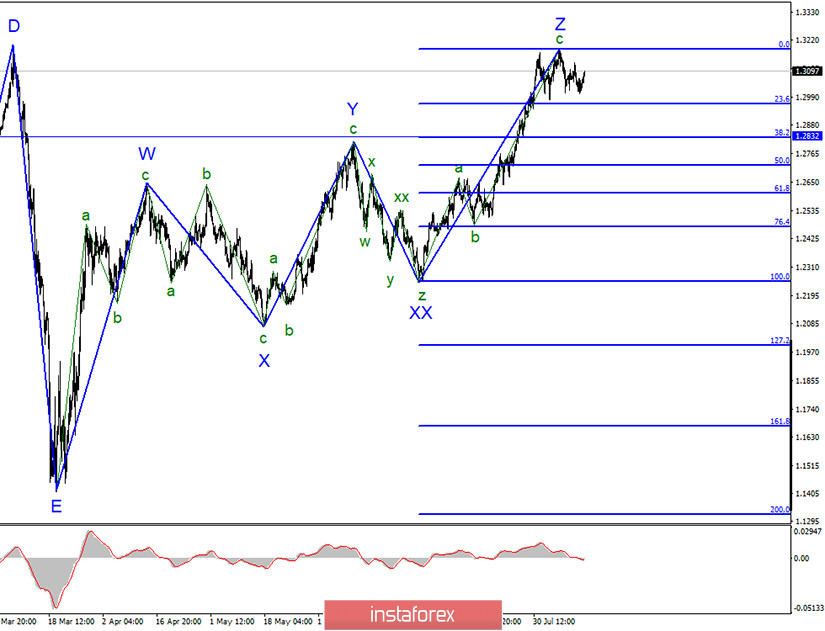

The wave structure of the upward trend section, which started on March 20, looks quite complete and has taken the form of a triple zigzag. The last wave Z may complicate its internal structure, however, I would not recommend considering this option as a working one, until a successful attempt to break through the 0.0% Fibonacci level. Now, the mood of the markets is very important, as well as the information background. If they do not favor the dollar, then the entire Z wave can take on a more complex and extended form. At the same time, all the waves look quite harmonious relative to each other. Thus, I still believe that the rise of quotes is complete.

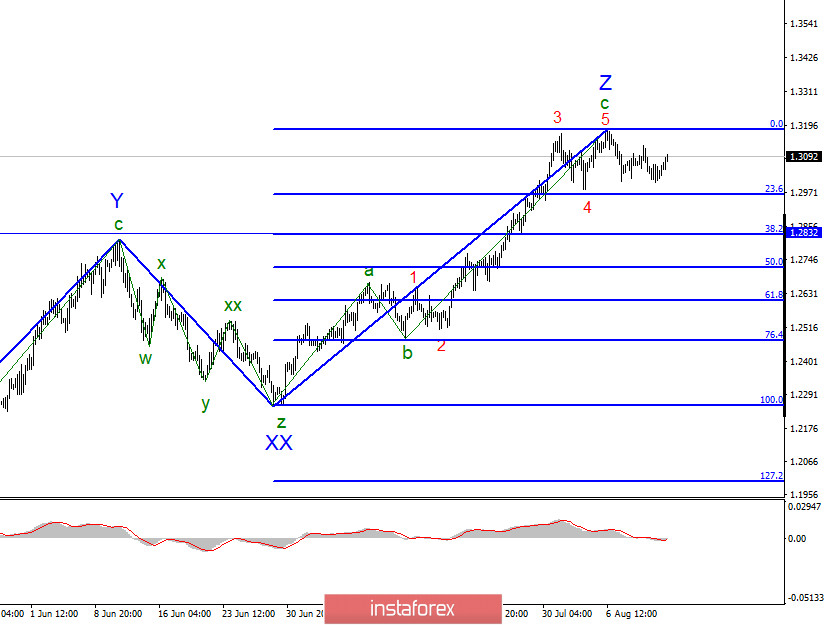

A closer look at the current wave pattern shows that wave structure a - b - c can be seen inside wave Z, and waves 1-2-3-4-5 are seen inside wave c. Moreover, the completion of this upward set of waves is beyond doubt, since everything looks like a textbook. There can only be complications in the section between the maximum from July 31 to the present day. This area may transform into a wave of 4 in c in Z, and then I will expect to build another upward wave - 5 in c in Z with targets located slightly above the 0.0% Fibonacci level.

The markets could not interpret yesterday's news background unambiguously. UK GDP in the second quarter was only one-tenth of a percent better than markets expected, but overall, the figure declined by 20.4%, which has never happened in the country's history. On the other hand, industrial production grew by 9.3%, which is better than forecasts by the same one tenth of a percent. Markets responded to these statistics by increasing demand for the pound. However, this increase in the instrument's quotes may not be related to UK statistics. I absolutely do not exclude the possibility that the reasons for the increase in the pound were different. For example, the euro also rose yesterday, so we can conclude that the demand for the US dollar was falling.

And in this case, we need to return specifically to America and try to figure out what is happening now in this country. Although one does not need to be distinguished by a special analytical talent to understand that everything is bad. Congressmen are unable to agree on a new stimulus package, although Treasury Secretary Steven Mnuchin promised the parties would come to an agreement by Friday. Today is Thursday, and there is no positive news. Donald Trump did not wait for any joint decisions by Democrats and Republicans at all and signed several decrees designed to help Americans in difficult times of crisis. And for more than a week, legal experts have been trying to figure out whether Trump had the right to single-handedly sign these decrees without Congress approval. It turns out that he did not have such a right. However, there are no proceedings in this regard. Democrats, who are only looking for an excuse to criticize Trump, only said that Trump's proposal is "raw", and the president himself "does not understand the full depth of the problem." There were no statements of abuse of authority and other things, which was strange.

Today, August 13, another report on claims for unemployment benefits will be released in the US. But I believe that this report can be safely dismissed as absolutely not of interest to the markets.

General conclusions and recommendations:

The pound/dollar instrument has supposedly completed the upward wave Z around 1.3183. Therefore, I recommend at this time to close all purchases at least until a successful attempt to break through the 0.0% Fibonacci level and tune in to a possible long-term decline in quotes within a new downward trend section with the first targets located around 1.2832 and 1.2719. which equates to 38.2% and 50.0% Fibonacci.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română