To open long positions on GBP/USD, you need:

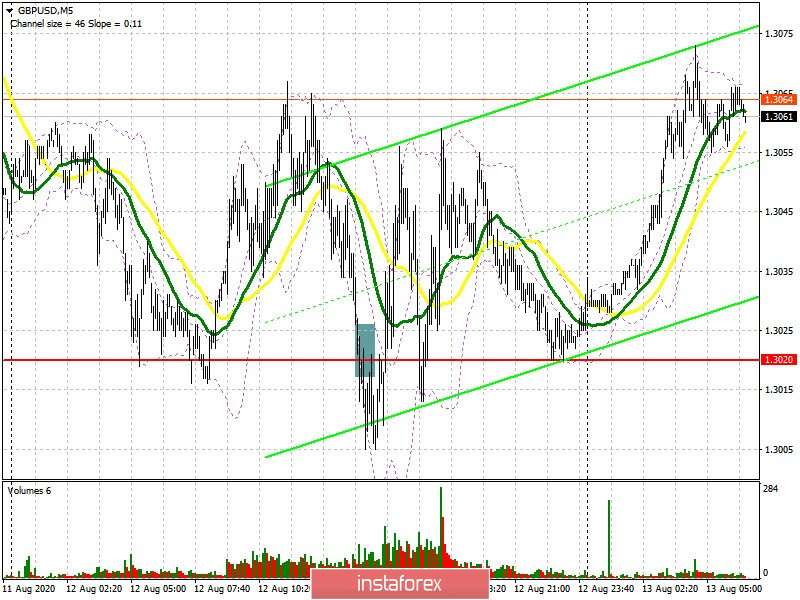

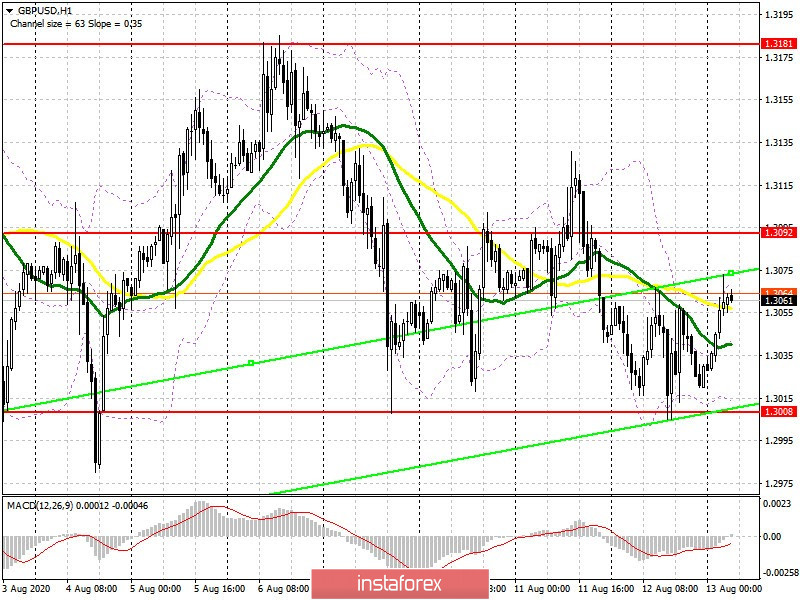

From a technical point of view, nothing changed yesterday. If you look at the 5-minute chart, you will see how a signal to sell the pound has formed, but, unfortunately, even upbeat US inflation did strengthen the US dollar, which left the pair in a sideways channel. You can see how the bears break below the 1.3020 support for the second time and test this level from the bottom up, forming a good point for short positions on the pound. But the bulls are regaining this range after the US consumer price index report was released. It was impossible to enter into purchases on the reverse correction from the top down, since the price seriously fell below 1.3020. At the moment, the pair is located in the middle of the side channel. Buyers need to break above the resistance of 1.3092 and I recommend buying the pound only after consolidating in this range, in anticipation of resuming the bullish trend with an exit to the high of 1.3181, where I recommend taking profits. A more optimal scenario for buying is a downward correction to the support area of 1.3008 and forming a false breakout there. If there is no activity in this range, I advise you to postpone long positions until the support test of 1.2946 and buy the pound there for a rebound in anticipation of a correction of 30-40 points within the day.

Let me remind you that the Commitment of Traders (COT) reports for August 4 recorded significant changes, as traders began to regain long positions on the pound and reduce short positions. This suggests that the balance of power is gradually changing again, and investors are more confident that the UK and the EU will be able to agree on a trade deal that will help the economy recover in 2021. The COT report indicates that short non-commercial positions decreased from the level of 64,738 to the level of 60,704 during the week. On the contrary, long non-commercial positions rose from the level of 39,392 to the level of 45,977. As a result, the non-commercial net position again decreased its negative value to -14,727, against -25,409, which indicates a slower fall in the pound after the US dollar regained strength.

To open short positions on GBP/USD, you need:

Sellers need to break below the support of 1.3008, since only a consolidation below this level will be a good signal to open short positions in anticipation of pulling down the pair to a low of 1.2946. The long-term goal is a low of 1.2879, where I recommend taking profits. In case the pair recovers in the first half of the day, and there is every reason for this since important fundamental data for the UK will not be released today, it is best not to rush with sales and wait for a false breakout to form in the resistance area of 1.3092. Sell GBP/USD immediately on the rebound, I recommend doing so only from this month's high in the 1.3181 area, counting on a correction of 30-40 points within the day.

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50 moving averages, which indicates the uncertainty of the market with a further direction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the upper border of the indicator around 1.3060 will lead to a new wave of growth in the pound. A break of the lower border of the indicator in the area of 1.3010 will increase the pressure by the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română