Crypto Industry News:

While many countries are inclined to ban the use of digital assets, regulators in the UAE take a different approach. The country is consistently pursuing its vision of becoming blockchain capital by providing a framework to guide crypto companies to act in accordance with the law.

The country's jurisdictions are divided into continents, with the Securities and Commodities Authority (SCA) as regulator, and Free Zones - geographically defined areas in the UAE with relaxed tax and regulatory regimes.

Such free zones include the Dubai International Financial Center which is regulated by the Dubai Financial Services Authority, the Abu Dhabi Global Markets which is regulated by the Financial Services Regulatory Authority and the Dubai Multi Commodities Center which is regulated by SCA. FSRA, ADGM's financial services regulator, was the first to regulate digital assets in 2018. ADGM was also one of the first regulators in the world to introduce regulations and guidelines for digital securities.

The current DFSA regulations cover tokenization of securities using blockchain technology and distributed ledger technology, including tokenization of stocks, derivatives, bonds, notes, certificates or fund units. However, consultation papers on stablecoins, convertible cryptocurrencies and NFT are still under development.

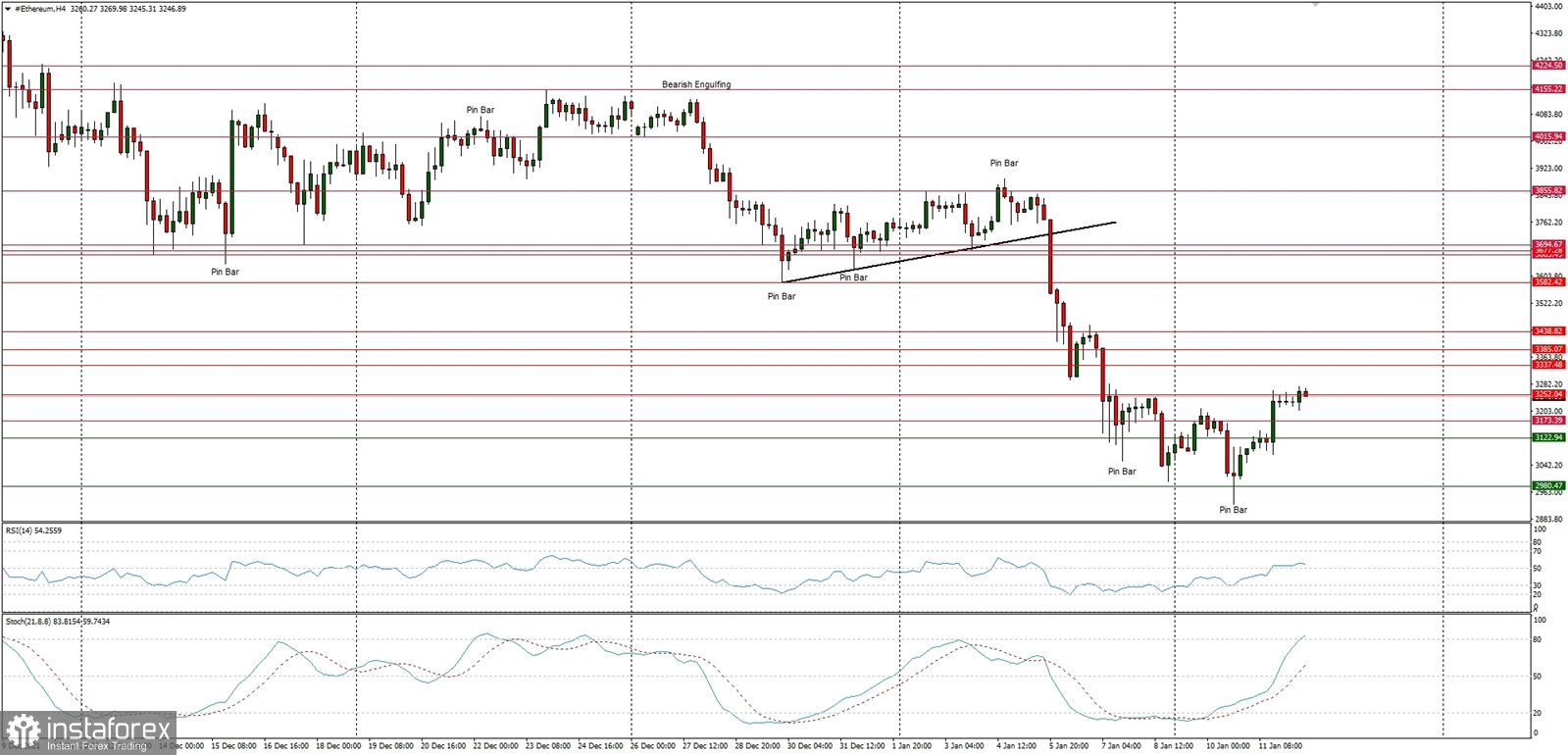

Technical Market Outlook

The ETH/USD pair has bounced from the level of $2,926 and is currently trading above $3,000 again, but the key short-term technical resistance is located at the level of $3,582, so the bulls have a quite a long road to make in order to resume the up move. The complex and time consuming corrective cycle in form of ABCxABCxABC pattern has not been completed yet, nevertheless larger time frame trend remains up and only a clear and sustained breakout below the swing low at $2,644 would change the outlook to bearish again.

Weekly Pivot Points:

WR3 - $4,512

WR2 - $4,187

WR1 - $3,620

Weekly Pivot - $3,304

WS1 - $2,721

WS2 - $2,382

WS3 - $1,782

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,644. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română