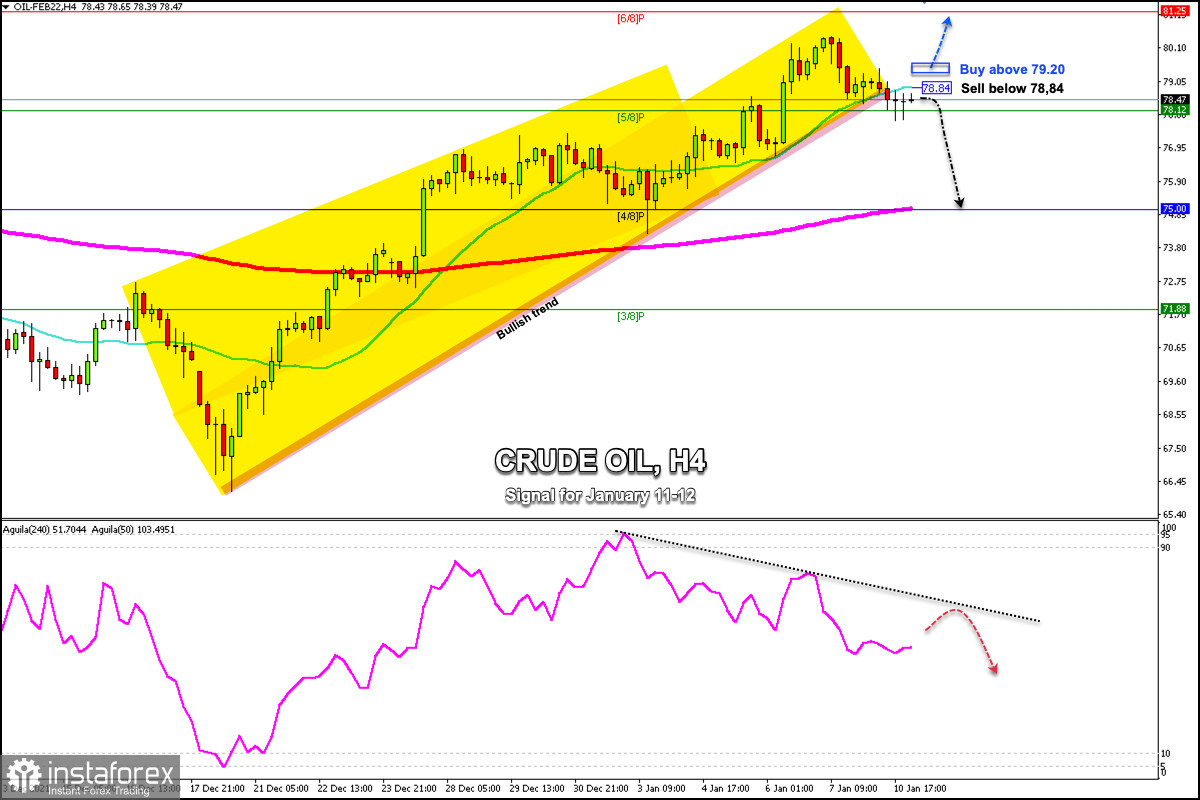

In the last hours, West Texas Intermediate of the United States (WTI - #CL) is showing indecision. In the 4-hour chart, we can see the latest candles are forming dojis, which means that the price could drop in the next few days as long as it remains below the SMA 21 (78.84).

Production at Kazakhstan's main oilfield, Tengiz, declined last week, its operator Chevron Corp said. Some contractors disrupted train lines in support of protests taking place across the central Asian country.

Kazakhstan is a major oil producer with a output of around 1.6 million barrels per day (bpd) in recent months. It has rarely seen production disrupted by unrest or natural disasters

Traders will keep an eye on developments in Kazakhstan. These events could affect crude oil production and we could see a rise in the price of a barrel in the coming days.

The key level is the SMA at 21 located at 78.84. If WTI breaks 79.00 and consolidates again above it, we could expect crude to reach the resistance of 81.25. This level coincides with 6/8 Murray.

On the contrary, with a daily close on the 4-hour chart and if WTI continues trading below 78.84 and below Murray's 5/8, a technical correction is possible towards the key level of 75.00. This level coincides with the EMA 200.

Our trading plan for the next few hours is to sell below 78.84. A confirmation signal will be given if WTI trades below Murray's 5/8 around 78.12. Below this zone, the price could accelerate its decline towards the level of 76.40 and down to 75.00. The eagle indicator is moving within a downtrend channel which supports our bearish strategy.

Support and Resistance Levels for January 11 - 12, 2022

Resistance (3) 81.25

Resistance (2) 80.17

Resistance (1) 79.29

----------------------------

Support (1) 77.68

Support (2) 76.95

Support (3) 76.07

***********************************************************

Scenario

Timeframe 4-hours

Recommendation: sell Below

Entry Point 78.84

Take Profit 76.40, 75.00 (4/8 - 200 EMA)

Stop Loss 79.40

Murray Levels 75.00 (4/8) 71.88 (3/8)

***********************************************************

Alternative scenario

Recommendation: buy above

Entry Point 79.20

Take Profit 80.00, 81.25 (6/8)

Stop Loss 78.65

Murray Levels 78.12 (5/8), 81.25 (6/8)

*********************************************************

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română