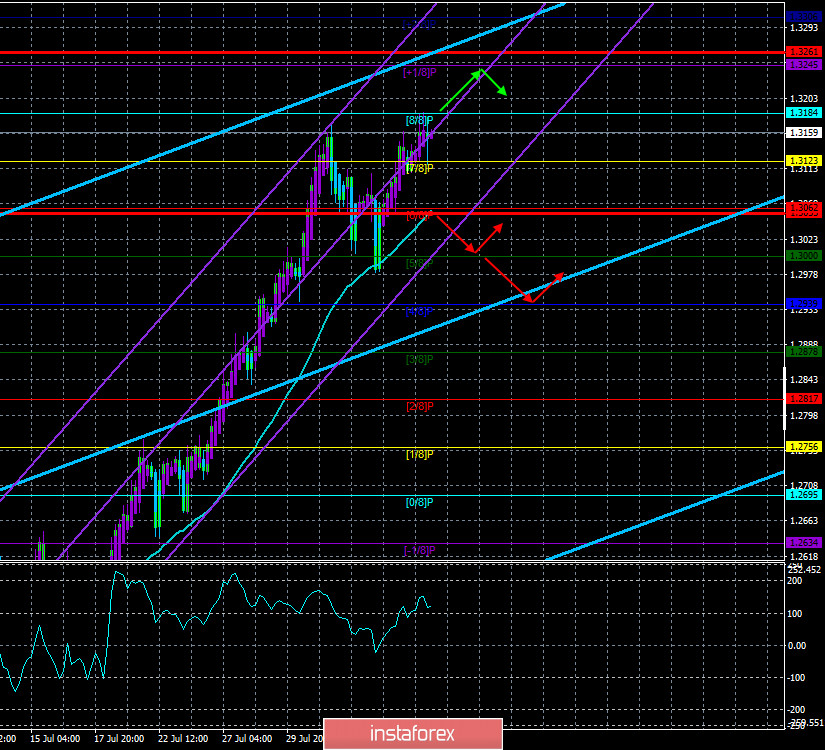

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 116.2358

For the British pound, yesterday was quite important. Even if you omit the meeting of the Bank of England and the speech of its head Andrew Bailey, traders of the pound/dollar pair had to decide whether they were ready to overcome the previous local high or intend to start a new downward trend. The day is over, and we have not received a clear answer to this question. By the end of the day, the pair's quotes reached the Murray level of "8/8" - 1.3184, which is located near the previous local maximum of 1.3169, but they did not manage to clearly and confidently overcome it. Thus, we still believe that new long positions are extremely dangerous at this time. Especially those for which Stop Loss levels are not set. Despite the fact that the trend is clearly upward and continues to persist, we still draw the attention of traders to the fact that the pound has already risen quite strongly against the dollar, and the sane correction since June 30 was only once.

Market participants did not expect much from the Bank of England meeting. However, you can always expect surprises from this scale of events. The British regulator left the key rate at the same level of 0.1%, the program of buying bonds from the open market at the same level of 745 billion pounds, and all 9 members of the monetary committee voted for the unchanged rate. However, the final communique of the regulator said that by the end of 2020, the British economy could lose 9.5%, which would be the worst indicator in the last 100 years. However, earlier the Bank of England announced a figure of -14.5% of GDP by the end of 2020, so the forecasts have improved. The question is only based on what? On the basis of what does the Bank of England expect that the losses will be less? On the basis of what he expects that during 2021, GDP growth will be 9%, which will almost completely offset all losses in 2020? Both the Fed and the ECB refrain from such optimistic forecasts, and in the UK, whose economy has been suffering for 4 years due to Brexit and whose damage from the pandemic is the highest among the EU countries, they expect a reduction in losses and a rapid recovery? So the regulator and the government of the Kingdom are not afraid of a second "wave" of coronavirus? BA made equally optimistic forecasts for inflation, which should rise to 2.3% y/y by 2023, and for unemployment, which may rise to 7.5% by the end of this year. Experts of the Bank of England believe that in the medium term, it will be possible to return inflation to the target level of 2%, and it does not matter that the last time inflation in Britain at this level was in July 2019, and since the beginning of 2018, it has been steadily falling. However, the statement of the monetary policy committee still states that the risks associated with the "coronavirus" pandemic still remain high, so most forecasts for the coming years can be adjusted depending on the epidemiological situation.

But what really supported the British pound was the speech of Bank of England Governor Andrew Bailey. The chairman directly stated at a press conference that "negative rates are part of the BA toolkit, but at the moment the regulator is not going to introduce them". Bailey also said that two main risks remain for the British economy – the lack of a trade deal with the EU and "coronavirus".

Meanwhile, Donald Trump is working on all fronts. The US leader has declared war on the Chinese social network TikTok and plans to ban it on American territory. The claims of the American government are simple. Trump believes that the social network collects personal data of American users and transmits it to the Chinese government. Of course, this hypothesis cannot be supported by evidence. TikTok management said that it does not transmit any information to the Chinese intelligence services or the government, and that it "does not plan to leave the American market". However, Trump spoke clearly and clearly: "We prohibit TikTok in the United States. Immediately." Some may think that this war between Trump and the Chinese social network is far-fetched. However, we recall that about a month ago, when Trump held his first campaign rally in the American city of Tulsa, it was with the help of this social network that his speech was disrupted. It was with the help of TikTok that Trump's opponents among voters agreed to fail the rally, registered en masse to participate in it, and then simply did not come. As a result, the stadium where Trump spoke was filled by about one-third, despite the fact that all the tickets were sold out. However, Trump is not against another scenario – if the TikTok platform is sold to the American company Microsoft, which offers about $ 30 billion for it. In this case, all claims to the social network will be withdrawn.

Well, the final thing is not to ignore the topic of the upcoming presidential elections in the United States, which are already a little less than 3 months away. Trump continues to push the idea that voting by mail can be rigged to the masses. In addition, the US President believes that it may take months or even years to count the votes. He said that in the last election in New York state, where remote voting was used, the vote count lasted several weeks, and its results were revised several times. There is a certain logic and meaning in the words of the US leader. One thing is for sure, we are looking forward to a terrifically fun end to 2020. Elections in America can become an event that will not leave the pages of all publications for several months.

On the last trading day of the week in America, several extremely important reports are planned, the main of which is NonFarm Payrolls. If the value of this report is weak (weaker than the forecast +1.6 million), then we can expect a new weakening of the US currency in a pair with the pound. However, in general, Friday is a good day to start a new round of corrective movement, which may later develop into a full-fledged downward trend. We are still leaning more towards this option. No macroeconomic reports are expected from the UK today.

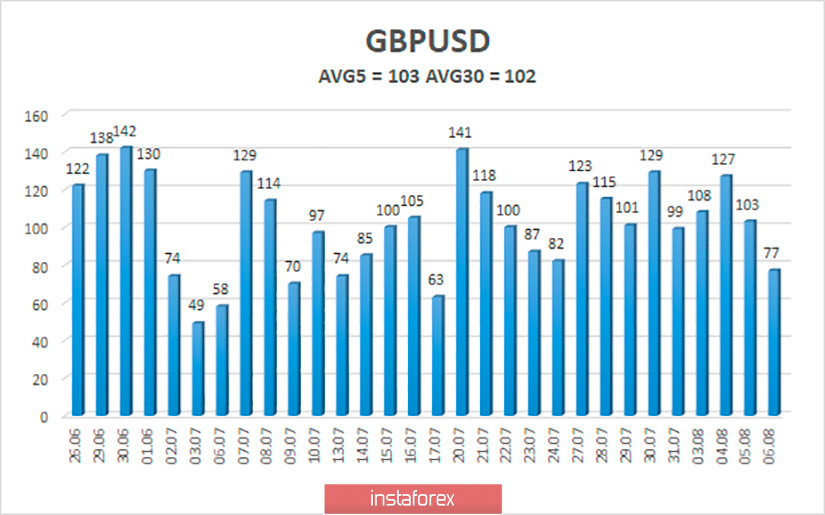

The average volatility of the GBP/USD pair continues to remain stable and is currently 103 points per day. For the pound/dollar pair, this value is "high". On Friday, August 7, thus, we expect movement within the channel, limited by the levels of 1.3055 and 1.3261. Turning the Heiken Ashi indicator downward will indicate the beginning of a new round of corrective movement.

Nearest support levels:

S1 – 1.3123

S2 – 1.3062

S3 – 1.3000

Nearest resistance levels:

R1 – 1.3184

R2 – 1.3245

R3 – 1.3306

Trading recommendations:

The GBP/USD pair resumed its upward movement on the 4-hour timeframe, but could not yet overcome the Murray level "8/8" - 1.3184. Thus, today it is recommended to stay in the longs with the goals of 1.3245 and 1.3264 while the Heiken Ashi indicator is directed upwards. Or close long positions near the level of 1.3184. Short positions can be considered no earlier than fixing the price below the moving average with the first goals of 1.3000 and 1.2939.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română