Crypto Industry News:

Industry leaders, analysts and investors share their predictions for the cryptocurrency ecosystem for 2022. Coinbase Product Director Surojit Chatterjee is confident that Ethereum will be at the forefront of the Web3 and cryptocurrency economy as it scales.

CPO shared his predictions today on the company's blog, in which he stated that Ethereum's scalability will improve, however alternative tier 1 networks will also become more popular:

"I am optimistic about the improvement in Eth scalability with the arrival of the Eth2 and many rollups."

He added that there will also be newer tier one networks focused on gaming and social media. Chatterjee predicts that scalability will be greatly improved with advances in layer-one-layer-two bridges, adding that the industry will be "desperate for improvements in the speed and usability of the bridges between L1 and L1-L2.

These bridges allow tokens to be moved from a first layer network such as Ethereum to a second layer network such as Arbitrum and vice versa.

Technical Market Outlook:

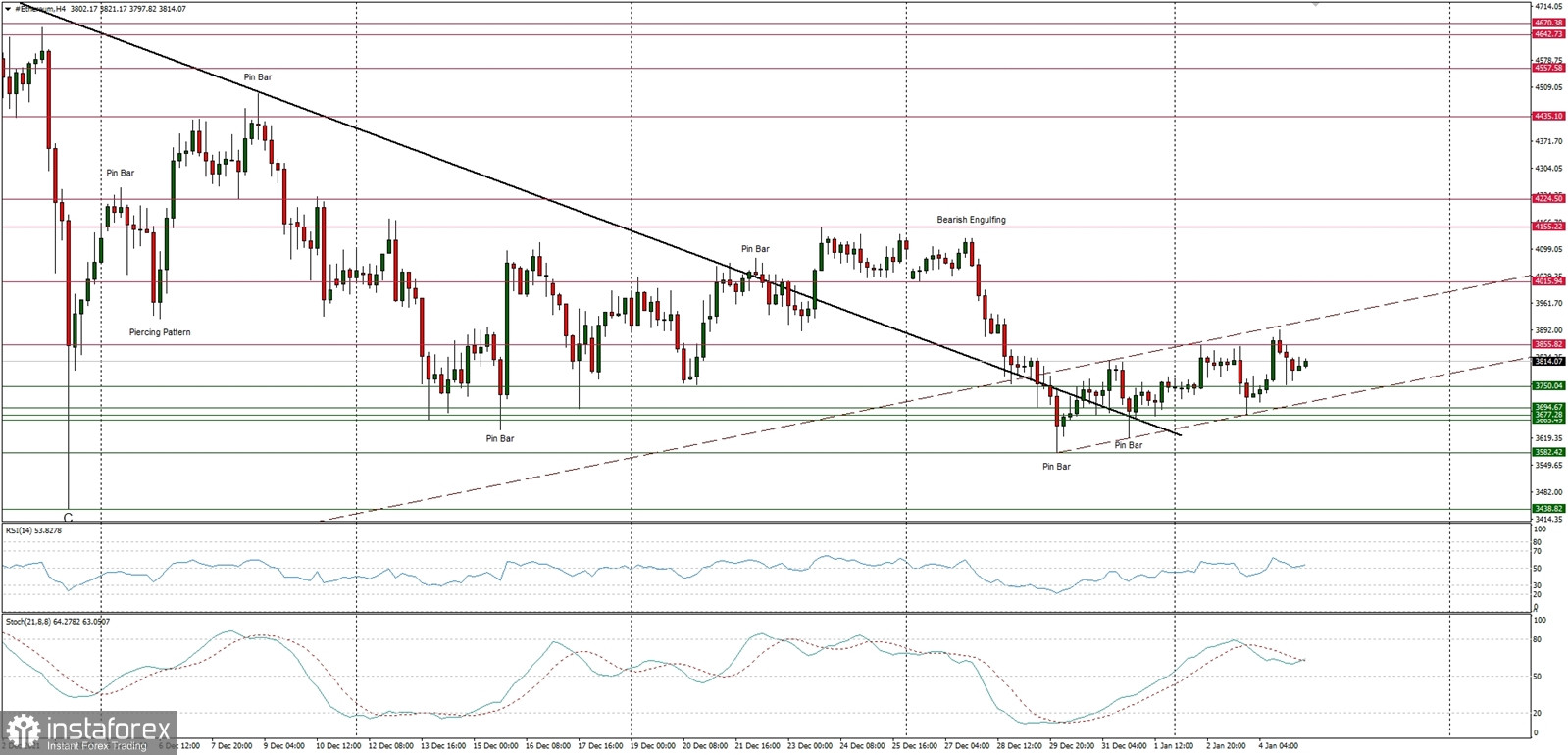

The ETH/USD pair is seen trading inside of an ascending channel with the last local high made at the level of $3,892. The bulls might break out from the channel and head towards the technical resistance seen at $4,015. On the other hand, the next target for bears is seen at the level of $3,438 and this is the key long-term technical support for bulls, so please keep an eye on price behavior around this level. Only a sustained breakout above the level of $3,855 would change to short-term outlook for bullish.

Weekly Pivot Points:

WR3 - $4,616

WR2 - $4,372

WR1 - $4,083

Weekly Pivot - $3,832

WS1 - $3,531

WS2 - $3,288

WS3 - $2,987

Trading Outlook:

The WXYXZ complex corrective cycle might soon be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română