The dollar index is showing an upward trend again. Since it reached a five-day low yesterday (93.19 points), the indicator turned around and headed towards the 94th figure. The index is gradually growing, but almost without recoil, reflecting the increased demand for the US dollar throughout the market. In turn, the European currency came under pressure from the coronavirus factor, which is now a headache not only for dollar bulls.

In general, the dollar's growth is primarily due to the increase of anti-risk sentiment in the financial markets. The blame is on the coronavirus, which began to gain momentum again in different countries of the world. This problem only narrowed to the US borders at the beginning of summer: the spread of COVID-19 was quite successfully contained in Europe, Australia, New Zealand, China, Japan and in most other developed countries- at least in comparison with the United States. The epicenter of the epidemic shifted to the southern and western states of the US, where tens of thousands of new infections were recorded daily. Some major cities (such as Miami) have tightened quarantine restrictions, jeopardizing the recovery of the US labor market. The coronavirus factor exerted background pressure on the dollar for a month and a half, and has only loosened its grip in recent days.

To be more precise, traders are now focused on global trends, worried about the recovery of the global economy. The incidence rate is accelerating again. If the number of infected people increased from 5 to 10 million in the period from May to June in almost 40 days, then the threshold of 15 million was overcome much faster - in just three weeks. And in just 19 days, the number of cases in the world has grown from 15 to 20 million. If we consider the indicator of daily growth, then India has become the leader of the anti-rating. It is followed by Brazil, and only then by the United States. The fastest growing epidemiological situation in India - the number of patients increased from one to two million (at the moment - 2.3 million) in just three weeks. Alarming trends continue to be reported in Brazil and generally in Latin America. As for Europe, local outbreaks are still being recorded here (for example, in northeastern Spain). Nevertheless, many EU countries (in particular, France and Greece) have tightened quarantine restrictions. For example, in Paris, as well as in some other French cities, masks need to be worn, including on the street.

This news flow has strengthened anti-risk sentiment, which allowed the dollar to climb. And although the coronavirus kills at least a thousand people every day in the United States, traders in the foreign exchange market focus on global trends. Moreover, the latest US events also supported the greenback.

As you know, US President Donald Trump signed decrees to provide assistance to the US economy over the weekend - in particular, on additional payments to unemployed Americans. Executive decrees were issued bypassing Congress, although congressmen were in charge of government spending. Given the legal doubtfulness of the signed documents, there are speculations on the market that the Democrats will appeal these decrees. But over the past two days, none of the representatives of the Democratic Party have taken concrete steps in this direction. It is likely that the Democrats came to the conclusion that on the eve of the presidential elections, such actions will not bring political points. Whatever it was, the fact remains: at the moment, talk about judicial appeal against presidential decrees has died down again. But negotiations may soon resume in Congress. As Trump tweeted yesterday, "senior Democratic officials have offered to hold a meeting at the White House." If the Democrats and the president come to a common decision, further agreement on the bill on the provision of assistance to the US economy will become a "matter of technicality."

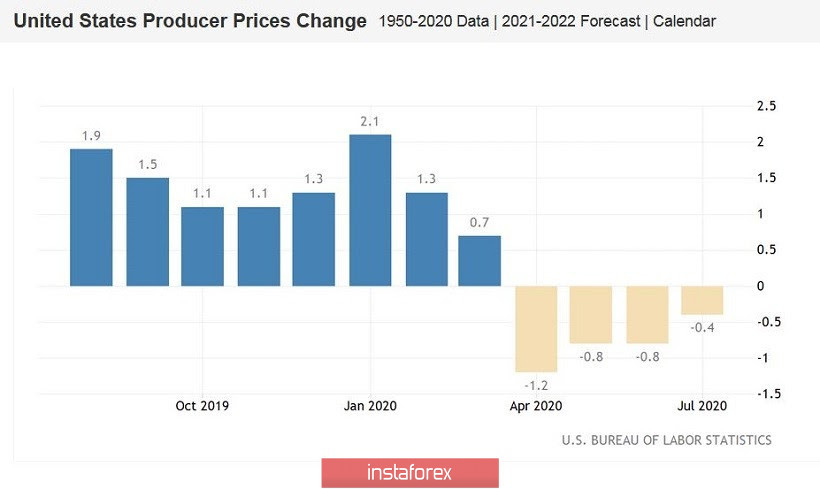

Macroeconomic reports also provided additional support to the dollar yesterday. The producer price index, which is an early signal of a change in inflationary trends, came out in the green zone - both on an annualized and monthly basis (+ 0.6% m/m, -0.4% y/y). The same index, only excluding food and energy prices, also turned out to be better than expected (+ 0.5% m/m, + 0.3% y/y, reflecting the economic recovery.

Today is another test for the dollar: we will find out the key data on the growth of US inflation. According to general forecasts, the general consumer price index in monthly terms should slow its growth to 0.3% in July (compared with 0.6% in June). In annual terms, the indicator should rise to 0.8% (an increase to 0.6% was reported in June). As for core inflation, excluding food and energy prices, indistinct dynamics is also predicted here - slower growth on an annualized basis (1.1%) and a slight increase relative to June in monthly terms (0.3%). If the numbers mentioned come out better than expected, the greenback can continue its ascent, having a corresponding impact on the dollar pairs.

Speaking directly about the EUR/USD pair, there are two support levels on the horizon. The closest one is at 1.1690 (the middle line of the Bollinger Bands indicator on the daily chart). The next one is a hundred points lower at 1.1590 (Kijun-sen line on the same timeframe). A deeper decline requires good news from Capitol Hill - on the prospects for new stimulus. If US inflation does not meet the expectations of investors, the EUR/USD pair may return to the boundaries of the 18th figure, that is, to the Tenkan-sen line on D1.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română