The pound has received support from the British macroeconomic reports, which were released this morning. Buyers of the GBP/USD pair got a reason to open long positions, but so far, they are not in a hurry to use it. There is still a release of data on the growth of US inflation, which can "redraw" the fundamental picture for the pair. Nevertheless, the figures published today allow us to draw certain conclusions – at least in the context of possible actions of the English regulator.

In general, the published data finally removed the issue of introducing a negative rate from the agenda. The probability of this scenario being implemented has significantly declined following the results of the August meeting (which took place last week), but now, this probability is zero. Firstly, many members of the Committee are against the rate cut and have been before (even at the peak of the epidemic). In their reasonable opinion, this step has too many side effects, and not only for the banking sector. Secondly, the wavering head of the Bank of England Andrew Bailey, who at first opposed negative rates, but then changed his position several times, finally abandoned this idea. At the last meeting, he stated that "negative rates are part of the stimulus measures of the Central Bank, but they will not be used to lift the UK economy out of the coronavirus crisis. Well, and thirdly, none of the Committee members voted for a rate cut last week (although some experts admitted that two members of the regulator would still take this step). Judging by today's figures, the Bank of England can afford to continue to take a wait-and-see attitude.

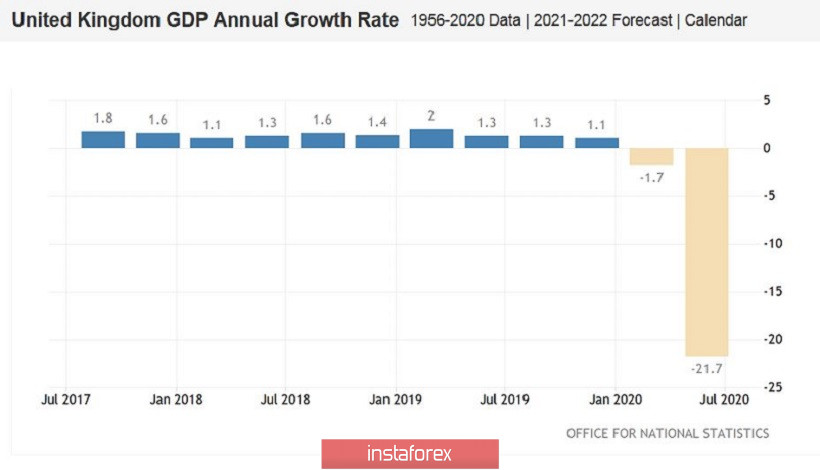

So, today, a whole block of macroeconomic statistics was published. First of all, we learned the data on the growth of the British economy for the second quarter. The numbers turned out to be "expected to fail". On a quarterly basis, the indicator declined to -20.4%, in annual terms - to -21.7%. Such anti-record figures were calmly accepted by the market. Everyone is well aware that the second quarter figures reflect the peak of the coronavirus crisis. From March to May, the UK economy was virtually blocked by a general lockdown, so the macroeconomic indicators could not have been better a priori. However, from a formal point of view, they still turned out to be slightly better than the forecast values (the consensus forecast was at the level of -20.5% q / q and -22.4% y / y), but this fact is too insignificant in this context.

But the rest of the components of today's release really ended up in the "positive zone", significantly exceeding the forecasted values in some cases. For example, production in the manufacturing sector grew in June by 11% at once (against the forecast of growth by 9.9%), and the volume of industrial production increased by 9.3% in monthly terms. But in the field of construction, a long-term record was recorded: the corresponding indicator grew by as much as 23.5% (m/m) against the forecast of growth by 15%. In general, in June, UK GDP increased by 8.7%, although most experts expected to see this figure slightly lower, at 8.1%. For comparison, it should be recalled that this figure came out at the level of -5.8% in March, at the level of -20.3% in April, and at 1.8% in May. The June release confirmed the positive trend with 8% growth. However, not without a problem - the service sector in June showed extremely weak dynamics. However, this is understandable given the ongoing collapse of the tourism and restaurant business in the UK in June. In particular, pubs and restaurants in the country opened only in early July.

In general, the published figures made it clear that the British economy is slowly but still consistently "recovering". The response from the GBP/USD pair has been limited for two reasons. The first is the rise in the dollar index. The dollar is strengthening its position by strengthening anti-risk sentiment. The rate of spread of the coronavirus epidemic is increasing again, and this time it is not only the States that are trending: anti-records of daily incidence have been recorded in India and Brazil. In addition, the dollar is growing in anticipation of today's release of data on the growth of US inflation. According to general forecasts, the July indicators will demonstrate growth, providing additional support to the greenback. Let me remind you that the last Nonfarms turned out to be much better than expected: the unemployment rate dropped to 10.2%, the number of people employed in the non-agricultural sector increased by 1 million 763 thousand, and the level of average hourly wages on a monthly basis for the first time since May came out of the negative zone. If July inflation also turns out to be above the forecasted values, the dollar may strengthen its positions throughout the market.

The second reason for the "cool" market reaction to the British release is the comments of UK Treasury Secretary Rishi Sunak. He said that the country's economy is going through a "difficult time" and new job losses are expected in the coming months. He also noted that the process of economic recovery will take "a lot of time." In other words, the minister came to the conclusion that "the glass is half empty", rather than, on the contrary, focusing on the terrible figures of the second quarter.

Thus, the British data, on the one hand, did not allow the bears to continue their downward movement, but, on the other hand, did not provoke an increase in the price of GBP/USD pair. Nevertheless, the figures published in the morning may play a supporting role - if the American release does not meet the expectations of investors. In the medium term, the dynamics of the pair will depend on US inflation: the price will either decline to the bottom of the 30th figure, or rise first to the borders of the 31st price level and then to the local maximum of 1.3180. In my opinion, the pair still retains upside potential, given the dynamics of British macroeconomic indicators, and most importantly, the dynamics of the Brexit negotiation process. Therefore, looking at longer term prospects, we can consider longs in downward recessions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română