In yesterday's trading, the pound/dollar currency pair showed a slight strengthening. The US currency is still under pressure, as market participants fear a slower recovery of the world's leading economy from the consequences of COVID-19, which most affected the United States of America.

The complicated relations between Washington and Beijing and the postponement of negotiations on a trade settlement, as well as the election tussle between Republicans and Democrats, during which the parties can not find a compromise on the adoption of an additional package of assistance to the US economy, also put pressure on the us dollar. Perhaps the publication of tomorrow's minutes can strengthen the position of the US currency, but for this to happen, there must be a strong optimism in the published ones. But where does it come from?

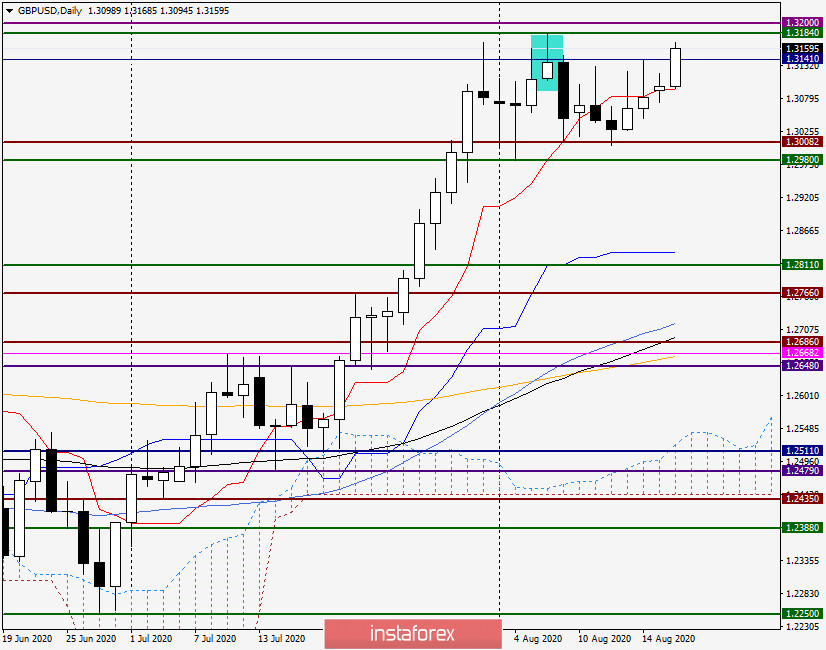

Daily

After yesterday's Doji candle with a small bullish body, at today's trading, at the moment of writing, the pair shows a more impressive growth and tests for a breakdown of the nearest resistance level at 1.3141, where the maximum trading values were shown on August 14. If this level is broken, the road to the equally important resistance area of 1.3184-1.3200 will open, where the further intentions of market participants for the pound/dollar pair will become clear. Once again, I note that specific sellers will return to the market only after a true breakdown of the important psychological and technical level of 1.3000, followed by a breakdown of support at 1.2980. In the meantime, judging by the technical picture on the daily chart, the continuation of the upward trend looks most likely. However, as noted above, much will depend on the ability of players to increase the rate to pass the resistance of sellers at 1.3141, 1.3184 and gain a foothold above the significant level of 1.3200.

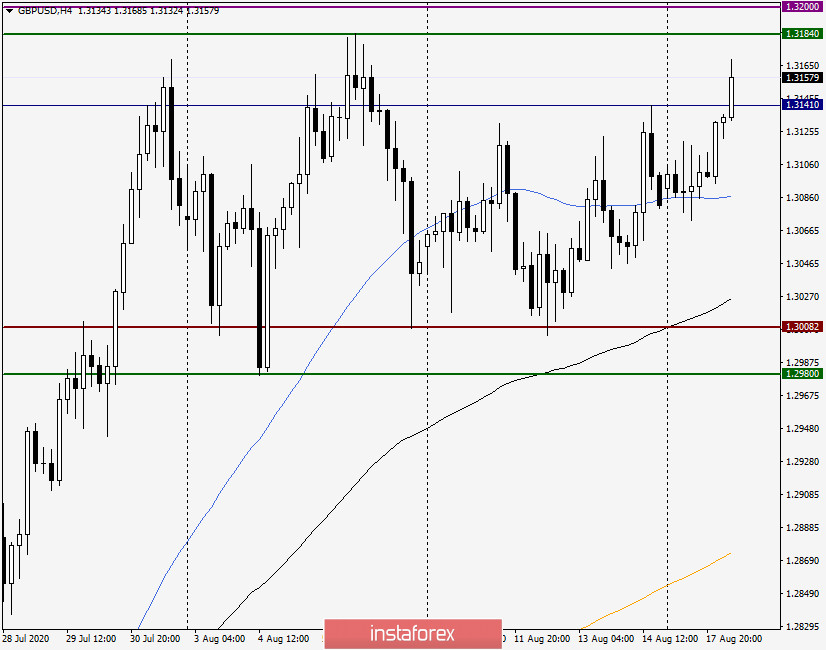

H4

On the four-hour chart, the pair has already fixed above the 50 simple moving average, and even earlier above the black 89 exponential. Now these moves, in the event of a corrective pullback, can provide support to the quote and return it to growth. However, looking at the current situation, the pair confidently looks up, without thinking about any adjustment. In this situation, it is quite risky to buy at the breakdown of the resistance indicated on the chart. The levels are strong and can turn the course down again. But in the case of a pullback to 50 MA, which passes at 1.3087, and the appearance of a reversal bullish model of candle analysis, a good signal will be received for opening long positions on GBP/USD.

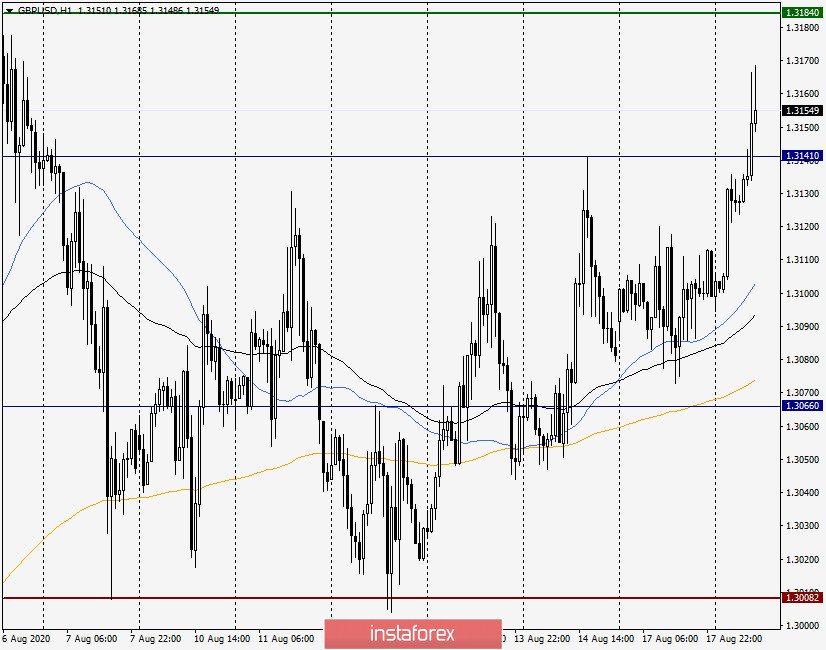

H1

At the end of the review, there is a confident and powerful breakdown of the sellers' resistance at 1.3141. If the breakout turns out to be true and the pair can gain a foothold above this level with three candles in a row, it is worth thinking about buying on the pullback. However, the next resistance at 1.3184 is very close, so I do not recommend setting large goals. If the level of 1.3184 is broken, this factor will further indicate the strength of the bulls for the pound, however, given the strong technical mark of 1.3200, I would not rush to open deals to buy. In my opinion, it is better to buy a pair from the depth and at lower prices.

The alternative option will become relevant in the case of false breakouts of 1.3141 and 1.3184, which will indicate the appearance of reversal models of candle analysis. With this option, you can try to sell the pound, but with small goals, in the area of 1.3120-1.3100. That's all for now.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română