losses and can go up to the psychological level of $4,000.

Ether is close to losing the weekly uptrend. If that happens, we could expect a range for the next few weeks between $2,500 and $3,125. This zone could represent the next accumulation of bulls looking for a new bullish wave.

Our trading plan for the next few days is to buy as long as ETH remains above the weekly uptrend channel and above the psychological level of 3,000. The targets could be set at the SMA of 21 around 3,826 and up to 4,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română