The continuation of an upward trend in risk assets remains unclear, as last month there was a surge in volatility in favor of the US dollar.

But even if so, it is unlikely that such will affect the global downward trend of the US dollar, which will continue amid global economic recovery. The current rise of the US dollar is still just a correction after the recent sell-offs of the currency, as real demand will only return in the event of another outbreak and re-introduction of quarantine restrictions. Unfortunately, those scenarios will lead to complete paralysis and very serious financial consequences not only for risk assets, but also for countries with developed economies.

The resumption of trade negotiations between the United Kingdom and the European Union is also another factor that will influence demand in the market. Hence, decisions must be carefully taken especially when opening long positions in the pound at current highs, since the currency may weaken ahead of the negotiations.

Going back to the coronavirus, the new surge in COVID-19 incidence in the United States further decreases the chances that demand for the US dollar will continue, more so because the Fed has maintained its soft monetary policy, pumping the economy with cheap money. In a report published by Johns Hopkins University, it was revealed that in July, the US recorded more than 1.9 million cases of new infections, which is more than double of what was observed in the previous months. Despite that, the Fed is still ready to abandon its usual strategy of preemptive rate hikes, that is, controlling inflation at 2.0%, which is the target range of the central bank. The Fed has used this same strategy over the past 30 years, but now, even if inflation rises above 2.0%, it will stick to low interest rates, which will pump even more funds into the economy.

As for macroeconomic reports on the US economy, the US Treasury Department reported yesterday that the loans of the US government in the second half of 2020 has already reached $ 2 trillion, and, according to the ministry, it is assumed that it will rise even further, as the Congress is set to take additional stimulus measures for another $ 1 trillion.

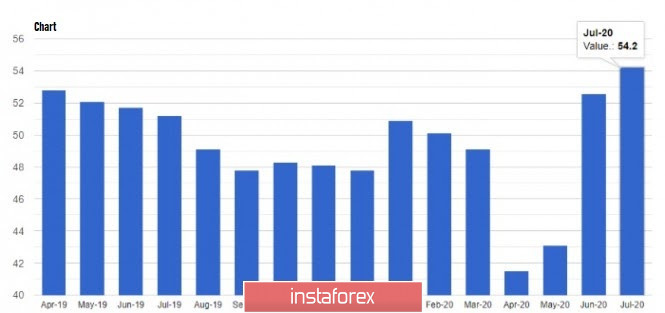

Meanwhile, data on manufacturing activity in the United States indicated that the economy is recovering after the coronavirus pandemic. A rise in activity has been observed for three months, but its pace is still far from ideal, in which real growth occurred only last month, when the indicator exceeded 50 points. Nevertheless according to IHS Markit, the calculated final PMI was 50.9 points in July, while the preliminary reading was at 51.3 points. In June, the index was at 49.8 points. The growth was mainly driven by a rebound in orders due to stronger demand.

The report of ISM has even prettier numbers. According to the data, the calculated PMI for July was 54.2 points against 52.6 points in June, while economists had expected the index to be 53.8. It is possible that the current rate of recovery will continue even further, since the domestic market is quite strong, and manufacturers in the US are gradually recovering from the coronavirus.

Construction costs in the US have also reduced last June, which, although did not excite the market, were down 0.7% m / m to $ 1.355 trillion, while economists were expecting a 1.2% growth.

Another important news is the deteriorating relations between the US and China, with which there was news that China is preparing for a worst scenario where all the PRC journalists would have to leave the United States. If the US really took such measures, Beijing would take retaliatory measures, ushering American journalists out of China as well. Such is a response to the previous announcement of the US that some of the Chinese journalists would have to leave the country due to controversy over how the media is covering the coronavirus pandemic. The US plans to expel 60 employees of the PRC media in total, in addition to the closure of consulates under the pretext that they were engaged in espionage and information gathering.

Thus, for the technical picture of the EUR / USD pair, the movement of the quote will depend on the resistance level of 1.1780, a breakout of which could push the pair to the highs at 1.1850. But if the attempts on the level were unsuccessful, a new wave of decline will occur in risk assets, which will return the quote to the larger support levels at 1.1700 and 1.1640.

AUD / USD

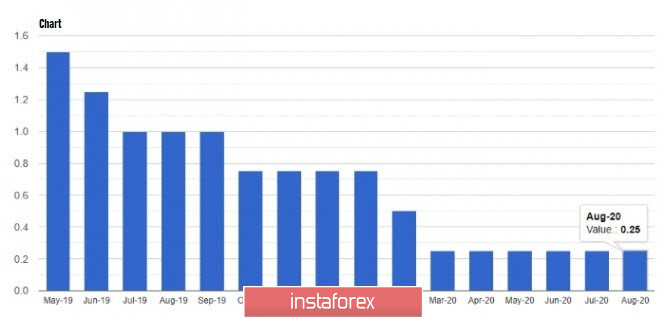

The Reserve Bank of Australian has recently announced its decision to take a wait-and-see attitude to assess the economic consequences of the quarantine restrictions implemented to curb the coronavirus. According to the data, the RBA left its key interest rate unchanged at 0.25%, and the yield on 3-year bonds at 0.25%. The central bank said that rates will remain low as long as necessary, since the Australian economy is in its worst recession since the 1930s.

The leaders of the RBA also announced various scenarios that the economy may lead to, and explained how they would respond to each of them.

Thus, for the baseline scenario that assumes a 6% reduction in GDP in 2020 and a 5% growth in 2021, unemployment is projected at 10% in 2020, only recovering to 7% in 2021-2022. During this period, no serious inflation is expected to rise above 2.0%, which will allow maintaining a soft monetary policy for a rather long time. On the plus side, the RBA noted that the current recession is not as deep as previously expected, and most of Australia is already recovering.

Nevertheless, for the technical picture of the AUD / USD pair, further recovery of the trading instrument is very problematic, as only a breakout from 0.7180 would lead to an upward move towards the highs of 0.7265 and 0.7390. If demand for the aussie remains low, large support levels will be seen around 0.6960 and 0.6830.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română