The US dollar may end with a decline for the seventh straight week. Against a basket of six main competitors, the greenback fell at the beginning of the week to its lowest levels since May 2018. At the same time, the dollar index lost more than 10% from the March highs.

For more than two weeks, the dollar index has been in the oversold zone. Such sustained pressure on the US dollar was last observed in 2008. After a long consolidation, it reversed, then a 12-year growth trend began.

However, there are no two identical situations, and it is naive to expect a trend reversal in the dollar solely from this experience. For example, before 2008, there were also periods of strong pressure on the dollar, followed by consolidation and renewed sales growth. It is dangerous for medium-term traders to rely on the dollar rebound only because it is oversold.

There are times when the technical picture is completely crossed out by fundamental factors. Like today, nonfarm payrolls and the unemployment rate will be released before the start of trading in the US.

Judging by the leading ISM indicators for the industry and services sector, one should not rely on better forecasts. Meanwhile, the recent decline in the number of applications for unemployment benefits does not allow thinking about the release of weak data. The final value is likely to be in the area of the consensus forecast, which is neutral for the market.

Millions of Americans returned to work after forced leave in May and June. But more and more information is emerging about long-term staff reductions. Many are out of work, and there is no talk of vigorous recovery of employment now.

For the greenback, this bodes tough times as the government and the Fed try to introduce a new stimulus to keep the economy from a W-shaped recession. The calculation is based on its V-shaped rebound.

It should be noted that dollar rates are still decreasing in the interbank market in New York and London. The most curious situation is in London, where the 3-month Libor rate hit a 5-year low. This is definitely a bad signal for the greenback.

Meanwhile, on Friday, the Federal Reserve will not buy bonds on the market, and the Treasury will also take a break. On August 11, the redemption of securities in the amount of $ 10 billion is expected, which should keep the dollar from falling.

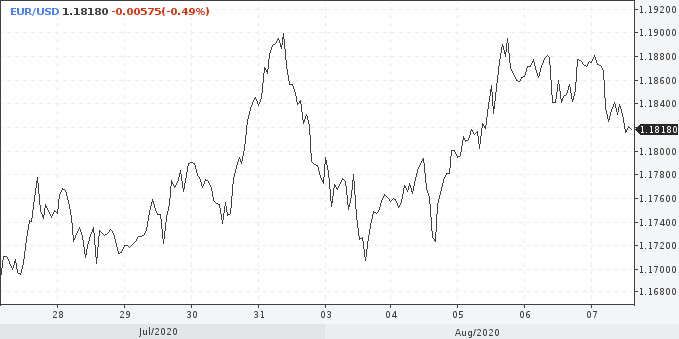

What do we end up with? The upward trend in the EUR / USD pair will continue, and the technical correction can be used to open buy positions.

Experts from UBS revised their forecast for the euro against the dollar to $ 1.2000 by the end of the year, previously they had expected an increase to 1.1700. They cited uncertainty about US fiscal stimulus as a reason for the shift in expectations.

"The risk of dollar depreciation should not be neglected, and in the long term, the growth of government debt is likely to affect the US currency," the bank's analysts said.

Nevertheless, they called it unreasonable to wait for a rally in the euro to the levels of 1.2500-1.3000. The European economy is recovering, but growth remains weak. In addition, the monetary policy of the ECB is too expansionary.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română