Hello, dear colleagues!

So, today at 13:30 London time, we will learn about the state of the US labor market for July. Unemployment in the United States is expected to fall to 10.5% (the previous figure is 11.1%), and the number of newly created jobs in non-agricultural sectors of the American economy will increase by 1 million 550 thousand. Let me remind you that in June, Nonfarm Payrolls amounted to 4 million 800 thousand. Regarding the average hourly wage, experts predict that its growth last month was minus 0.5%, which compared to the previous figure of minus 1.2% will already be a small step forward.

To tell the truth, these expectations don't look too high. The actual values may exceed forecasts, and then market participants will have to decide whether to continue selling the US dollar or switch to buying the US currency.

Characteristically, after weak data from ADP, yesterday's reports on initial jobless claims exceeded expectations, indicating a continuing recovery in US jobs. However, we should not forget that the United States is still at the center of COVID-19 proliferation, which harms the world's leading economy and the US labor market. As Federal Reserve Chairman Jerome Powell said at his recent press conference, due to COVID-19, the timing of economic recovery in the country is extremely uncertain. This uncertainty fully applies to today's statistics on the US labor market.

A little bit about the significance of American labor statistics for the market and its impact on the US dollar. Perhaps, along with the Fed's decision on rates and press conferences of the Fed's leaders, this is the strongest indicator in terms of its influence on the markets. In the past years, it was Nonfarm that often deployed price dynamics and changed trends. However, in recent years, such a pronounced influence is no longer observed. Of course, after the release of the US labor reports, volatility in the markets increases significantly, however, this is not what it was before. Well, things are changing, and it's inevitable.

Daily

In the current situation, it is the NFP that can determine the further dynamics of the US currency. With weak data, the US dollar will finally sink in the waves of sales. If the reports exceed the expectations of economists, you can count on at least a correction of the US currency, which is already significantly oversold.

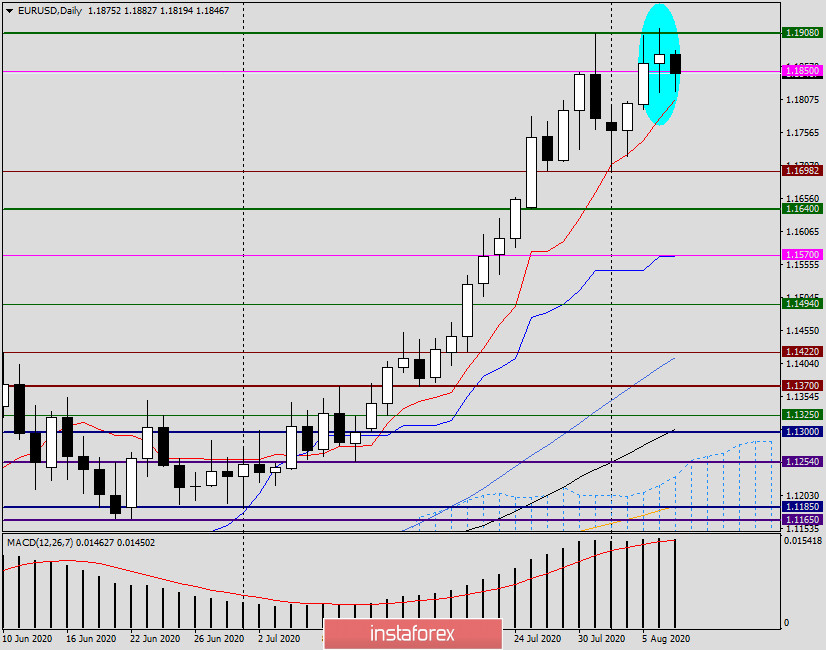

At least for the second scenario, the daily chart has a technical foothold in the form of yesterday's Doji candle, which can be considered a reversal. The situation for the euro bulls is aggravated by the fact that they can not break through the strong technical level of 1.1900 and gain a foothold above this mark.

At the end of this article, the main currency pair of the Forex market is trading with a slight decrease near 1.1835. If the decline continues, the support at 1.1807 will be tested, which is represented by the Tenkan line of the Ichimoku indicator. Closing trades below this line and 1.1800 will signal the inability of players to increase the rate to continue growing. In this regard, let me remind you that the last five-day trading period was not completed by the euro bulls above 1.1800, and the last weekly candle has a fairly long upper shadow.

Taking into account the need to adjust the exchange rate and the appearance of yesterday's reversal candle model on the daily chart, I venture to assume today's decline in the rate to 1.1800, 1.1780, 1.1750, and 1.1725. Naturally, this scenario will only be possible in the case of strong labor reports on the US labor market. At the same time, mixed data can not be excluded, which will provoke multidirectional movements.

Most often, on such days, I refrain from specific trading recommendations, especially when the positions are against the main trend. For those who trade recently, I recommend not to tempt fate and not to risk a deposit. Stay out of the market. For the rest, I can recommend looking at the opening of short positions, after the rise of EUR/USD in the price zone of 1.1860-1.1890. Once again, I would like to draw your attention to the fact that such positioning is risky, so the final decision is yours.

Good Luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română