The US dollar index reached two-year lows, falling to the middle of the 92nd figure. The last time the indicator was at this level was in April 2018. Then the problems of the dollar were associated with Nonfarms: the increase in the number of employees in the non-agricultural sector dipped to 135,000 (seasonal factor + strikes at large enterprises). The US currency is slumping for other, more ambitious reasons today. The disappointing results of the July Federal Reserve meeting amid an increase in the number of COVID-19 infected in the United States and a record slowdown in the American economy - all these factors have exerted strong pressure on the greenback. US President Donald Trump also added fuel to the fire yesterday, voicing the unprecedented idea of postponing the presidential election. Such a unipolar fundamental background did not allow dollar bulls to develop a correctional movement.

Let me remind you that the Fed Chairman Jerome Powell focused his attention on the coronavirus at the last central bank meeting. The rate of spread of the epidemic in the US is alarming in the Fed's camp, especially given the shaky recovery of key macroeconomic indicators (primarily inflation). In fact, Powell linked the prospects for monetary policy to the prospects for a pandemic. Therefore, yesterday's sharp increase in the number of cases in the US (the daily increase was more than 89,000) negatively affected the mood of traders.

The greenback showed signs of recovery amid general profit-taking at the end of the July Fed meeting, but the corrective growth was short-lived and insignificant. According to Johns Hopkins University, the number of deaths from coronavirus has already exceeded 150,000 in the United States – according to experts from this university, the pandemic is spreading almost uncontrollably in almost every state of the country. The number of new cases in two-thirds of the states has increased significantly over the past week. The most difficult situation is in the southern regions of the country. More than 70,000 in Florida over the past seven days new cases were detected, 67,000 in California, more than 57,000 in Texas. Georgia, Arizona, Louisiana, Tennessee, North Carolina, Alabama, South Carolina and Illinois have reported more than 10,000 cases in the past week. The gloomy picture is supplemented by the forecasts of experts, who warn of a worsening of the situation in the fall and winter, when the coronavirus will also connect with seasonal flu.

Against the backdrop of such trends, Powell's words about deflationary risks have taken on a new color. He stated that due to the ongoing epidemic, US consumer activity is still at a low level.

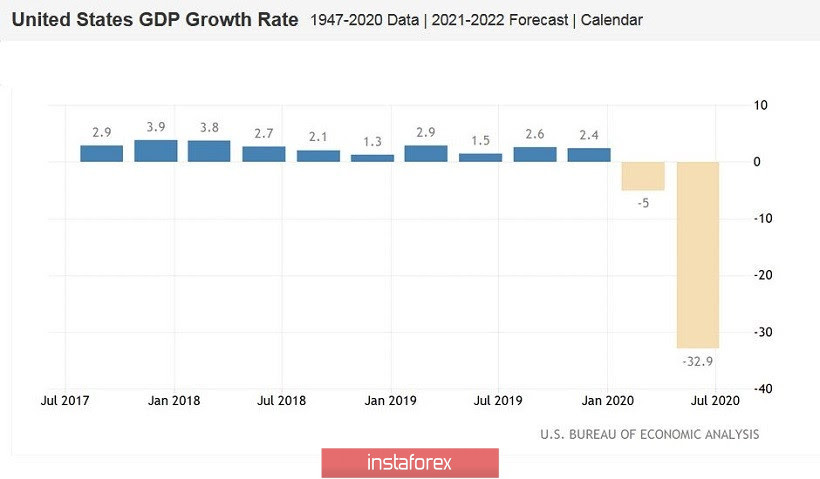

The data released yesterday on the growth of the US economy served as another confirmation of these words. And although the key indicator came out slightly better than forecasted (the volume of GDP decreased by 32.9% instead of 35%), this nuance did not save the general situation. The U.S. economy has not slowed as much throughout its history as it did in the second quarter of 2020. All components of yesterday's release similarly disappointed market participants. In particular, the personal consumption indicator fell to -34%, the GDP price index immediately fell to -18% (although the consensus forecast was at 0.1%), the base PCE indicator also turned out to be in the negative area, reaching -1.1% at forecast of a decline to -0.9%. Consumer spending on durable goods fell to -1.4%, business investment fell to -27%, and investment in new equipment fell to nearly -40%. Foreign trade also showed anti-records. Both exports (-64%) and imports (-53%) collapsed. At the same time, the US Department of Commerce emphasized that the published figures "cannot fully reflect the economic consequences for the country from the pandemic." Whereas an updated analysis of the economic situation will be published by the ministry in a few weeks - on August 27.

Figuratively speaking, the dollar could not stand such a number of anti-records, especially against the background of Powell's dovish position and another surge in the number of COVID-19 cases in the United States. Trump acted as an additional factor of pressure, who unexpectedly proposed to postpone the presidential elections. This idea was rather harshly criticized in Congress, and both Democrats (which is expected, given Biden's ratings) and Republicans. In particular, Senate Majority Leader Mitch McConnell and the head of the Republican Party in the House of Representatives, Kevin McCarthy, reminded the head of the White House that in the history of federal elections they have never been canceled and should be so in the future. In turn, the Democrats called the head of the White House "insane", adding that even during the world wars, elections in the country were not postponed. Trump later retracted his offer himself, claiming that his words had been misinterpreted. This incident added to the grim fundamental picture for the greenback.

Thus, the dollar continues to be under strong pressure from negative fundamental factors.The US currency is already approaching the 19th figure against the euro. The 1.1900 mark is the closest resistance level, breaking which will open the way to the next "round" level 1.2000, which is of strategic importance for the pair's traders. Therefore, when buyers overcome the 1.1900 target, longs can be considered, but for short distances (40-60 points): the closer the pair gets to the 20th figure, the more difficult it will be for the bulls to conquer each subsequent point.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română