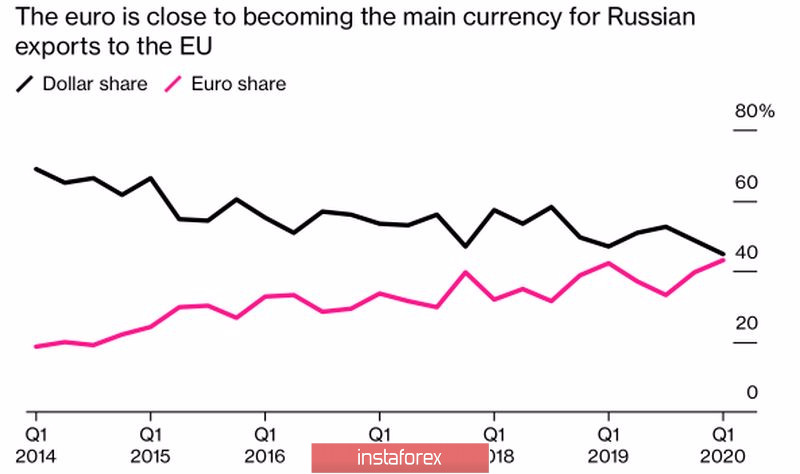

It is always better to rely on yourself. So, the Russian ruble, which came under severe pressure in June-August, received good news from Moscow. The speculations that central banks are shifting their gold and foreign exchange reserves and investment portfolios into the euros and euro-denominated assets are driving the EUR/USD pair upwards. In the meantime, the USD/RUB bears gain support from the policy of de-dollarization in Russia. Recently, Russia has increased the share of the euro in export settlements with its main trading partners, China and the EU, to more than 50% and 43% respectively. Of course, in terms of international trade, this had little effect on the US dollar, yet the first step in this direction has been made!

The share of EUR and USD in settlement between Russian and China

The share of EUR and USD in settlements between Russia and the EU

Despite the favorable external background for risk assets, investors do not rush to invest in the currencies of emerging markets. Although the S&P 500 is testing all-time highs and oil is on track to continue its rally, EM currencies volatility is growing. This happens on concerns about the escalation of the US-China trade conflict and the reluctance of Democrats to continue negotiations with Republicans on expanding the fiscal stimulus package. Democrats believe that the scale of the problem is huge, so they insist on at least $2 trillion fiscal stimulus. At the same time, Republicans supported by Donald Trump doubt the need to spend money that will actually stop people from going back to work. Judging by the continued growth of US stock indices, the market believes that the deal will be finally reached. Yet, this does not make it easier for the currencies of developing countries.

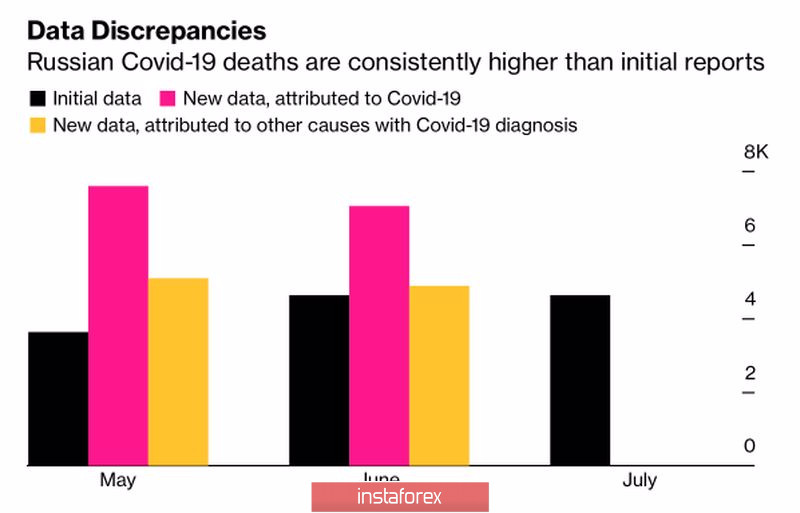

The ruble is also weighed down by the situation around pandemic in the country. In June, the number of deaths across the country increased by 19% on a yearly basis. This makes up about 25 thousand deaths, half of which are associated with COVID-19. The official data, however, reported 4.6 thousand deaths.

Death rate in Russia

In the time of coronavirus, the currencies of the countries that managed to withstand the crisis and have better prospects for a quick economic recovery are more popular with investors. And this is hardly surprising. Besides, the factor of a robust economic recovery becomes the key one. Even the President of the Federal Reserve Bank of Boston, Eric Rosengren, admits that the eurozone economy will recover faster than the American one, which contributes to an increase in the EUR/USD quotes.

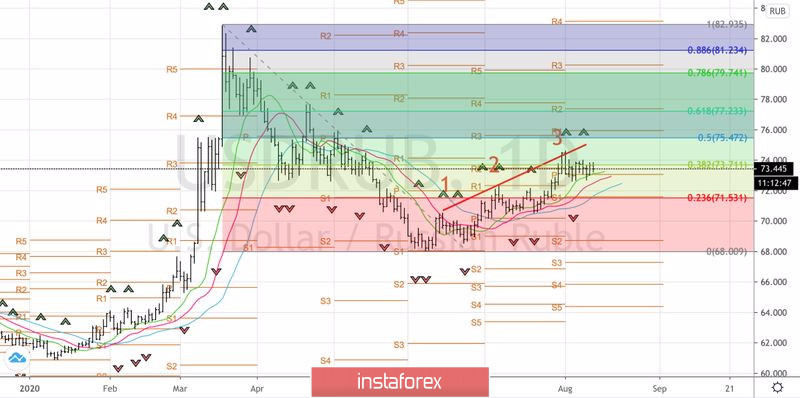

The ruble's exchange rate depends more on external factors rather than on internal ones. First of all, it relies on the demand of non-residents for Russian assets and on oil prices. Therefore, the announcement from Moscow about its intention to use its new vaccine was good news for fans of risk assets and stopped the bulls' attacks on USD/RUB. Indeed, the rescue of a drowning man is the drowning man's own job! I recommend placing short positions on the pair. This time, short positions should be added to previously opened from the level of 74.2. They could be formed in the event of a breakthrough of the support at 72.9-73.0.

USD/RUB daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română