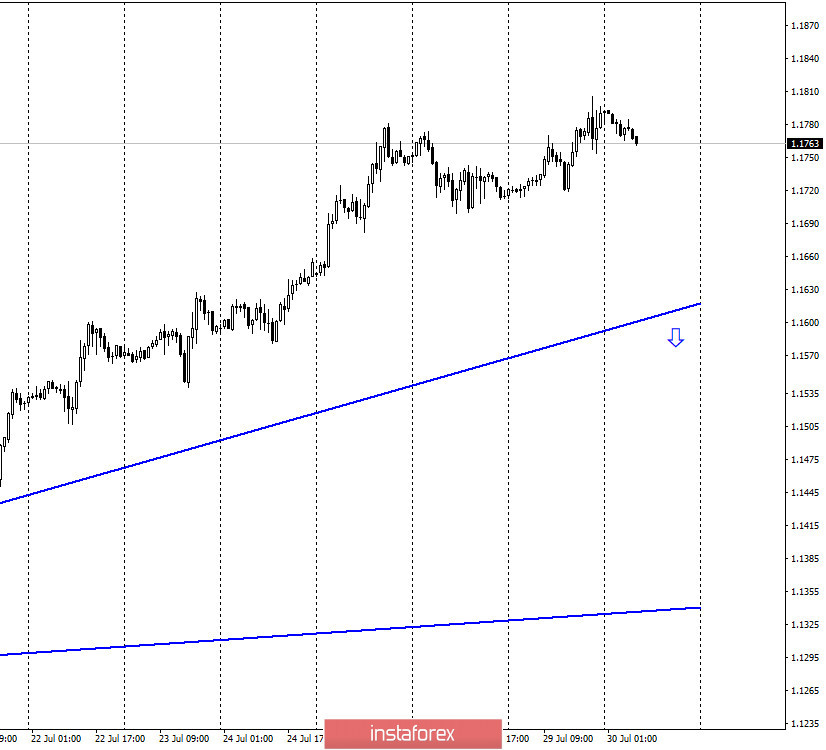

EUR/USD – 1H.

Hello, traders! The EUR/USD pair resumed the growth process on July 29. Thus, the overall mood of traders remained "bullish", as evidenced by two rising trend lines at once. All the interest of traders yesterday was reduced to the meeting of the Fed, its results and the speech of Jerome Powell. It was in anticipation of the next "dovish" decisions and "dovish" statements that the US dollar continued to fall on July 29. However, after it became known that the Fed did not change any parameters of monetary policy, purchases of the euro currency did not continue. Traders began to wait for Powell's speech, which also did not surprise them at all. The head of the Federal Reserve again put the coronavirus and the fight against it first in importance. According to Powell, the prospects for the American economy remain uncertain due to the epidemic. Everything will depend on how many more waves of the pandemic there will be, what measures the US government will take to counter COVID-2019. Powell said that as long as the virus continues to put Americans in fear, there is no question of returning to a normal life in which people will behave the same way as before the crisis and the pandemic. Powell also hinted that the US Congress will need to approve a new package of stimulus measures, which is very necessary for the economy.

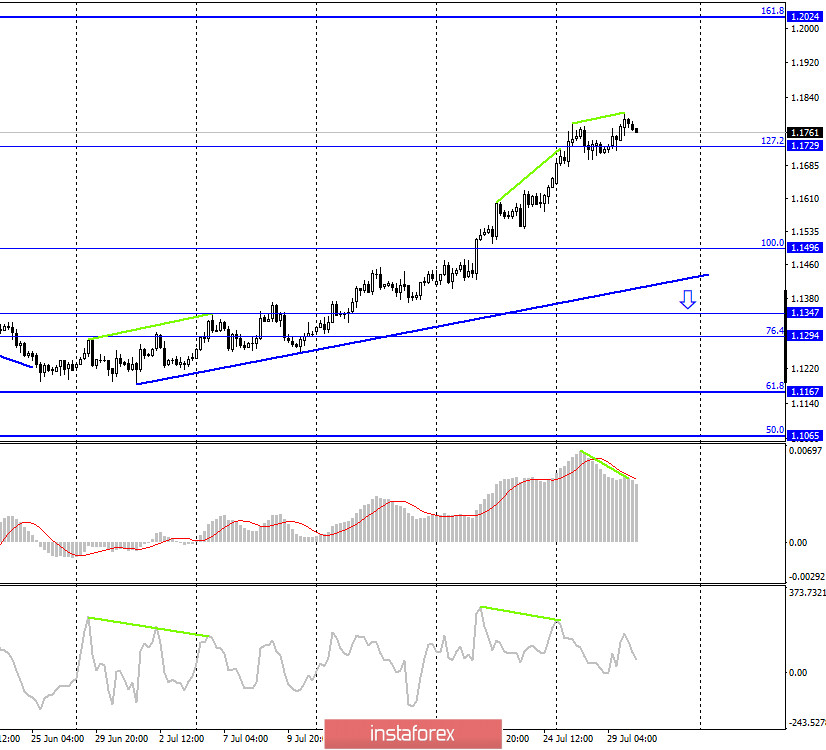

EUR/USD – 4H.

On 4-hour chart, the EURUSD consolidated above the corrective level of 127.2% (1.1729), so we can expect the pair growth towards the next Fibonacci level of 161.8% (1.2024). However, the formation of a bearish divergence casts doubt on the further growth of quotes. A reversal was made in favor of the US dollar, and if the pair closes at the Fibo level of 127.2%, the fall in quotes will continue in the direction of the level of 100.0% (1.1496). Closing above the last divergence peak will increase the probability of further growth of quotes.

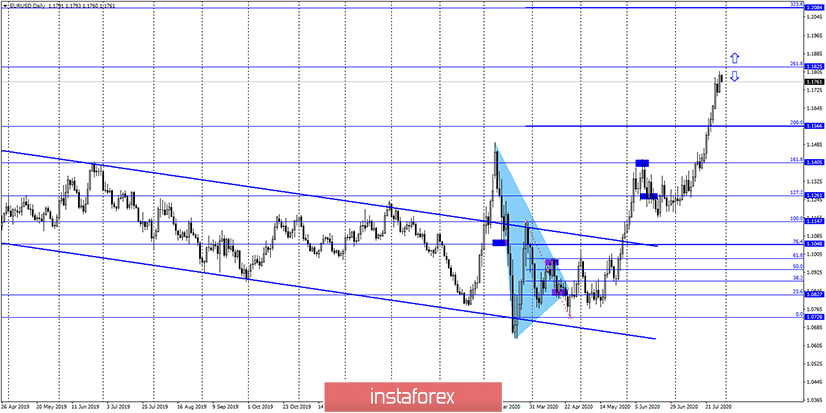

EUR/USD – Daily.

On the daily chart, the EUR/USD pair continues the growth process in the direction of the corrective level of 261.8% (1.1825), the rebound from which will work in favor of the US currency and the beginning of a fall in quotes.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair, after rebounding from the lower line of the "narrowing triangle", performed an increase to the upper line of the "triangle", which now allows you to count on rebounding from it (at the end of the week) and resuming the fall. Otherwise, the growth process will continue.

Overview of fundamentals:

On July 29, the US hosted a speech by Jerome Powell and a summary of the Federal Reserve meeting. There was no more news or reports in America or the European Union.

News calendar for the United States and the European Union:

Germany - unemployment rate (07:55 GMT).

Germany - change in GDP (08:00 GMT).

EU - unemployment rate (09:00 GMT).

Germany - consumer price index (12:00 GMT).

US - change in GDP for the quarter (12:30 GMT).

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On July 30, all traders' attention will be focused on the US GDP report for the second quarter. It is expected to shrink by 34.5%, which may be the record decline in the economy for the entire history of the country.

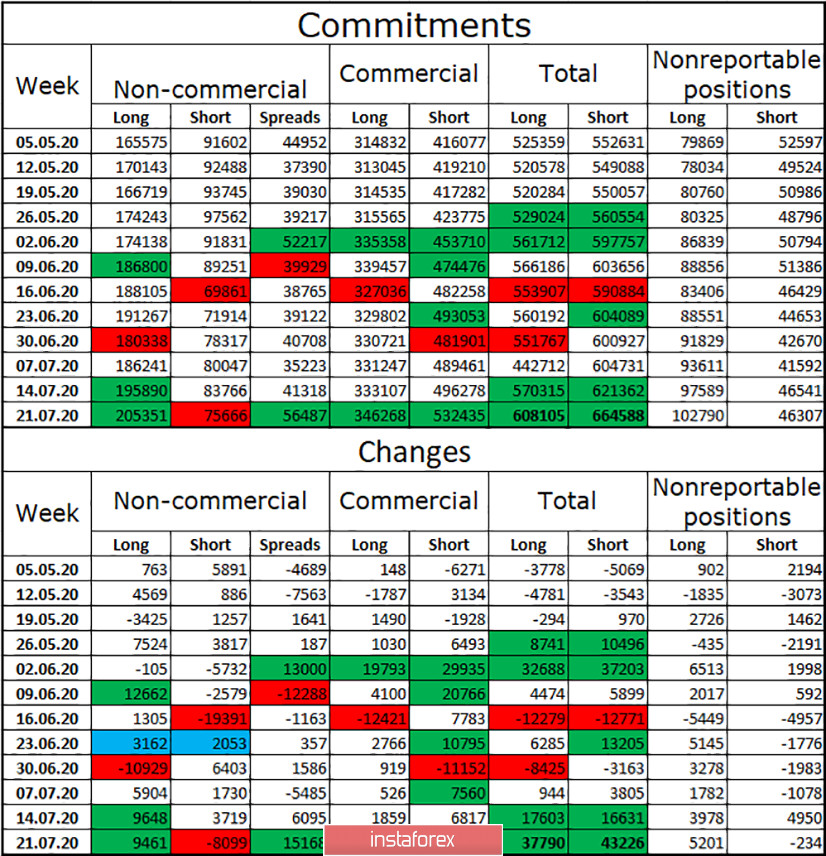

COT (Commitments of Traders) report:

The latest COT report, released on Friday, showed major changes in the mood of major market players. Changes that exceed or are close to 10,000 contracts are highlighted in green and red. As you can see, almost all the cells in the last report are colored green or red. Speculators (the "Non-commercial" group) actively increased long-contracts for the euro in the reporting week and at the same time got rid of short-contracts (-8100). Commercial players (the "Commercial" group) entered the market with both purchases and sales of euros. Thus, in total, more than 80,000 new contracts were opened by all groups of traders during the reporting week. The activity of traders in the euro has increased significantly, and the "bullish" mood has remained.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend buying a currency pair with a target of 1.2024 if a close is made over the last peak of bearish divergence on the 4-hour chart. I recommend selling the pair if the quotes are fixed below the level of 1.1729 with the goal of 1.1496.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română