Trading recommendations for the EUR / USD pair on August 6

Analysis of transactions

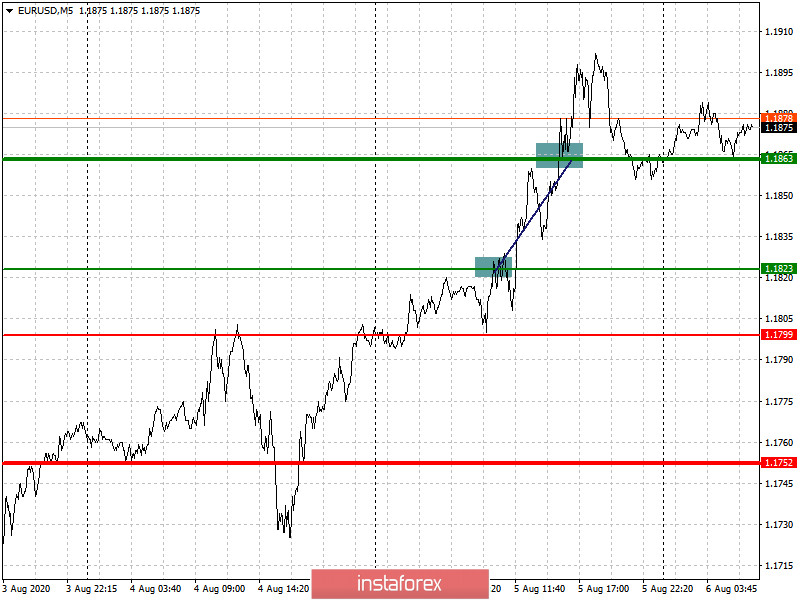

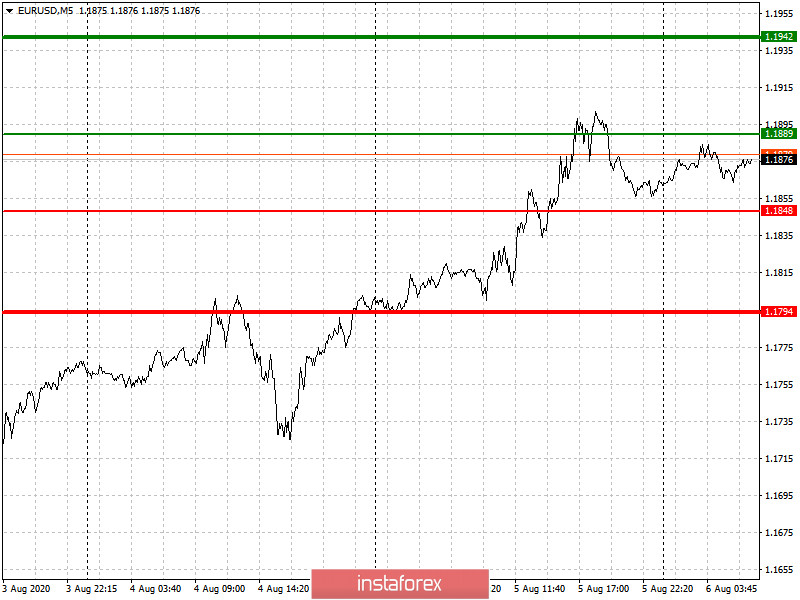

Good reports on the eurozone services sector led to a continued growth in the European currency, so buy transactions from the level of 1.1823 brought more than 50 points of profit yesterday.

Today, the weekly report on unemployment claims in the United States will be published, in which if the indicator grows, the US dollar will weaken even further while the euro will continue to rise in the market.

- Buy positions when the quote reaches the level of 1.1889 (green line on the chart), targeting a rise to the level of 1.1942. Weak data on the US labor market will support the euro to rise in the trading chart. Take profit at the price level of 1.1942.

- Sell positions after the quote reaches the level of 1.1848 (red line on the chart), targeting a drop to the level of 1.1794. It is important for the bears that the report on the US labor market is better than the forecasts of economists, as this will strengthen the position of the US dollar in the market. Take profit at a price level of 1.1794.

Trading recommendations for the GBP / USD pair on August 6

Analysis of transactions

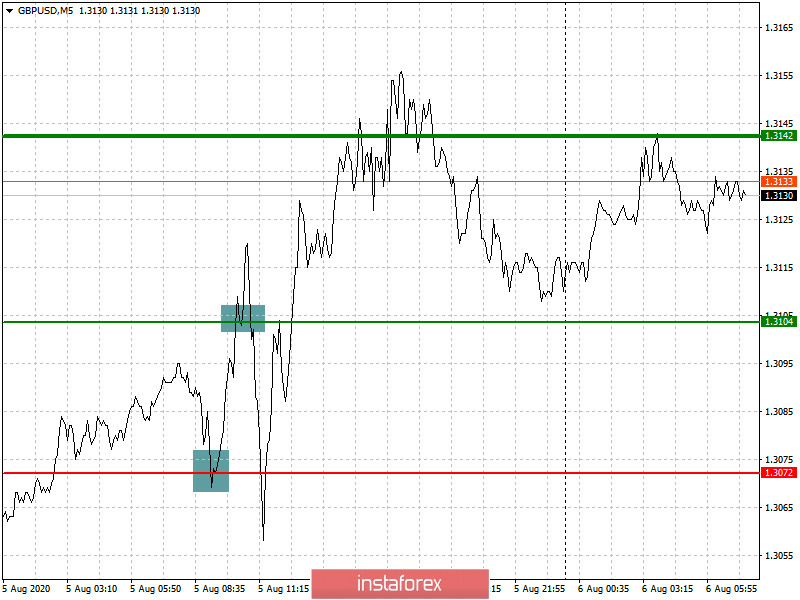

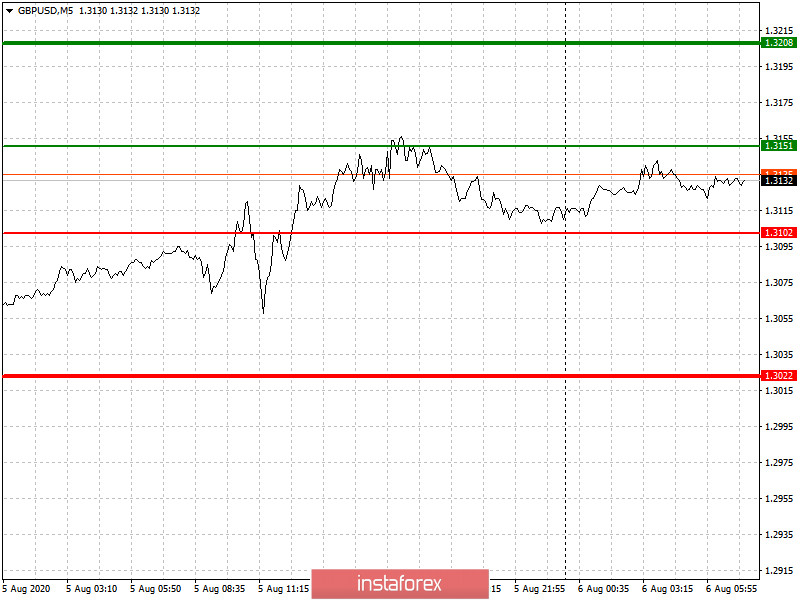

Trades for the pound were unprofitable yesterday, mainly due to the excessive volatility in the market ahead of the Bank of England meeting, which will take place today.

The Bank of England is set to meet today to discuss further plans on interest rates, which may determine the movement and direction of the British pound. Hence, wait for the announcement of results before making any trading decisions.

- Buy positions when the quote reaches the level of 1.3151 (green line on the chart), targeting a rise to the level of 1.3208 (thicker green line on the chart). An increase will occur, if the Bank of England points out new measures to support the UK economy. Take profit when the quote reaches a price level of 1.3208.

- Sell positions after the quote hits a price level of 1.3102 (red line on the chart), as a breakout of which will lead to a rapid decline in the daily TF. However, for a larger fall in the pound, the Bank of England has to take a wait-and-see attitude and not announce any changes in its policy today. The target for the decline is the level of 1.3022, where taking-profit is recommended.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română