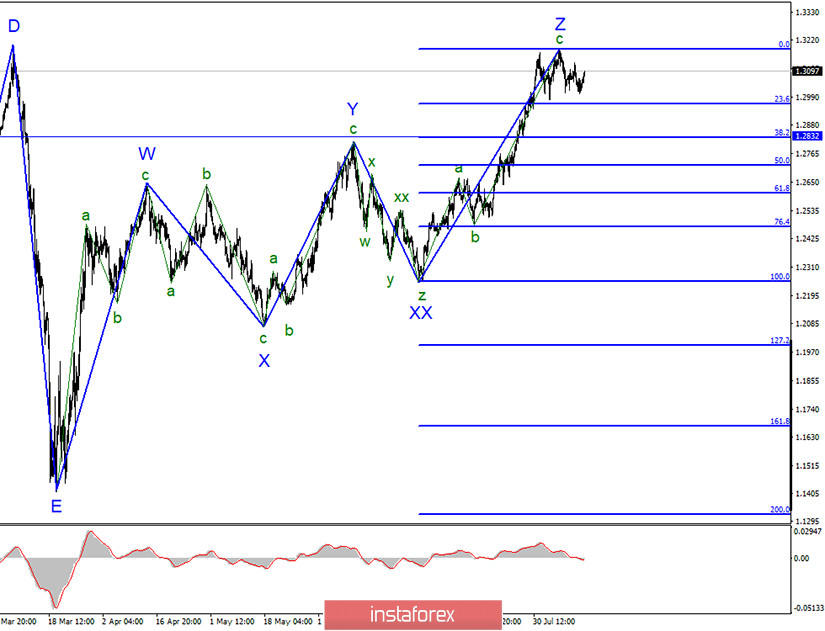

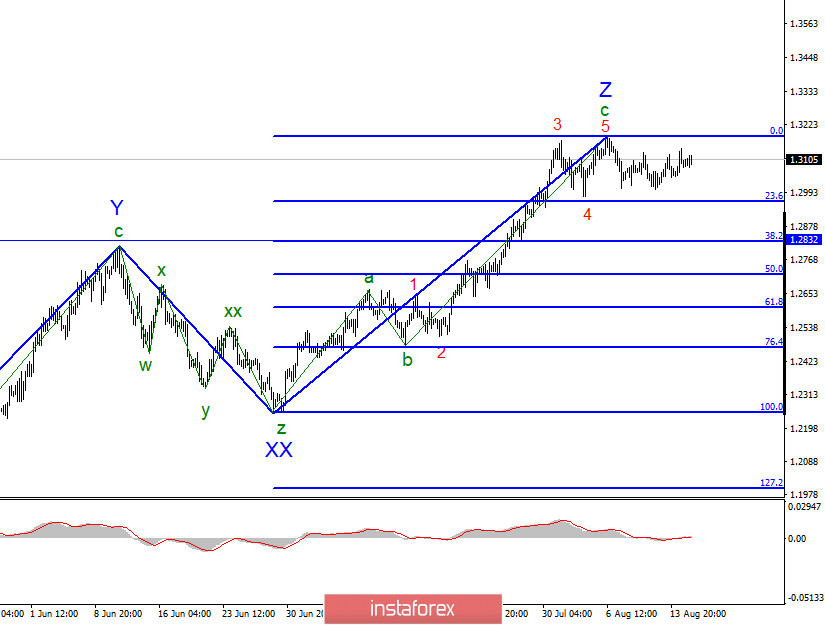

The wave structure of the upward section of the trend, which originates on March 20, looks fully completed and took the form of a triple zigzag. The last wave Z may complicate its internal structure, but before a successful attempt to break through the 0.0% Fibonacci level, I would not recommend considering this option as a working one. However, if the news background from the US continues to remain so weak, the entire wave Z may take on a more complex and extended form. However, all the waves look quite harmonious relative to each other. Thus, I still believe that the increase in the quotes of the instrument is complete.

If you look at the current wave pattern in more detail, you can see that the wave structure a-b-c is visible inside the wave Z, and the waves 1-2-3-4-5 are visible inside the wave C. Thus, at the moment, I believe that the upward section of the trend has completed its construction. If this is true, then the decline in quotes will continue with the goals located around the 23.6% and 38.2% Fibonacci levels and below. At the same time, a weak news background from America may still lead to an even more complicated upward trend.

The news background for the pound/dollar instrument on Friday was similar to the euro/dollar instrument. There was no report or other news in the UK. Moreover, in recent years, the topics that regularly had the strongest influence on the British have faded. The most important topic for the English currency (Brexit) has completely exhausted itself and the markets are now just waiting for this significant date of December 31, 2020, when Britain will finally leave the EU. About the Brexit negotiations, in my opinion, have already been forgotten or simply put an end to them. In general, there is no news from Britain, and the ones that were last week did not particularly interest the markets, although there were very important ones among them. And although the current wave markup implies a decrease in quotes, it is the news background from America that can prevent this option from being implemented.

No economic events are expected in America or the UK today or tomorrow. Thus, the instrument can continue to trade with a minimum amplitude and with a minimum downward slope. However, news from the US continues to arrive, in particular on the negotiations between Republicans and Democrats, on the COVID-2019 pandemic, and all of them can further reduce the demand for the dollar. Nevertheless, I recommend considering the option of building a new downward wave as the main one, and only in the case of a successful attempt to break the 1.3185 mark, go to the option with the complication of the entire wave marking and the resumption of the increase.

General conclusions and recommendations:

The pound/dollar instrument presumably completed the construction of an upward wave Z around the 1.3183 mark. Therefore, I recommend at this time to close all purchases at least until a successful attempt to break through the 0.0% Fibonacci level and adjust for a possible long-term decline in quotes within the new downward trend with the first goals located around 1.2832 and 1.2719, which is equal to 38.2% and 50.0% for Fibonacci.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română