At first glance, the market did not behave quite adequately yesterday. Especially if you look at the time interval between the release of European and US data. The fact is that, despite the release of good data on the euro area, after a short delay, the single European currency resumed to fall. Most likely, this indicates the simple fact that the market is still overheated and the single currency remains overbought.

The weakening of the euro, which began on Friday, only stopped when the final data on the index of business activity in the manufacturing sector of the euro area was published, which turned out to be much better than forecasts. If the preliminary estimate showed an increase in the index from 47.4 to 51.1, then the final data showed growth to 51.8. It turns out that the European industry is doing much better than expected. And the most important thing is that, judging by the index, the industry has come out of the recession and is already showing some growth. At least the mood in the industry is just that. After all, these very sentiments reflect the business activity index.

Manufacturing PMI (Europe):

However, this did not lead to the euro's growth. This only halted its decline, which resumed with renewed vigor an hour later. The market was waiting for similar data from the United States, where growth was also expected. After all, the preliminary estimate said that the index of business activity in the manufacturing sector of the United States should rise from 49.8 to 51.3. That is, just like in Europe, a transition from stagnation to growth is visible. The final data confirmed this very transition. But the index only rose to 50.9, which is slightly worse than forecasted. As a result, the single currency immediately won back part of its losses and returned to the values at which it was at the time of the release of European data. But in general, we can see the mood for a correction and strengthening the dollar.

Manufacturing PMI (United States):

Nevertheless, to all appearances, a full-fledged correction will have to wait a bit, and the single currency may well strengthen its positions. The fact is that the only thing that will be published today is producer prices in Europe, its rate of decline should slow down from -5.0% to -4.0%. That is, producer prices are clearly going up. And this indicator is leading for inflation. And if producer prices are going up, then there is nothing to reduce inflation, and it could rather start to grow. Well, the growth of inflation, especially if it is practically zero, is an extremely positive factor. At least from the point of view of investors.

Producer prices (Europe):

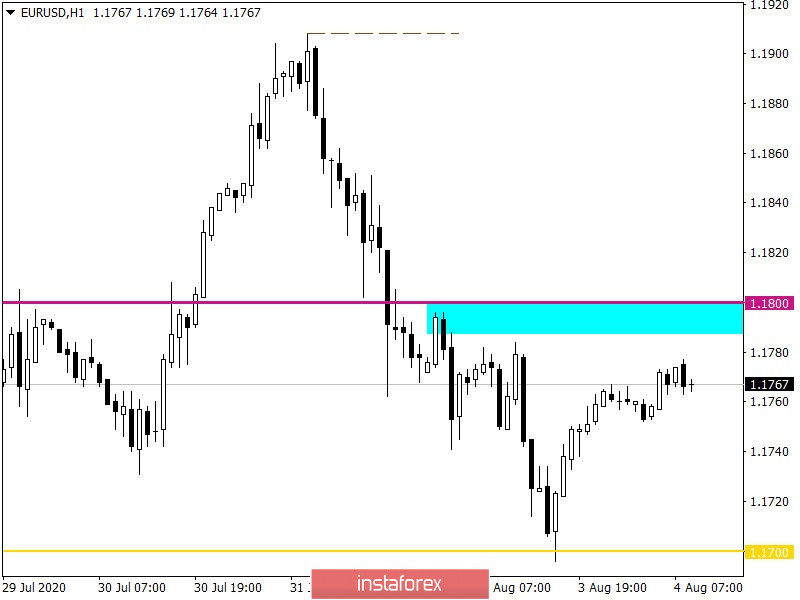

The euro/dollar pair managed to go down to the 1.1700 area in the course of the correction, where a support point was found and as a result a rebound in the opposite direction.

The 1.1700 area plays the role of interaction of trading forces, having confirmation for the period of July 27-29, where the quote was systematically slowing down.

In terms of dynamics, a high volatility of 100 points is recorded, which indicates speculative interest in the market.

Looking at the trading chart in general terms (daily period), you can see that the quote followed an upward trajectory for the last five weeks, as a result of which the highs were updated, and the quote was pinned in the 2018 area.

We can assume that the upward turn set a day earlier will still remain in the market, directing the quote towards the value of 1.1800. After that, the breakout/rebound method from the value of 1.1800 takes effect, where you should monitor the behavior of market participants.

From the point of view of complex indicator analysis, we see that the indicators of technical instruments on minute and hour periods signal a purchase due to the process of price rebound from the value of 1.1700. The daily period, as before, is focused on upward momentum, signaling purchases.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română