Economic statistics released on Wednesday in Britain, the Eurozone and the United States did not have a significant impact on the dynamics of the currency market. The dollar was trading in different directions under the influence of two important factors.

On the one hand, this is a surge in yields on US government bonds, from 5-year to 30-year, amid expectations of a 10-year placement today at 17:00 Universal time, which is expected to have unprecedented volumes. On the other hand, the inability of representatives of the Democratic and Republican parties to agree in Congress on the issue of new stimulus measures from D. Trump, which are often called "aid" measures.

In fact, observing the situation on the market, we can say that these two factors have a mutually compensating effect on the dynamics of the dollar, forcing it to move in different directions against the major currencies, which was fully observed on Wednesday.

Yesterday, a large package of statistics from the UK was released, which showed slightly better values of the country's GDP indicator for the 2nd quarter, as well as the values of production volumes. But the figures could not support the British currency, as the GDP figures, although better than expected – 20.4% against 20.5%, but still significantly bad. It can be recalled that only in the States, GDP values declined by almost 33.0%. In addition, the unhealed wound of Brexit is still felt in Britain.

Contrary to British figures, industrial production in the euro zone in July declined more than expected to 9.1% from 12.3%. The annual value of the indicator also turned out to be not better, falling by 12.3% against the forecast of -11.5% and the previous value of -20.4%.

In contrast to the pound, the euro received support on Wednesday, but, as we see it, the reason for this was the growth in demand for risky assets, which coincides with the upward dynamics of the euro in the last 11 years after the 2008-09 crisis.

The dollar could not be supported by really good data on consumer inflation in America, which showed good growth. In July, core inflation rose by 0.6% against 0.2% in June. On an annualized basis, it jumped 1.6% against 1.2% and expected growth by 1.1%.

However, the US dollar did not respond again to this data, as investors have recently focused on the launch of industrial production of vaccines against COVID-19 and voting on the Trump project on measures to "help" the Americans.

Observing everything that happens, we believe that the general period of consolidation in the currency market in the major currency pairs will most likely continue this week. In the long term, if the yields of US Treasuries fall again, and so, the dollar will be under strong pressure again and resume decline in the currency markets.

Forecast of the day:

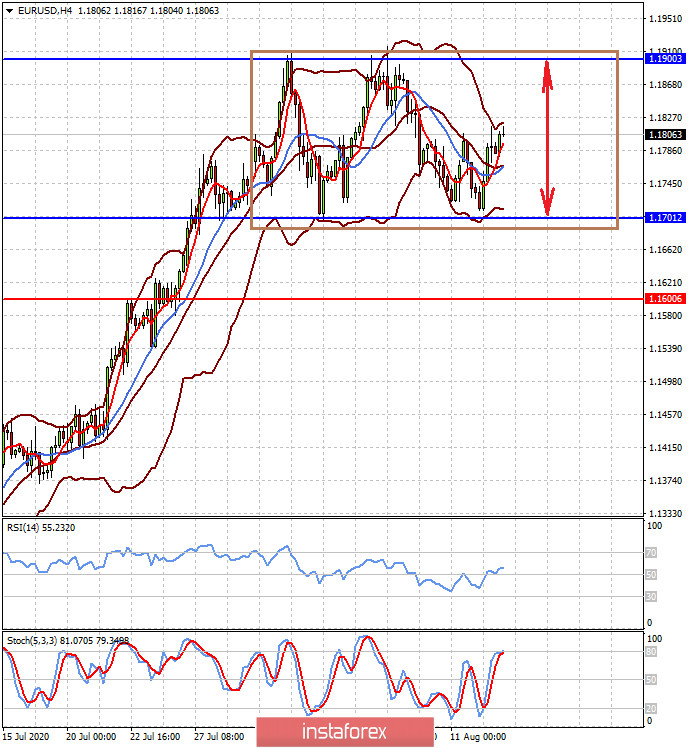

The EUR/USD pair cannot break out of the range of 1.1700-1.1900 in any way amid growing US Treasury yields and weak data on industrial production in the Eurozone. We believe that the pair will probably remain in this range until the market shows clear trends weakening the dollar.

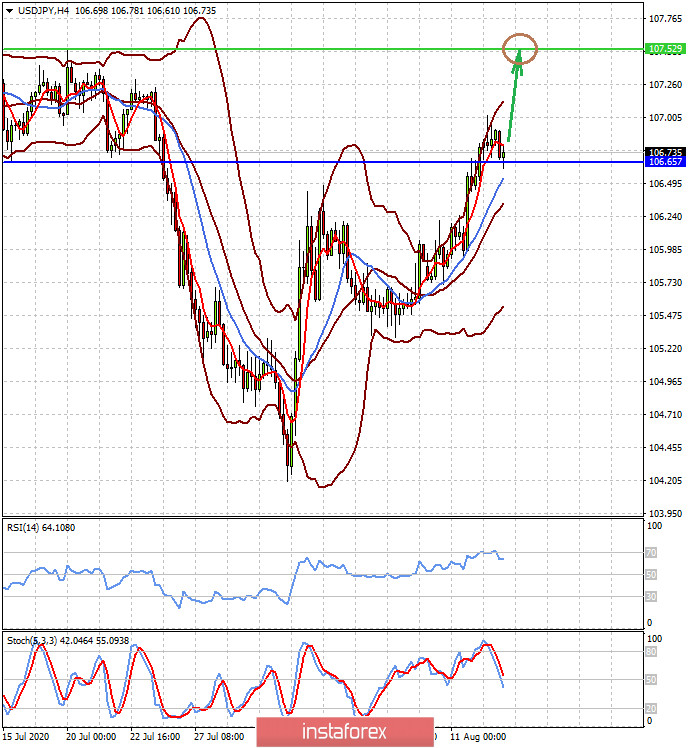

The USD/JPY pair is trading above the level of 106.65 amid support for the dollar by rising Treasury yields and uncertainty over whether Trump's new stimulus will be resolved. If this situation persists and the pair consolidates above 106.65, the pair will continue to rise to the level of 107.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română