A recovery in the dollar is not yet expected, as investors are still betting on the further drop of the currency. In addition, the data published last Friday only put pressure on the dollar, mainly because the failure to reach an agreement on a new fiscal stimulus is a more serious problem in the US, since the longer there is no progress on this issue, the worse it is for the US economy.

Unfortunately, the euro and the pound may also face budgetary problems in the near future, as in September, the UK will again begin a dialogue with the EU regarding a trade agreement, in which the parties have not yet found common points of contact. Italy and Spain, along with a number of other southern European countries, will continue to drag the EU's economy downward, inflating their own budget deficits.

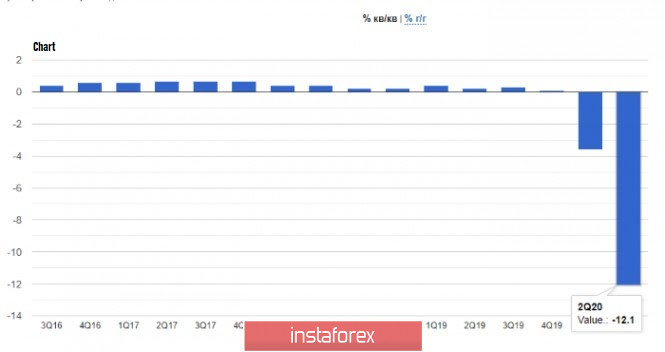

Last Friday, it was reported that the EU economy in the 2nd quarter contracted by 12.1% at once, which fully coincides with the forecasts of economists. However, the data are ambiguous due to the fact that in different regions of the EU, economic activity contracted in different ways.

Nonetheless, good signals continue to appear in the summer, especially since economic activity in the eurozone is starting to recover amid easing of quarantine measures. Latest data reveals that exports have increased by 11.2% in June compared to May, while imports increased by 5.2%. In total, the positive balance of foreign trade in goods rose from € 8.6 billion to € 17.1 billion in May, but the report also highlighted that even with the current leap, there is not enough to fully offset the losses incurred in March and April amid quarantine measures. The rate of exports is still 17% lower than in February, before the pandemic began.

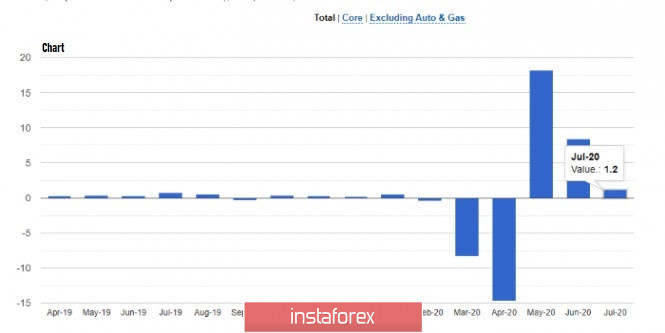

As for the United States, the situation seems to be not improving, as the latest data in retail sales have indicated that growth in the indicator has slowed down, mainly due to continuous high unemployment and problems in the service sector caused by the coronavirus. The report published by the US Department of Commerce showed that retail sales in the US, although rose 1.2% in July, have slowed its pace as compared to its recovery in June.

In addition, retail sales is likely to slow further in August, as Americans stopped receiving additional unemployment premiums last July 31. The US Congress has not yet found a compromise on this, which will negatively affect US spending. Currently, there are only payments of $ 300, which was ordered by US President Donald Trump.

The latest data on industrial production, despite rising by 3.0% in July, also failed to raise the US dollar in the market. This is because compared to the same period in 2019, industrial production is 8.2% lower, and the main growth in the indicator was due to the rapid rise in the production of cars and spare parts, where the rise was 28.3% at once. At the same time, the utilization of production facilities in July reached 70.6% against 68.5% in June.

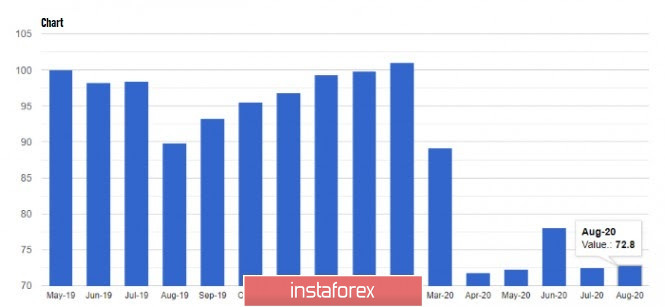

Data on consumer confidence also did not affect the market, as the indicators in August remained practically unchanged compared to the July data. The information from the University of Michigan indicated that the preliminary consumer sentiment index in August was 72.8 points against 72.5 points in July, while economists had expected the indicator to be 71.0 points.

Thus, for the technical picture of the EUR/USD pair, the bulls need a breakout from the major resistance level at 1.1865, above which they failed to break through last Friday. Only a real breakout from this range, which will be very difficult since macroeconomic reports are lacking today, will be the impetus for a rise towards the high of 1.1915 and then to a test of the 20th figure. But if demand for the euro decreases, larger players will wait for the euro to decline to the low of 1.1780.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română