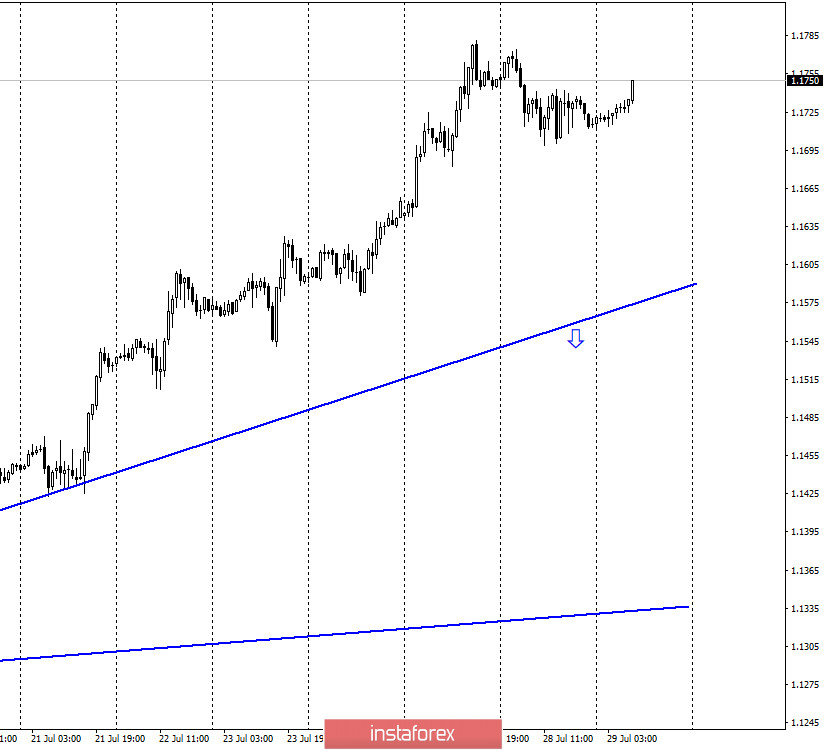

EUR/USD – 1H.

Hello, traders! The EUR/USD pair was in the process of falling all day on July 28, however, this morning, it has already performed a reversal in favor of the European currency and resumed the growth process, according to the general mood of traders, which is evidenced by two upward trend lines. We can not say that in the first two days of the week there were important news and economic data from the US and the European Union, which allowed yesterday to roll back down, and resume the growth process today. Rather, the situation is as follows: bull traders continue to actively buy the euro, but from time to time take a pause to review their strategies and carefully study the information background. Since the information background does not change at all, and the decrease in the number of cases of coronavirus in the United States from 60-80 thousand per day to 59 can hardly be considered a positive moment, the euro continues to grow. This evening there will be a relatively important event – a meeting of the Fed, as well as a press conference and a verdict on the key rate. "Relatively important" because traders do not expect any changes in the Fed's monetary policy. Thus, only if the Fed presents any surprise, then we can expect the growth of the US currency. And the euro continues to grow without the help of the Fed.

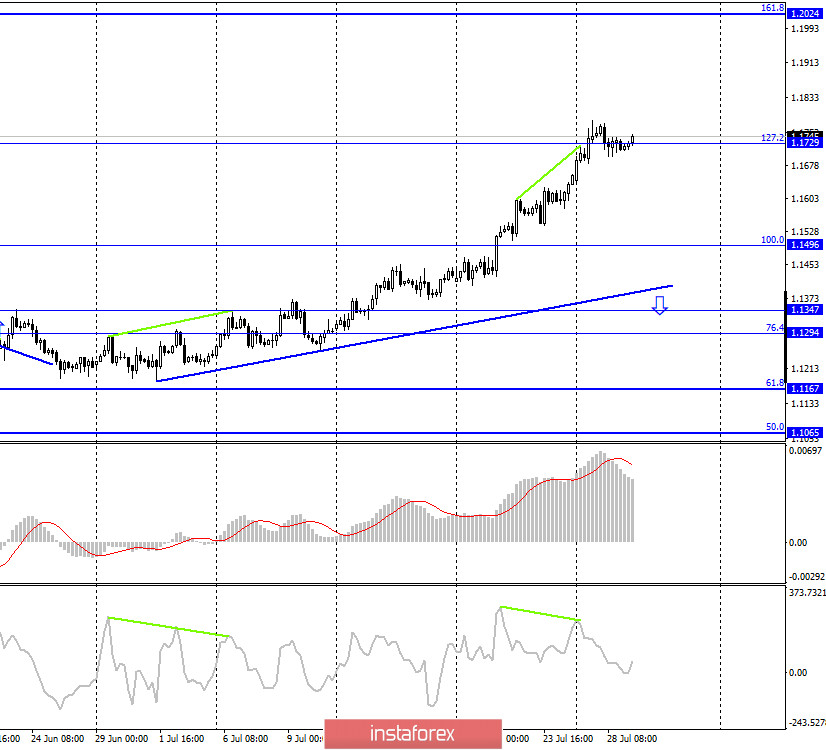

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair made a consolidation above the corrective level of 127.2% (1.1729). Thus, the growth process can be continued towards the next Fibo level of 161.8% (1.2024). Closing the pair's exchange rate under the Fibo level of 127.2% will work in favor of the US currency and start falling in the direction of the corrective level of 100.0% (1.1496). Bearish divergence has already been canceled by the time the quotes turn down, and the upward trend line continues to characterize the mood of traders as "bullish".

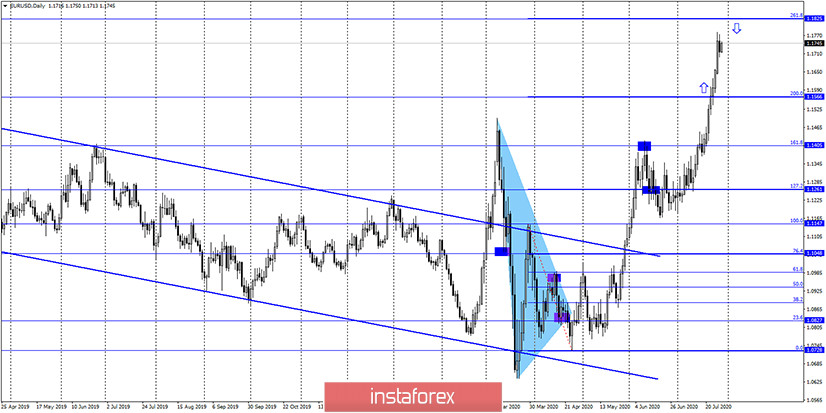

EUR/USD – Daily.

On the daily chart, the EUR/USD pair made a consolidation above the Fibo level of 200.0% (1.1566). Thus, the growth process continues in the direction of the corrective level of 261.8% (1.18250, the rebound from which will work in favor of the US currency.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair, after rebounding from the lower line of the "narrowing triangle", performed an increase to the upper line of the "narrowing triangle", which now allows you to count on rebounding from it (at the end of the week) and resuming the fall. Otherwise, the growth process will continue.

Overview of fundamentals:

On July 28, the United States and the European Union did not have any economic reports or other important events. The calendar was completely empty.

News calendar for the United States and the European Union:

US - FOMC decision on the main interest rate (18:00 GMT).

US - accompanying FOMC statement (18:00 GMT).

US - FOMC press conference (18:30 GMT).

On July 29, all traders' attention will be focused on the evening events in America. Traders do not expect a rate change, however, the accompanying statement may reflect the Fed's mood, as well as the press conference that will follow.

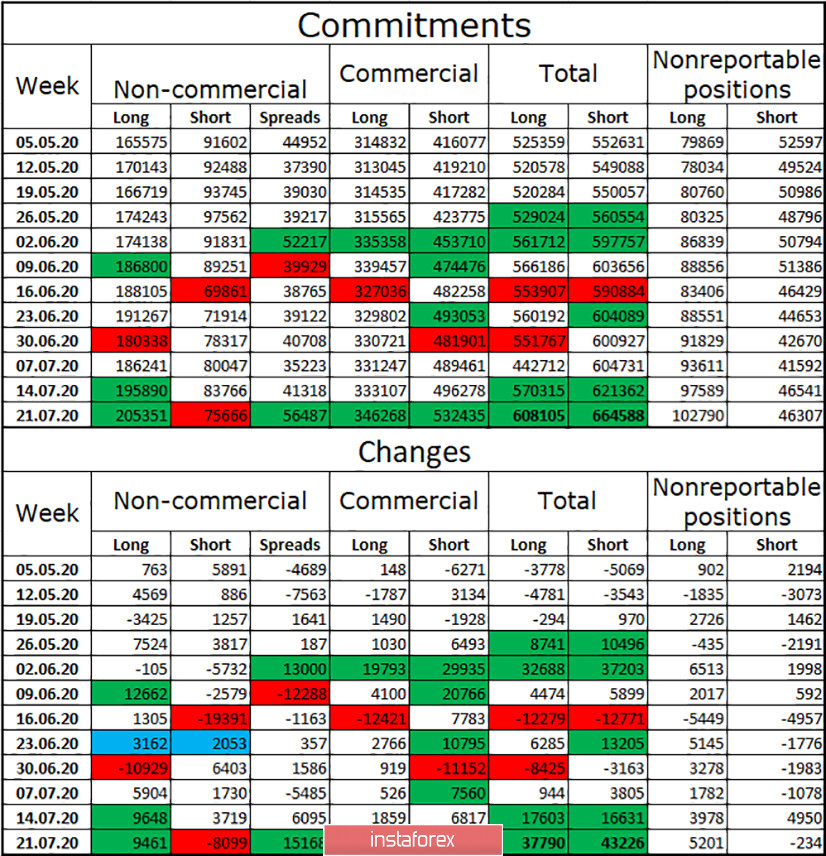

COT (Commitments of Traders) report:

The latest COT report, released on Friday, showed major changes in the mood of major market players. Changes that exceed or are close to 10,000 contracts are highlighted in green and red. As you can see, almost all the cells in the last report are colored green or red. Speculators (the "Non-commercial" group) actively increased long-contracts for the euro in the reporting week and at the same time got rid of short-contracts (-8100). Commercial players (the "Commercial" group) entered the market with both purchases and sales of euros. Thus, in total, more than 80,000 new contracts were opened by all groups of traders during the reporting week. The activity of traders in the euro has increased significantly, and the "bullish" mood has remained.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend buying a currency pair with a target of 1.2024, since the close was made above the level of 1.1729 with the stop-loss level at 1.1729. I recommend selling the pair if the quotes are fixed below the trend line on the hourly chart with the goal of 1.1496.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română