Crypto Industry News:

Minnesota State Representative Tom Emmer has announced that he will introduce a law aimed at preventing the Federal Reserve from acting as a retail bank with the potential issuance of the digital dollar.

Emmer said the law would prohibit the Fed from issuing central bank digital currency directly to US consumers. According to a Minnesota official, requiring a government entity to open accounts in order to gain access to the benefits of the digital dollar "would put the Fed on a dubious path similar to digital authoritarianism in China."

"The Fed does not and should not have the authority to offer retail bank accounts. Regardless, any CBDC implemented by the Fed must be open-ended. This means that every digital dollar must be accessible to all, it must transact on a blockchain that is transparent, and keep the cash privacy elements, "said Emmer.

In addition to claims about potential financial oversight, the US legislature criticized the Fed's introduction of CBDC as too centralized, leaving users' personal data vulnerable to attack. According to Emmer, the digital dollar should be designed to protect financial privacy, maintain the dominance of the domestic fiat currency, and encourage innovation.

The bill came just a day after Jerome Powell said the Fed would release its CBDC report in the coming weeks. In a confirmatory hearing before the Senate banking committee, the Fed chairman also answered in the affirmative when Senator Pat Toomey questioned the Fed's ability to act as a retail bank.

Technical Market Outlook

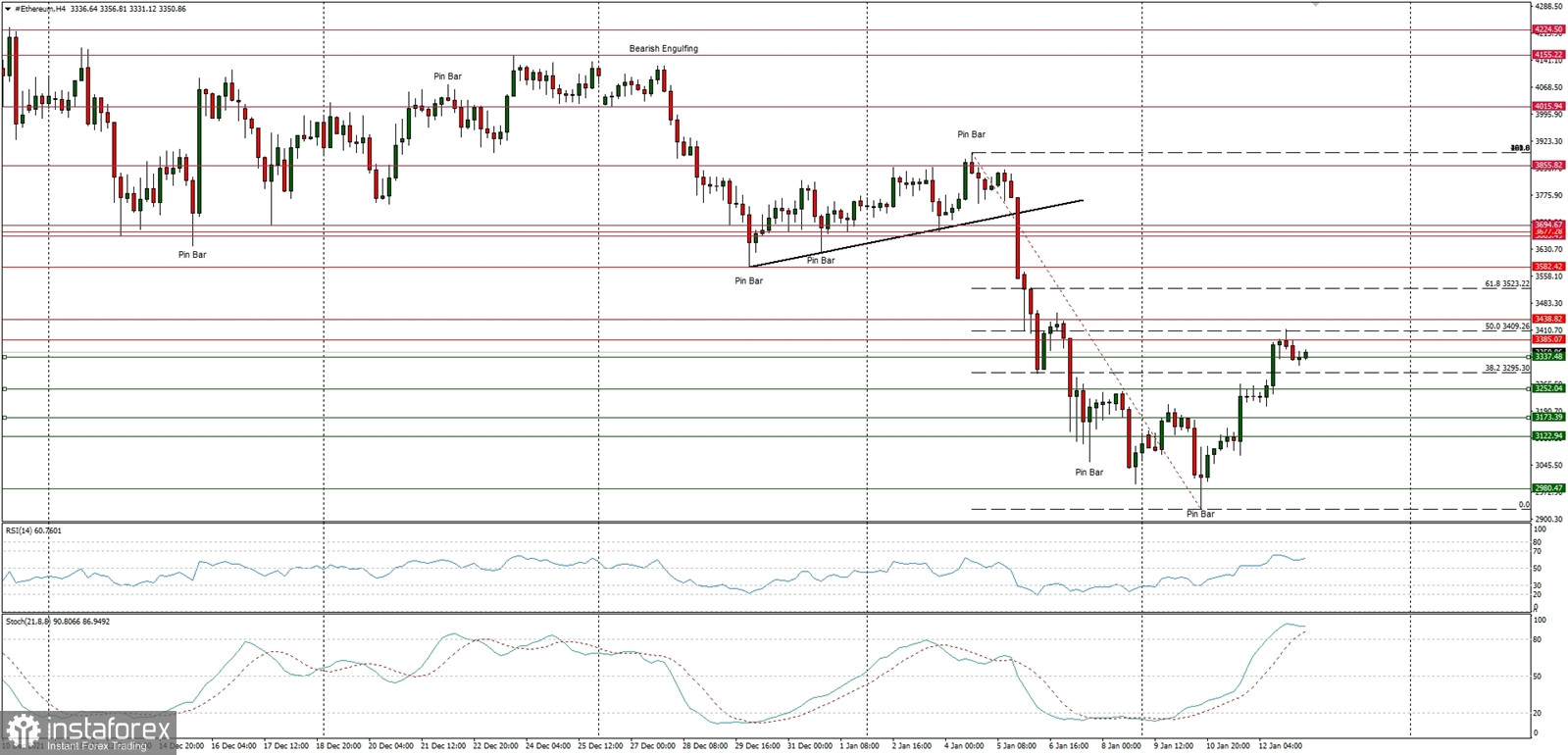

The ETH/USD pair has retraced 50% of the last wave down and hit the level of $3,049 during the bounce. The next target for bulls is seen at the level of 61% at $3,523. The game changer (the level that change the market control from bears to bulls)

is located at $3,694. The complex and time consuming corrective cycle in form of ABCxABCxABC pattern might have been completed, nevertheless larger time frame trend remains up and only a clear and sustained breakout below the swing low at $2,644 would change the outlook to bearish again.

Weekly Pivot Points:

WR3 - $4,512

WR2 - $4,187

WR1 - $3,620

Weekly Pivot - $3,304

WS1 - $2,721

WS2 - $2,382

WS3 - $1,782

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,644. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română