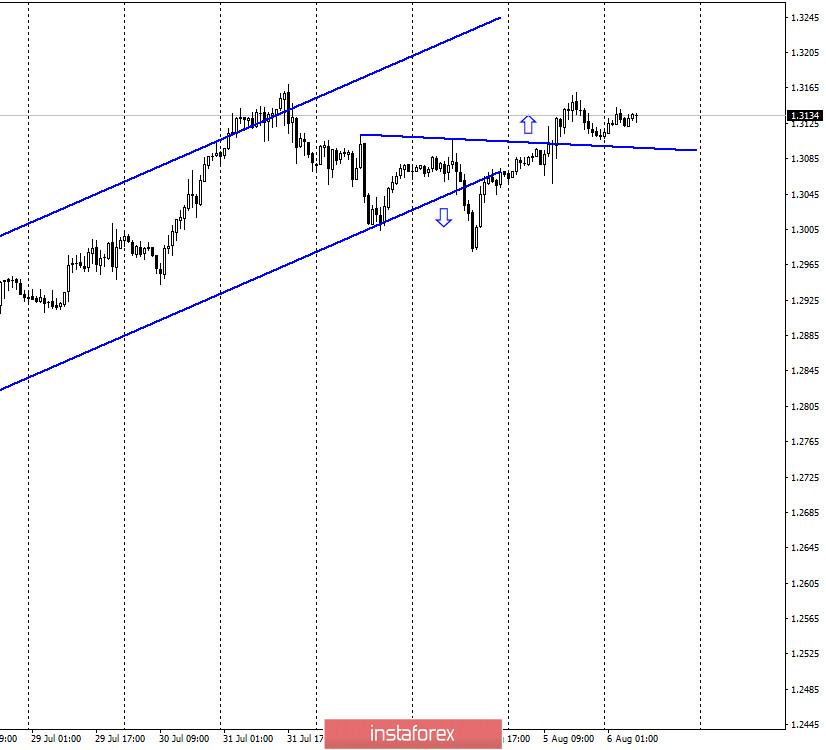

GBP/USD – 1H.

Hello, traders! On the hourly chart, the quotes of the GBP/USD pair closed first under the upward trend corridor, then closed over a very short-term downward trend line. However, the latest graphical signal lets us know that bull traders are ready to buy the pair again. This morning, the results of the Bank of England meeting became known. As traders expected to see, the key rate remained at 0.1%, and the volume of the asset purchase program - at the level of 745 billion pounds. Despite the fact that there were no changes, the British pound began to grow again on the morning of August 6. All nine members of the monetary committee voted to keep the rate unchanged. Now the markets will be waiting with interest for the speech of the Bank of England Chairman Andrew Bailey, which is scheduled for the afternoon. You also need to wait for the monetary policy report, which will contain forecasts for GDP and inflation in the near future. From this report and Bailey's speech, traders will be able to understand the current mood of the regulator and what further steps it is going to take in 2020. Let me remind you that for a long time there have been rumors that the Bank of England may further expand the quantitative easing program and lower the rate.

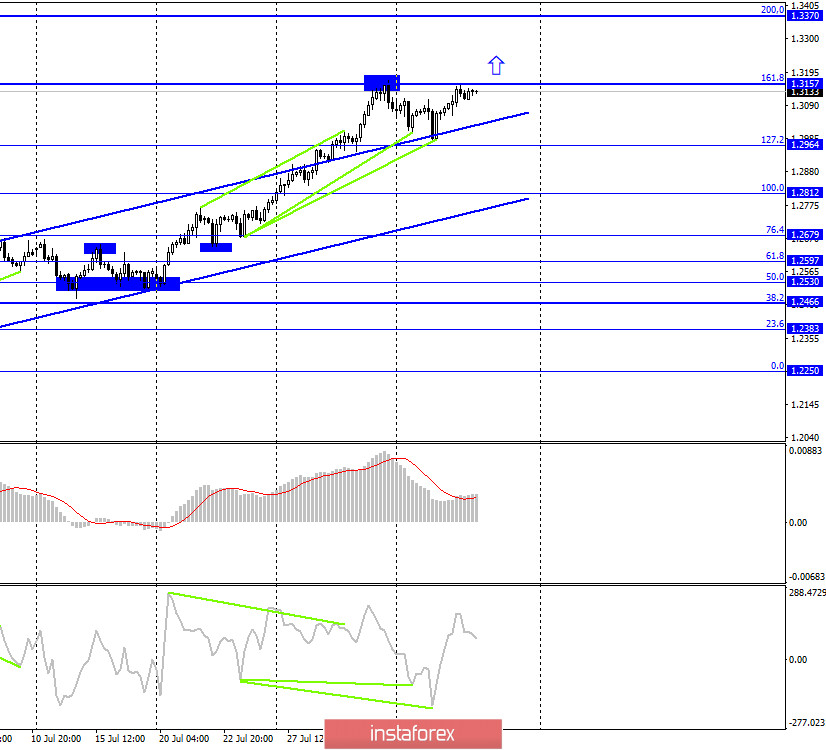

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair returned to the corrective level of 161.8% (1.3157). Thus, a new rebound of quotes from this level will again work in favor of the US dollar and some fall in the direction of the corrective level of 127.2% (1.2964). The MACD indicator is brewing bearish divergence, which may coincide with the rebound from the level of 1.3157 and increase the probability of a fall in quotes. Closing the pair's rate above the level of 1.3157 will work in favor of continuing growth in the direction of the next corrective level of 200.0% (1.3370).

GBP/USD – Daily.

On the daily chart, the pair's quotes performed an increase to the corrective level of 100.0% (1.3199), however, the level of 161.8% on the 4-hour chart does not allow the growth process to continue. Closing the pair's rate above the 100.0% level will work in favor of further growth in the direction of the Fibo level of 127.2% (1.3684).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the lower downward trend line. The rebound from this line may allow the pair to perform a reversal in favor of the US dollar and resume the process of falling in the direction of the lower trend line, that is, approximately to the level of 1.1500.

Overview of fundamentals:

On Wednesday, reports on business activity in the service sector were released in the UK and America, which almost did not interest traders. The report on changes in the number of employees from ADP had a greater impact on traders and the US dollar began to fall again.

News calendar for the US and UK:

UK - decision on the main interest rate of the Bank of England (06:00 GMT).

UK - planned volume of asset purchases by the Bank of England (06:00 GMT).

UK - summary of monetary policy (06:00 GMT).

UK - Bank of England monetary policy Report (06:00 GMT).

UK - Bank of England Governor Andrew Bailey will deliver a speech (09:00 GMT).

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On August 6, all the most interesting events will take place in Britain. Actually, the results of the meeting have already been announced, we can only wait for reports on monetary policy and the speech of the Governor of the Bank of England.

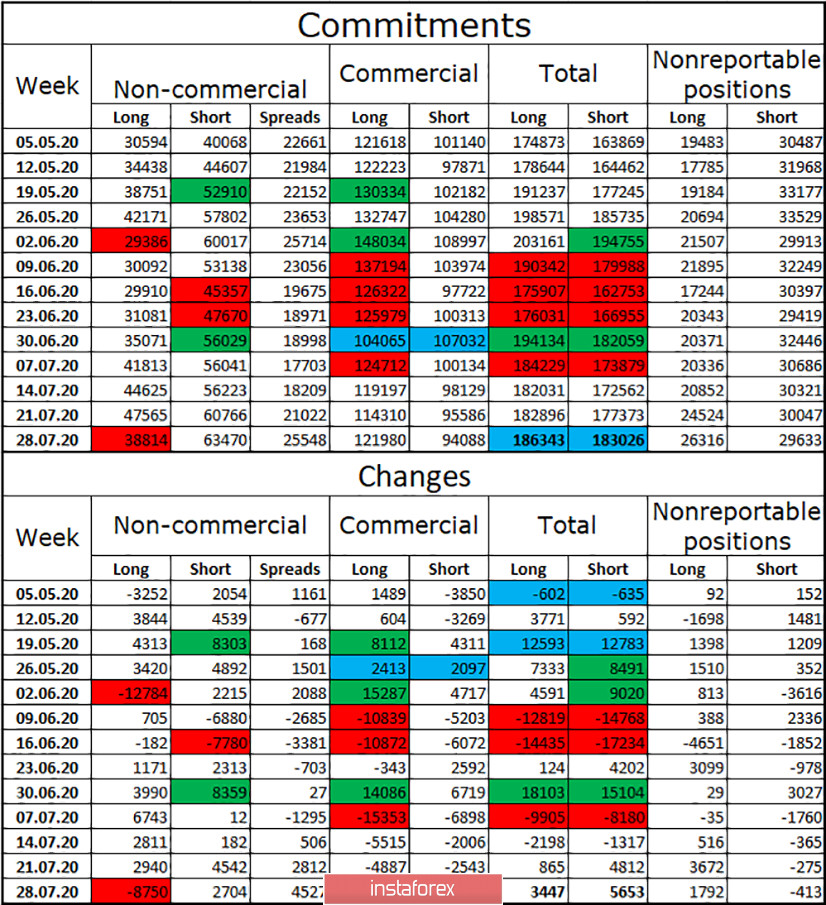

COT (Commitments of Traders) report:

The latest COT report on the pound was quite interesting and unexpected. It turned out that during the reporting week, the "Non-commercial" group did not increase long-contracts, but on the contrary, got rid of them, which is very strange, given the confident and strong growth of the British pound, which continued after July 28. However, the reported data shows a drop in interest among major players in the British. Moreover, the same group of traders opened 2704 short-contracts, so in general it turns out that the interest of speculators in the pound fell by about 10 thousand contracts. Given that there are only 38 thousand long and twice as many short contracts left in the hands of speculators, I can assume that a strong drop in the British dollar's quotes is possible in the near future.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goals of 1.2964 and 1.2812, if a new rebound from the level of 1.3157 is made today on the 4-hour chart. I recommend buying the British currency again if the quotes close above the level of 1.3157 with the goals of 1.3200 – 1.3250.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română