Latest COT report (Commitments of Traders). Weekly outlook for EUR / USD

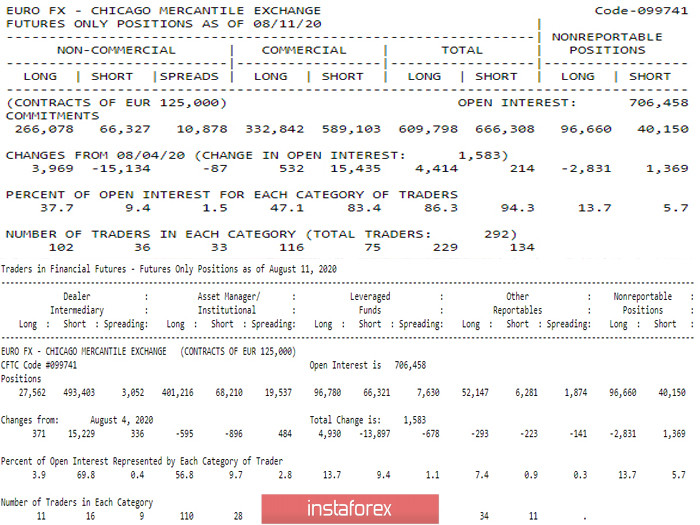

Over the past reporting period, there is a continued growth of open interest (706458; +1 583) for the euro. Groups of large players were able to increase their net positions, but due to the fact that there is a multi-directional interest and uneven efforts (Non-Commercial advantage of long positions 28.3%; Commercial advantage of short positions 36.3%), the bearish total position (56510) in the general report received a reduction this time. You can see that the clients of the leading Dealers (Dealer intermediate) continue to prefer long positions, although the rate of strengthening of this component has significantly decreased compared to previous periods (+14858, last time it was +29848, and before that + 43124).

The main conclusion

The upward trend in investments in the European currency continues, but the overall decline in activity continues to support uncertainty and weekly consolidation. The pair has been in the correction zone for a long time. If the tactics of major players do not change, then consolidation will continue. If there are changes, they will most likely be recorded by both the chart and the next COT report (Commitments of Traders).

Technical picture

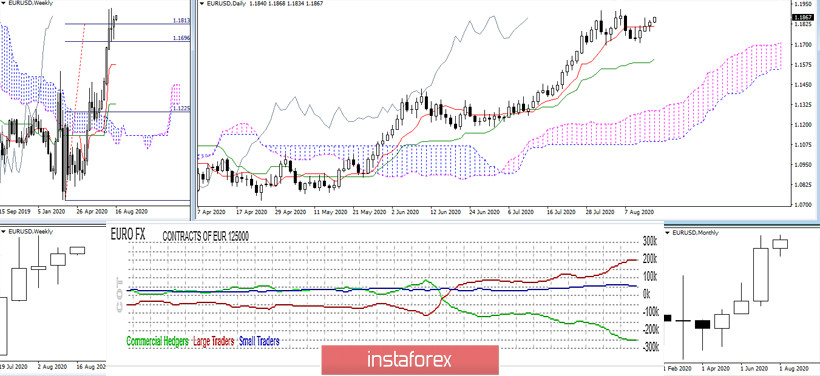

Despite the fact that the maximum gap and divergence of the dominant positions of large players is observed on the COT chart, there is calm and consolidation on the EUR / USD chart. The long stay in the zone of the downward correction and the lack of further performance contributed to the fact that the key elements of the Ichimoku indicator took a horizontal (neutral) position. Exiting from the correction zone and secure consolidation above may contribute to the realization of the bullish potential of the last month. Deepening of the correction and reliable consolidation below the current consolidation may lead to an active strengthening of bearish mood. In the current situation, both directions have approximately equal chances, any more or less significant political or economic event can a catalyst;

The bulls last Friday kept the support of the weekly long term trend in the smaller halves, thanks to this they continue to have the advantage. Today, the pair has renewed last week's high by testing R1 (1.1867), further intraday upside targets are 1.1892 (R2) and 1.1935 (R3). The key supports today are located at 1.1824 (central pivot level) and 1.1790 (weekly long-term trend). Anchoring below will change the current balance of forces - 1.1756 (S2) and 1.1731 (S3) will act as landmarks in this case.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română