Latest data on the US labor market surprised traders, as claims for unemployment benefits came out better than the forecast despite the surge in coronavirus incidence this July. It seems that the situation is starting to improve, which could lead to a recovery in the US dollar, more so if today's Non-farm Employment Change report also turns out good.

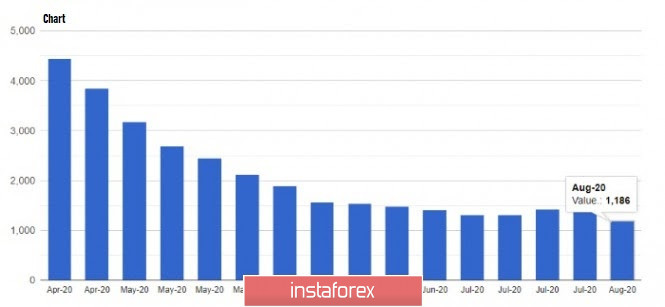

The report published by the US Department of Labor indicates that unemployment rate has slowed significantly in July, and the labor market continues to recover from the coronavirus pandemic. The data revealed that on the week of July 26 to August 1, initial applications for unemployment benefits decreased by 249,000 to 1.2 million, while secondary applications from July 19 to 25 fell by 844,000, to 16.1 million.

Meanwhile, for the July Non-farm Employment Change report, a less active recovery is expected compared to June, but much will depend on which direction the indicator deviates more from the forecast of economists. Good data may lead to a rise in the US dollar, but such will only be temporary, as the recovery in the US labor market will fuel more demand for risky assets. If the report, on the contrary, turns out to be far worse than the forecasts, the dollar may weaken for a while, but this will lay another stone in the general foundation of the downward correction trend of risky assets.

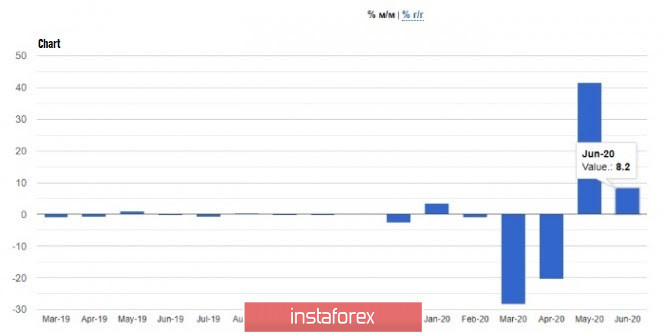

Data on industrial production in Italy also came out yesterday, which rose by 8.2% in June compared with the previous month. Similar reports for Germany and France will be published today, with which a significant increase in the indicator is also expected. Since orders in the industry recovered significantly in the summer after the lifting of quarantine measures, industrial production is expected to go beyond the forecasts, but is unlikely to support risk assets, since all attention will be given to the state of the US labor market, on which the further direction of the pair will depend.

Thus, for the technical picture of the EUR/USD pair, a breakout of the side channel will be carried out, the direction of which will determine where the quote will go in the price chart. Large resistance is seen at the price level of 1.1906, which the pair has already failed twice to break out of, clearly indicating the presence of large sellers. Its breakout will lead to new highs at the 20th figure, as well as a rise to the levels 1.2060 and 1.2090. But if the bears manage to break below the support level of 1.1810 today, a rather strong bearish move will occur, capable of passing the 1.1720 and 1.1650 lows.

AUD/USD

The Australian dollar ignored the scenarios for the recovery of the Australian economy, which the Central Bank announced today.

The report indicates that the future prospects for the economy are extremely uncertain, therefore, three scenarios were developed, according to which the recovery may proceed in the future.

The baseline and best-case scenario assumes that Australia's GDP will contract by 6% in 2020 and grow by 5% in 2021, with unemployment rate gradually decreasing from 10% to 7%. Inflation will remain below 2% over the next two years, which will keep interest rates at fairly low levels for a fairly long period of time.

A more optimistic scenario assumes that unemployment will peak at a lower level and then decline very quickly.

But in a negative scenario, new outbreaks of the virus and increased restrictions in some areas are laid. This will lead to a slowdown in the recovery of exports in the service sector, as well as a drop in consumer spending throughout the second half of 2020. A sharp decline in corporate capex and a slow recovery in activity in the country will keep the unemployment rate near its peak throughout 2021.

As noted above, there was no reaction from the Australian dollar to this report. A slight decline from weekly highs was more of a technical nature. For the Australian dollar to continue growing, it is necessary to break above the level of 0.7245, and only this scenario will open a direct road to new highs at 0.7315 and 0.7390.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română