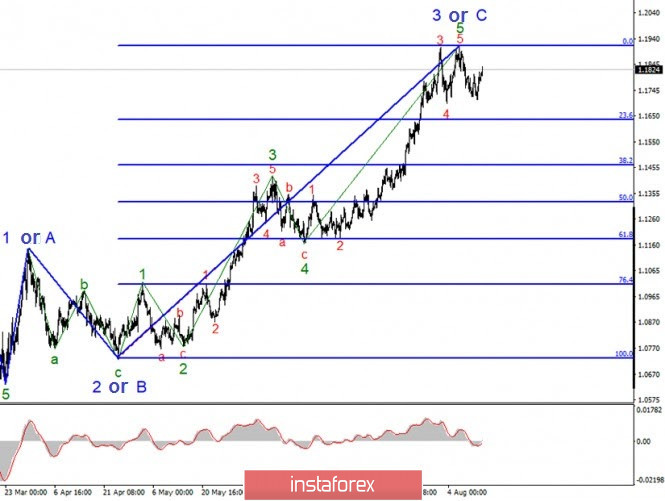

In the most global terms, the wave marking of the EUR/USD instrument looks quite complete. However, the entire section of the trend, which originates on March 20, can easily be transformed into a five-wave one. At the moment, everything looks as if the upward section of the trend is complete, and the internal wave structure of each global wave looks quite convincing and does not cause much doubt. A successful attempt to break the 0.0% Fibonacci level by 90% will mean that the upward section of the trend will take a 5-wave form and the euro will continue to rise.

A smaller scale wave markup shows that the pair has built two new waves after the end of the assumed wave 3 or C. Thus, the decline in quotes should resume almost in any case within the framework of wave C or 4. The expected wave b has already taken a three-wave form, respectively, the decline in the instrument's quotes should resume today or tomorrow. A break in the peak of wave 3 or C will also initially indicate the construction of the same wave 4.

On Friday, August 14, very important reports were released in America that could help the markets form an opinion about the state of the American economy at this time. However, before the markets learned the American statistics, the Eurozone released a report on GDP for the second quarter. Despite the fact that the European economy shrank by 12.1% compared to the first quarter, which also recorded a "minus", the euro currency did not experience any pressure on itself and demand for it did not decrease during the day. US statistics were intended to help the US currency, but two of the three economic reports did not differ much from market expectations (the consumer confidence index and industrial production), and retail sales rose by just 1.2% in July. However, the value of 1.2% is now considered normal after two months of collapse and two months of strong growth. This indicator simply returned to pre-crisis values. In general, the statistics from America did not impress the markets and the dollar did not get help.

No economic reports are scheduled for Monday in the EU and the US. Meanwhile, more and more economists fear that the US economy will start slowing again in the coming months. If we are now talking about its recovery, it may be significantly slowed down due to the continuing spread of the pandemic due to the inability of the Democratic and Republican parties to agree on a new stimulus package for the economy. In this case, the demand for the US dollar may remain low and in accordance with the current wave pattern, it will be a maximum of a downward correction wave, and not a new downward set of waves.

General conclusions and recommendations:

The euro/dollar pair presumably completed the construction of an upward wave C or B. Thus, at this time, I do not recommend new purchases of the instrument, and I recommend closing the old ones at least until a successful attempt to break the 0.0% Fibonacci level. I also recommend considering the possibility of selling the instrument with the first targets located near the calculated levels of 1.1634 and 1.1465, which is equal to 23.6% and 38.2% for Fibonacci, based on MACD downward signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română