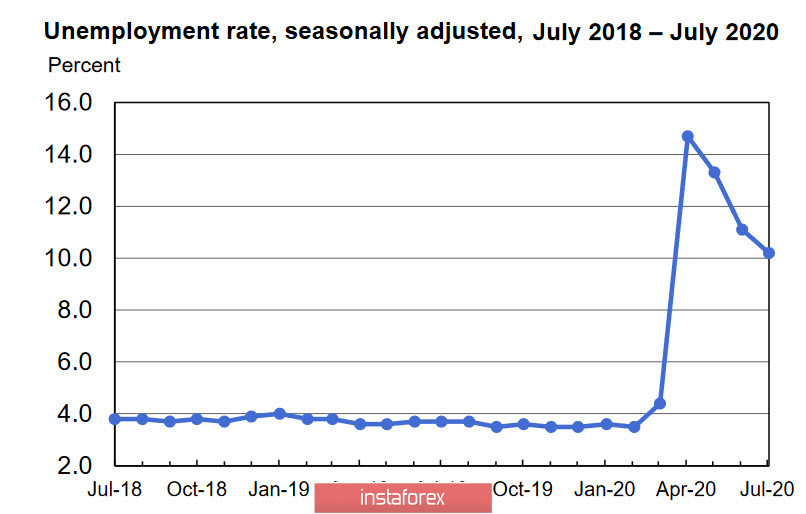

The report on the US labor market in July was unexpectedly strong and completely out of line with the data obtained in the ADP and ISM polls. 1.783 million new jobs were created against the forecast of 1.6 million, the average hourly wage rose by 4.8% y/y, the unemployment rate dropped to 10.2% altogether. The latter result is completely contradictory to the data obtained earlier, since unemployment is declining amid further reductions in personnel both in the service sector and in the manufacturing sector (as follows from the ISM reports), and labor force participation also decreased from 61.5% to 61.4%.

However, fantastic tricks of US statistics are still in the players' confidence zone – the dollar strengthened at the end of the week.

The CFTC report shows signs of an impending reversal. The favorites are defensive assets – the Euro, yen, franc and gold confidently added to the accumulated long positions, which is not true for commodity currencies. Short positions in the Canadian dollar and the Mexican peso increased significantly, while the New Zealand dollar was in the negative zone, and only the Australian dollar partially played back the negative of the previous week.

Rising tensions are a bullish factor for the dollar, despite its obvious weakness. In favor of a gradual recovery from the complacent state caused by a massive influx of liquidity to the markets, and the recent actions of US President Trump, who announced an increase in duties on aluminum from Canada over the weekend (with a high probability of extending restrictions to steel), as well as restricting the use of mobile applications from China TikTok and WeChat, which is regarded by the markets as a new stage of the trade war. Trump needs a small victorious war ahead of the election, and there is no doubt that the trade war scenario will come to fruition in some form, which will inevitably affect the markets in favor of their decline.

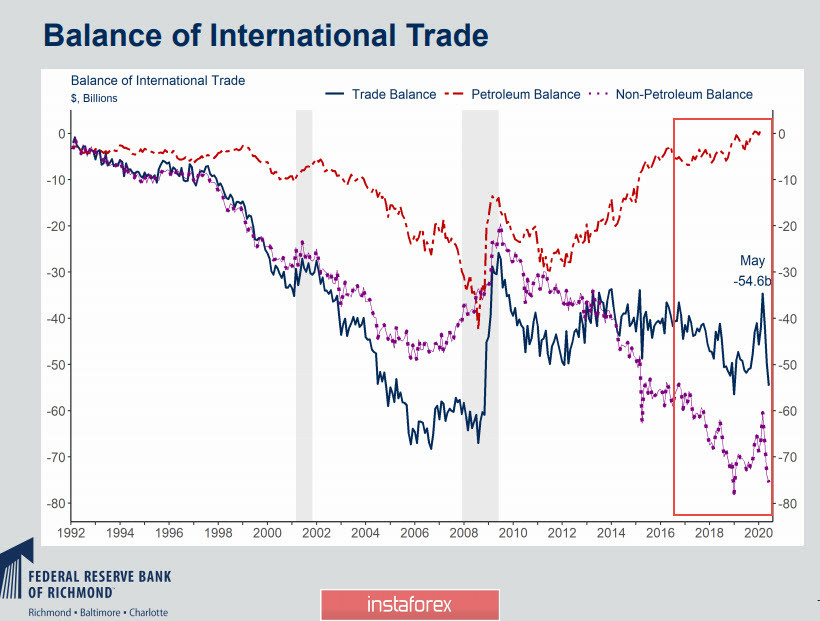

Despite Trump's best efforts, the U.S. trade balance continues to deteriorate. In fact, for the entire presidential term since 2016, it is based only on a decrease in imports of oil and oil products due to the growth of its own production, without taking into account these components, the growth of the foreign trade deficit is obvious.

Without waiting for the decision of Congress, Trump announced over the weekend the start of payments to the unemployed in the amount of $ 400 a week, and also announced a tax holiday for 98% of the country's residents, that is, for those who earn less than $ 100 thousand a year. If he is reelected for a second term, then Trump promises to make these tax holidays permanent, that is, in fact, to forgive them. At the same time, the eviction of non-payers for rent and mortgages is suspended, benefits for students on tuition fees are being considered, and some additional steps are being considered.

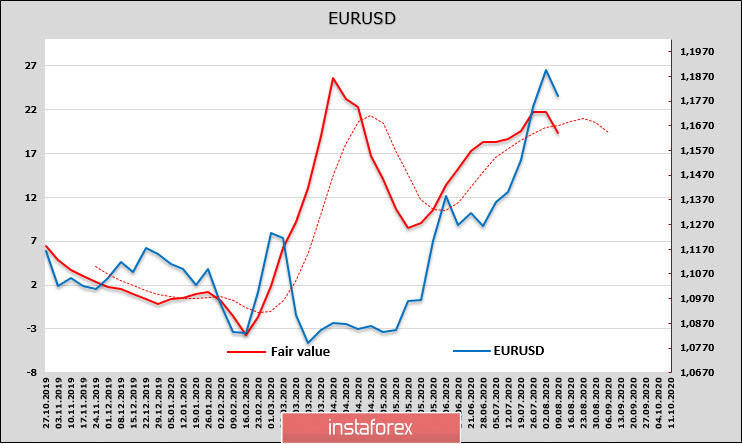

EUR/USD

The net long position in the euro increased by another 3.578 billion, but the rise in the estimated fair price has stopped, as other factors have come into play, which will put pressure on the euro.

Sentix Confidence Indicator will be released today, ZEW survey on Tuesday, and Industrial production report on Wednesday. The optimism regarding the prospects for the euro is gradually fading away, and in favor of profit-taking is also the threat of a geopolitical confrontation between the EU and the United States regarding Nord Stream-2.

Technically, a double top in the 1.19 area indicates that the bulls are not ready for further growth, while a decline towards the 1.1695 support looks very likely.

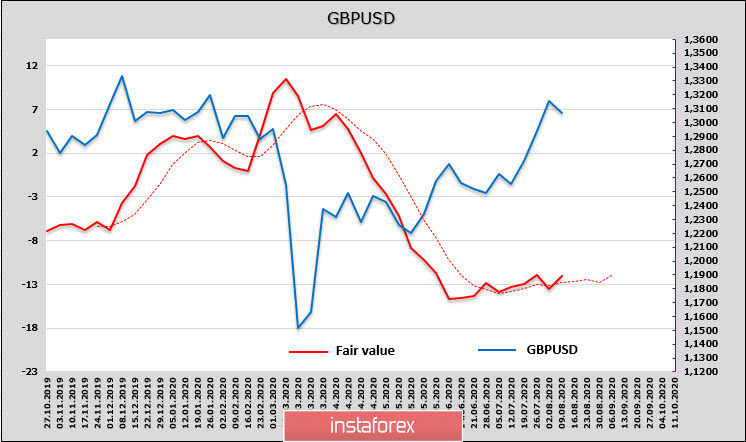

GBP/USD

The net short position on GBP decreased by 851 million, but this fairly strong indicator had little effect on the estimated fair price. The pound is significantly higher than the calculated level, so the probability of a downward turn remains high.

On Tuesday, a report on the UK labor market will be published on Wednesday. On industrial production and trade balance, the assessment of the general state of the economy will be given by NIESR. A fairly saturated information background may lead to increased volatility, but the growth is likely to stop. A decline to 1.2977 and further down is most likely.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română