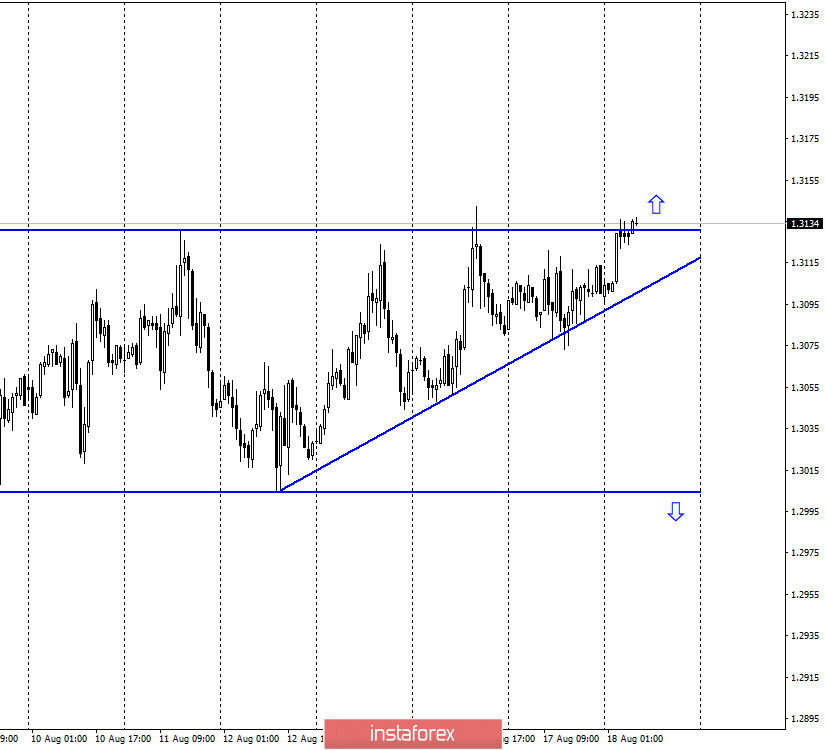

GBP/USD – 1H.

Hello, traders! On the hourly chart, the quotes of the GBP/USD pair continue to grow. The upward trend line at this time characterizes the mood of traders as "bullish", and the fact that quotes are fixed above the upper border of the side corridor increases the probability of further growth of the pair. Since the information background in the UK and America is currently absent, I would like to draw the attention of traders to the results of a Bloomberg survey, according to which many economists and experts do not expect a full recovery of the British economy until the end of 2021. Let me remind you that the Bank of England previously stated that it expects to reach pre-crisis levels by the end of 2021. The Central Bank believes that industrial production will fully recover by then. However, economists believe that a certain number of businesses will still go bankrupt as a result of the crisis, and unemployment will rise in any case, since the Bank of England will not be able to constantly stimulate the economy by maintaining wages. Now it looks like this: the state supports enterprises financially, so that they do not dismiss employees. This explains the low unemployment rate in Britain. In addition, economists fear a disordered split with the European Union, after which British and European companies will not be able to trade with each other as easily and duty-free as they are now.

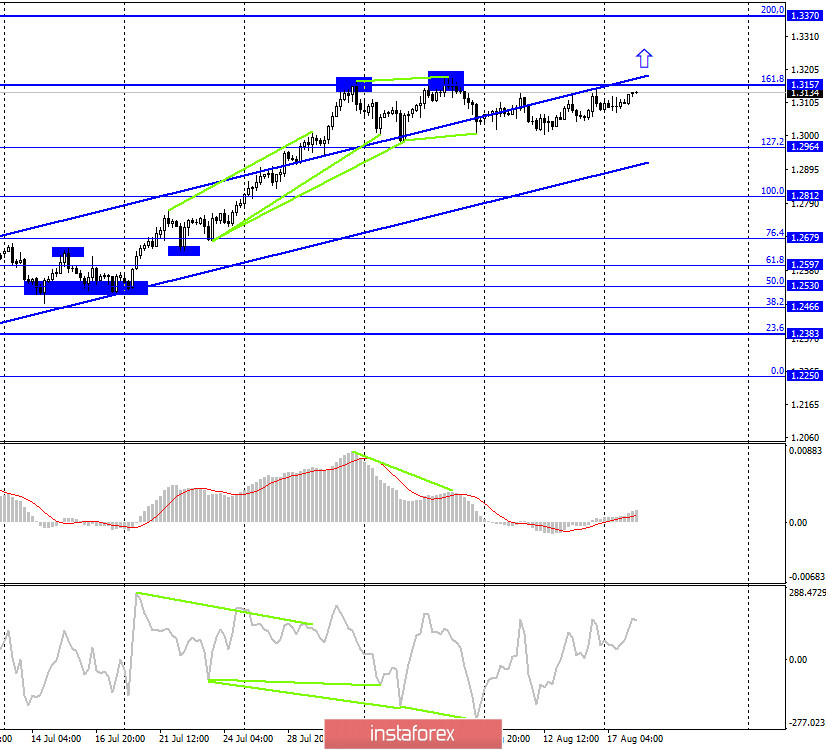

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair continues to grow in the direction of the corrective level of 161.8% (10.3157. The sideways corridor is also clearly visible on the 4-hour chart, as the pair has been trading neatly between the levels of 127.2% and 161.8% for several weeks. Fixing the pair above the Fibo level of 127.2% will increase the probability of further growth towards the next corrective level of 200.0% (1.3370). The rebound from this level will work in favor of the US dollar and resume the fall of quotes in the direction of the lower border of the side corridor on the hourly chart.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed an increase to the corrective level of 100.0% (1.3199), however, the level of 161.8% on the 4-hour chart does not allow the quotes to continue the growth process. Closing above the 100.0% level will work in favor of further growth in the direction of the Fibo level of 127.2% (1.3684).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the lower downward trend line. A pullback from this line may allow the pair to perform a reversal in favor of the US dollar and resume the process of falling towards the approximately 1.1500 level. This is a long-term perspective.

Overview of fundamentals:

On Monday, in the UK and America, the calendars of economic news were empty, so the background information did not have any effect on the course of trading during the day.

News calendar for the US and UK:

On August 18, the information background will also be absent, since the calendars of economic events in the UK and the US do not contain anything interesting.

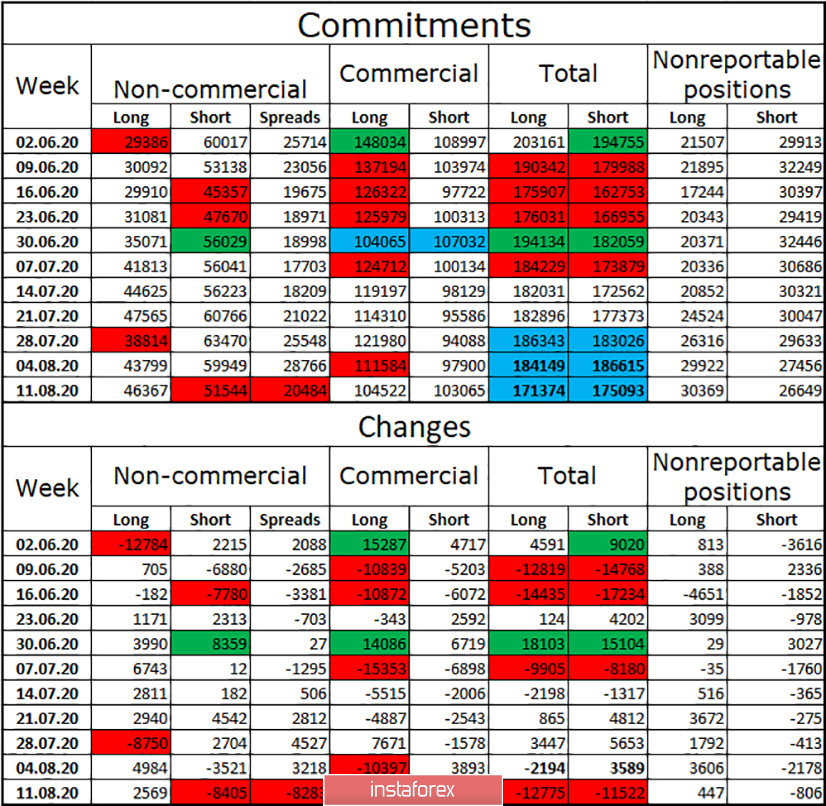

COT (Commitments of Traders) report:

The latest COT report on the British pound was absolutely predictable. Large speculators continued to increase long-contracts (+2.5 thousand) in the reporting week and got rid of short-contracts (-8.5 thousand). Thus, the "Non-commercial" group continued to believe in the pound. The total number of buy positions opened by speculators has been growing for three weeks in a row, and the number of short contracts in their hands has been declining for three weeks in a row. At the same time, the total number of open long and short contracts for all groups of traders is already approximately the same - 171 thousand and 175 thousand.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goal of 1,3005, if a new rebound is made from the level of 161.8% (1.3157) on the 4-hour chart. I do not recommend buying the British currency today, as there is a high probability of a rebound from the upper border of the side corridor and the level of 161.8% (1.3157).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română