The ISM service sector PMI rose to 58.1p in July against 57.1p a month earlier, the main US economy is in a recovery phase, and the S&P 500 stock index climbed to 3328p on Wednesday, having almost completely recovered from the February-March failure.

The positive ISM report contains an annoying detail – employment in the service sector in July declined for the fifth month in a row, the employment sub-index was only 42.1%, which is even less than 43.1% a month earlier. It turns out that, as in the manufacturing sector, firms report an increase in activity, an increase in new orders, etc., but they continue to cut staff.

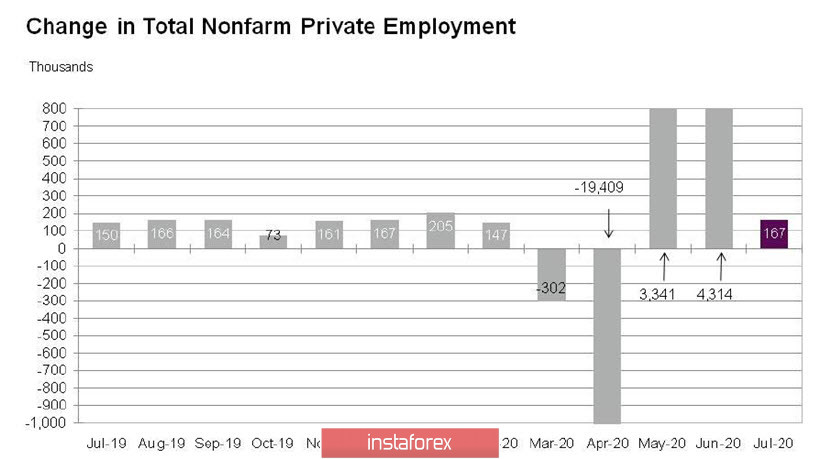

The ADP Private Sector Employment Report fully confirms the trend emerging from the ISM releases. In July, only 167 thousand new jobs were created, and this, with the forecast of 1.5 million. So, isn't the gap big?

At the same time, a total of 19.711 million jobs were lost in two "covid months", in March and April, and over the next three months, only 7.822 thousand were restored, or less than 40% of the total number of reductions.

Several mutually exclusive conclusions are clearly visible - the US economy is growing, which is reflected in the growth of PMI in all key sectors, but employment continues to decline. Before the publication of Non-farms on Friday, the uncertainty went off scale. According to forecasts, 1.6 million new jobs were created in July, but after the ISM and ADP reports, the chances of seeing a result no worse than forecasts have significantly declined.

The dollar, accordingly, is under pressure again. If there were signs of correction at the beginning of the week, then all positive signals recede into the background again by Thursday.

Fed Chairman, Powell, has repeatedly stated that in order to determine the impact of the coronavirus on the US economy, it is necessary to analyze the labor market reports for July and August. From this, it follows that the possible failure of the Nonfarm report increases the chances that the launch of a new monetary stimulus will be announced at the September meeting of the Fed. This is how the market will assess Friday's Non-farms, and therefore, their impact on the dollar may turn out to be very high if the deviation from forecasts is significant.

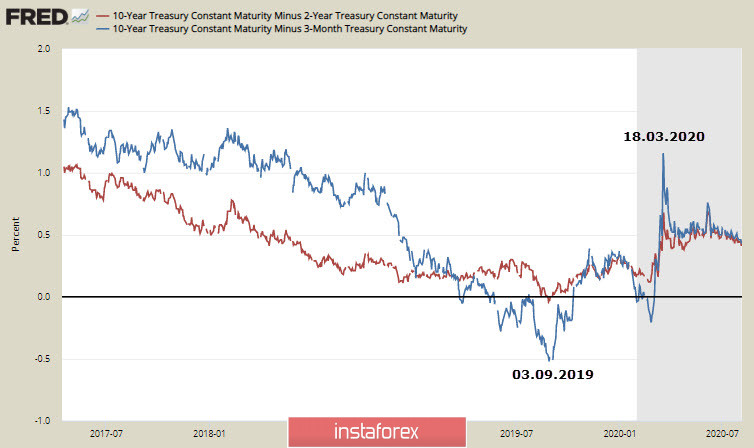

So far, these indicators are not in favor of the dollar. Bond yields are low, and demand for gold is growing aggressively. The yield spread, which was developed at the end of 2019, is again turning towards zero level.

The growth of stock indexes is based primarily on available and cheap liquidity, rather than on a real economic recovery. While the labor market has not shown a stable trend to recovery, the threat of a large-scale collapse of the depression remains high, and the dollar will continue to remain under pressure, since the liquidity crisis in the markets of developing countries has not yet occurred. The market will assess the current situation as conducive to the introduction of new stimulus measures by the Fed, which will have a decisive impact on the dollar's prospects.

EUR/USD

The pace of economic recovery in the eurozone is helping to boost demand for the euro. PMI Markit indices are growing in the growth phase as well as retail sales and prices, the situation is favorable for the continued growth of the euro. At the same time, consolidation above 1.19 is unlikely before the publication of Non-farms, the most logical move to a sideways range in anticipation of the report.

The lower border of the range is 1.1800/10. In case of a decline, it is possible to resume buying with the target of testing 1.19.

GBP/USD

The Bank of England, following the meeting ended this morning, left all the parameters of the current monetary policy unchanged. Most likely, the pause will last at least until September.

The pound reacted to the results of the meeting with an attempt to grow, as the markets took into account the low probability of expansion of stimulus measures. At the same time, there are no serious reasons for continued growth, except for the only one - the threat of further weakening of the dollar across the entire spectrum of the market.

It is likely to trade in a sideways range with a slight upward trend until Friday. We should expect either a decline to the support of 1.2800/20, or testing the resistance of 1.32 with subsequent consolidation above depending on the results of non-farms.In this regard, all depends on Non-farmers.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română