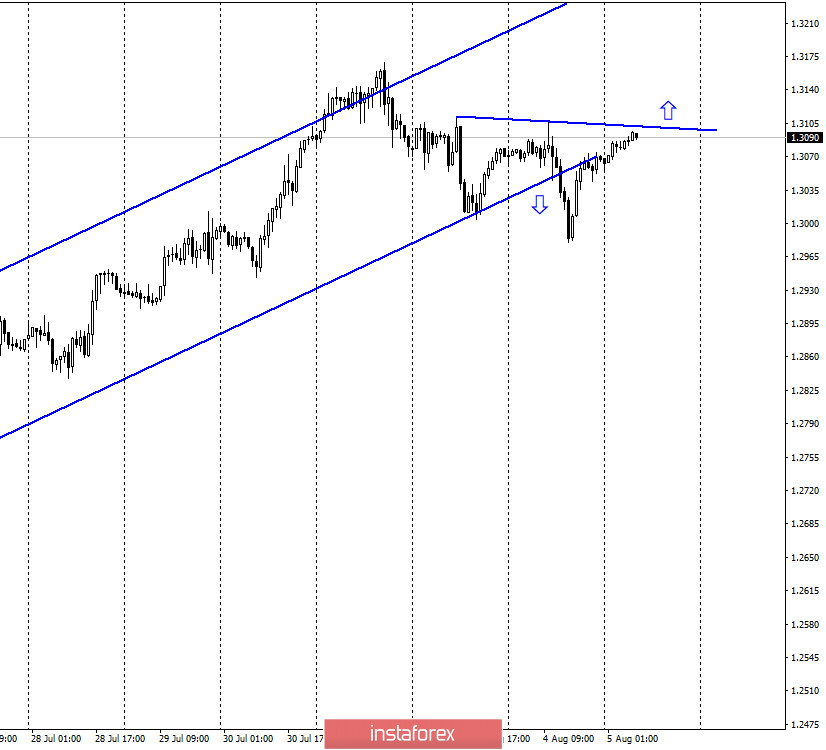

GBP/USD – 1H.

Hello, traders! On the hourly chart, the quotes of the GBP/USD pair performed a close under the uptrend corridor, but almost immediately performed a reversal in favor of the British dollar and began a new growth process. However, I believe that the mood of traders at this time has changed to "bearish". I also built a weak downward trend line, which may lead to a reversal of the pair in favor of the US currency. The problems of the US currency, which I listed in the article on EUR/USD, also concern the GBP/USD pair. The only difference is that the EU is now much more stable than the UK. That is, if the euro currency has certain reasons for growth against the dollar, the pound has much less of them. However, we see that both pairs are extremely reluctant to fall, keeping the chances of resuming the upward trend high. In the context of the current situation, the Bank of England meeting on Thursday will be of great importance for the British. Most likely, its results will not be optimistic. Traders are waiting for new negative information from the Bank of England, including a statement on the transition to a policy of negative rates. And this event may lead to a stronger growth of the US dollar.

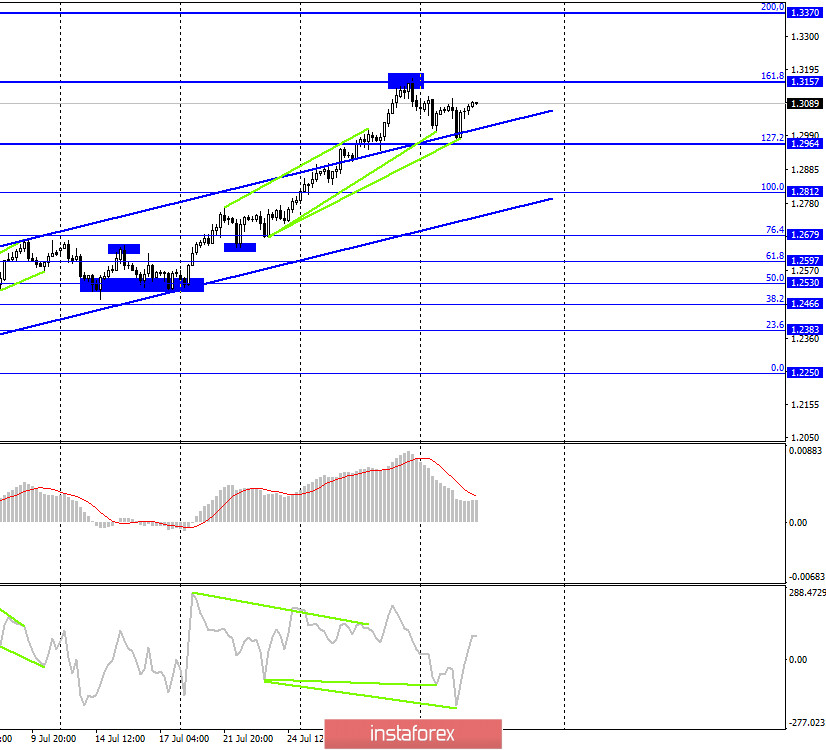

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair rebounded from the corrective level of 161.8% (1.3157) and began the process of falling in the direction of the corrective level of 127.2% (1.2964). However, two bullish divergences at the CCI indicator kept the pair from a strong fall. Now bear traders need to expect the pair's exchange rate to consolidate under the Fibo level of 127.2%, which will allow them to count on a further drop in the quotes in the direction of the corrective level of 100.0% (1.2812).

GBP/USD – Daily.

On the daily chart, the pair's quotes performed an increase to the corrective level of 100.0% (1.3199), however, the rebound from the level of 161.8% on the 4-hour chart stopped the growth process. Thus, now it is possible to drop quotes. Closing the pair's rate above the 100.0% level will work in favor of further growth in the direction of the Fibo level of 127.2% (1.3684).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the lower downward trend line. The rebound from this line may allow the pair to perform a reversal in favor of the US dollar and resume the process of falling in the direction of the lower trend line, that is, approximately to the level of 1.1500.

Overview of fundamentals:

There were no economic reports in the UK and America on Tuesday. The information background in general also did not please traders.

News calendar for the US and UK:

UK - PMI for services (08:30 GMT).

US - change in employment from ADP (12:15 GMT).

US - ISM composite index for non-manufacturing sector (14:00 GMT).

On August 5, there won't be much interest in the UK, but in America there will be two interesting reports: the important ISM index for the service sector and the ADP report, which will show how quickly Americans find work after a serious increase in unemployment.

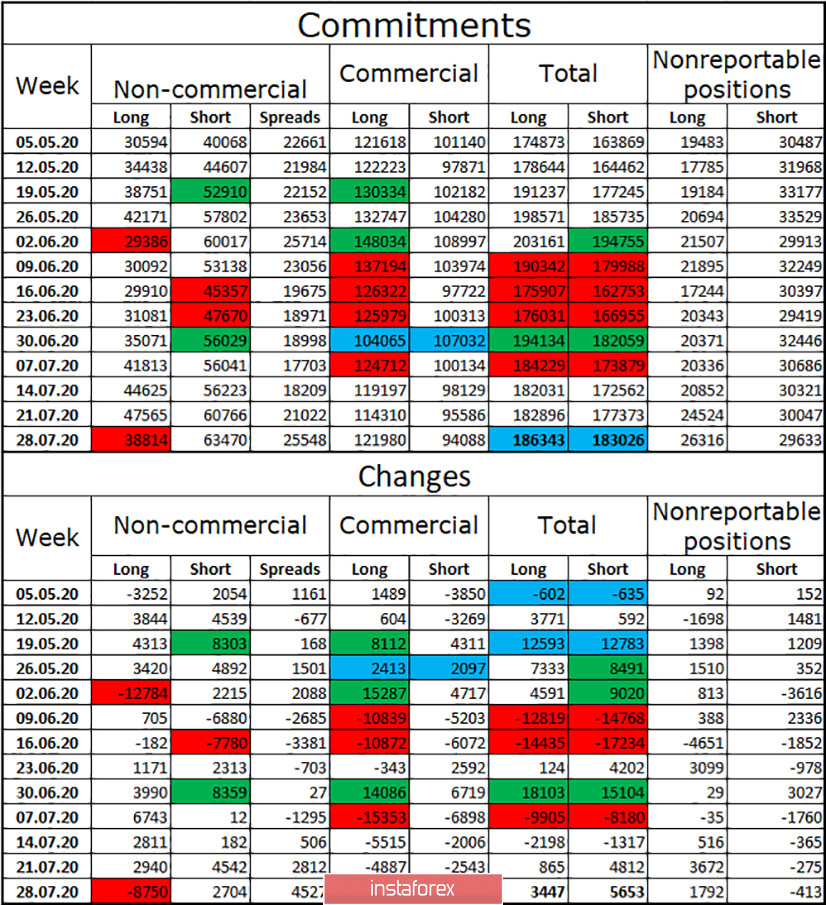

COT (Commitments of Traders) report:

The latest COT report on the pound was quite interesting and unexpected. It turned out that during the reporting week, the "Non-commercial" group did not increase long-contracts, but, on the contrary, got rid of them, which is very strange, given the confident and strong growth of the British pound, which continued after July 28. However, the reported data shows a drop in interest among major players in the British. Moreover, the same group of traders opened 2704 short-contracts, so in general, it turns out that the interest of speculators in the pound fell by about 10 thousand contracts. Given that there are only 38 thousand long and twice as many short contracts left in the hands of speculators, I can assume that a strong drop in the British dollar's quotes is possible in the near future.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goals of 1.2964 and 1.2812, since the closing was performed under the trend corridor on the hourly chart. I recommend buying the British currency again if the quotes close above the level of 1.3157 with the goals of 1.3200 - 1.3250.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română